In this week’s commentary, we’ll be discussing:

- What’s in Store for the 2nd Half the of Year

- Rentokil North America Acquires Innovative Pest Management

- Pest Control in the Emerging Markets

- A Little More on Knocking Doors

So I’ve been a little slow in publishing the weekly commentary lately… it’s been very busy out there. As you’re about to see over the course of the next six months, the PCT Top 100 is about to be rearranged … again.

This week’s commentary is going to be a little short and we’ll get back to normal next week.

Although I am going to touch on my recent trip to the emerging markets of the Middle East and North Africa — namely, Egypt, Saudi Arabia and Turkey — first I want to get into my thoughts on the second half of the year…

M&A Outlook for the Second Half of 2018

As we begin to approach pest control M&A season in the United States (the end of the summer / autumn), here’s what’s in store:

- 2018 will be the first year (at least that I can remember) that over 10% of the PCT top 100 will be acquired

- Between now and the end of the year, we’ll see over a half of billion dollars in North American pest control M&A… meaning that pest control M&A should top $750 million in transaction value for the year.

- From July 1 through the end of the year, it’s likely that we’ll see another 30 to 40 transactions close as M&A pipelines are very robust… further, supply has not depressed prices… we’re at a valuation plateau at the zenith and that is expected to continue through at least the end of the year.

- Rollins has continued to acquire in new markets — the UK and now Southeast Asia (Singapore) — I expect that that will only accelerate.

- Rentokil has become more selective on platform acquisitions and has accelerated density acquisitions, consistent with their plans. This may put upward pricing pressure on smaller deals, further narrowing the gap (e.g., multiple expansion based on size will likely recede in the coming months).

- It’s likely that Anticimex will pick up at least one more regional US platform before the end of the year.

Rentokil North America Acquires Innovative Pest Management

Four years ago it was rare to see sellers in their fifties, let alone 30s or 40s. In this market, folks are selling young and redeploying the proceeds into other businesses. We’re pleased to announce Rentokil’s acquisition of Innovative Pest Management and we wish the Caldwell family the very best in the future.

When we thought about selling the business, it was tough considering all the different facets that were before us. Finding someone that we could trust was very important.

Paul Giannamore is a true professional with an amazing mind and skillset. The trust that we had in him to get this done was like no other. We have made friends with him, business and personal because of this transaction.

We are thankful God put Paul in our lives.

Paul walked us hand and hand through the entire process of the merger and we can only give him the highest marks. Potomac did an outstanding job for our business and I’m sure they will do the same for others.”

Pest Control in the Emerging Markets

As many of you know, I’ve spent a lot of years working in the emerging markets — Egypt being one of them. I hadn’t been to Egypt since before the Arab Spring and returned last month as Potomac as entered North Africa on the pest control side.

Over the last decade, as central banks around the world unleashed unprecedented liquidity that chased returns in developing economies like Egypt, Turkey, Brazil, etc, that money went into unsustainable projects (i.e, businesses, real estate, etc) that wouldn’t have taken place without that government-sponsored money injection. For example, my old apartment in Cairo was worth about $25K in 2008, it’s worth about $200K today. If you can whether an Arab Spring or two, it’s not a bad investment.

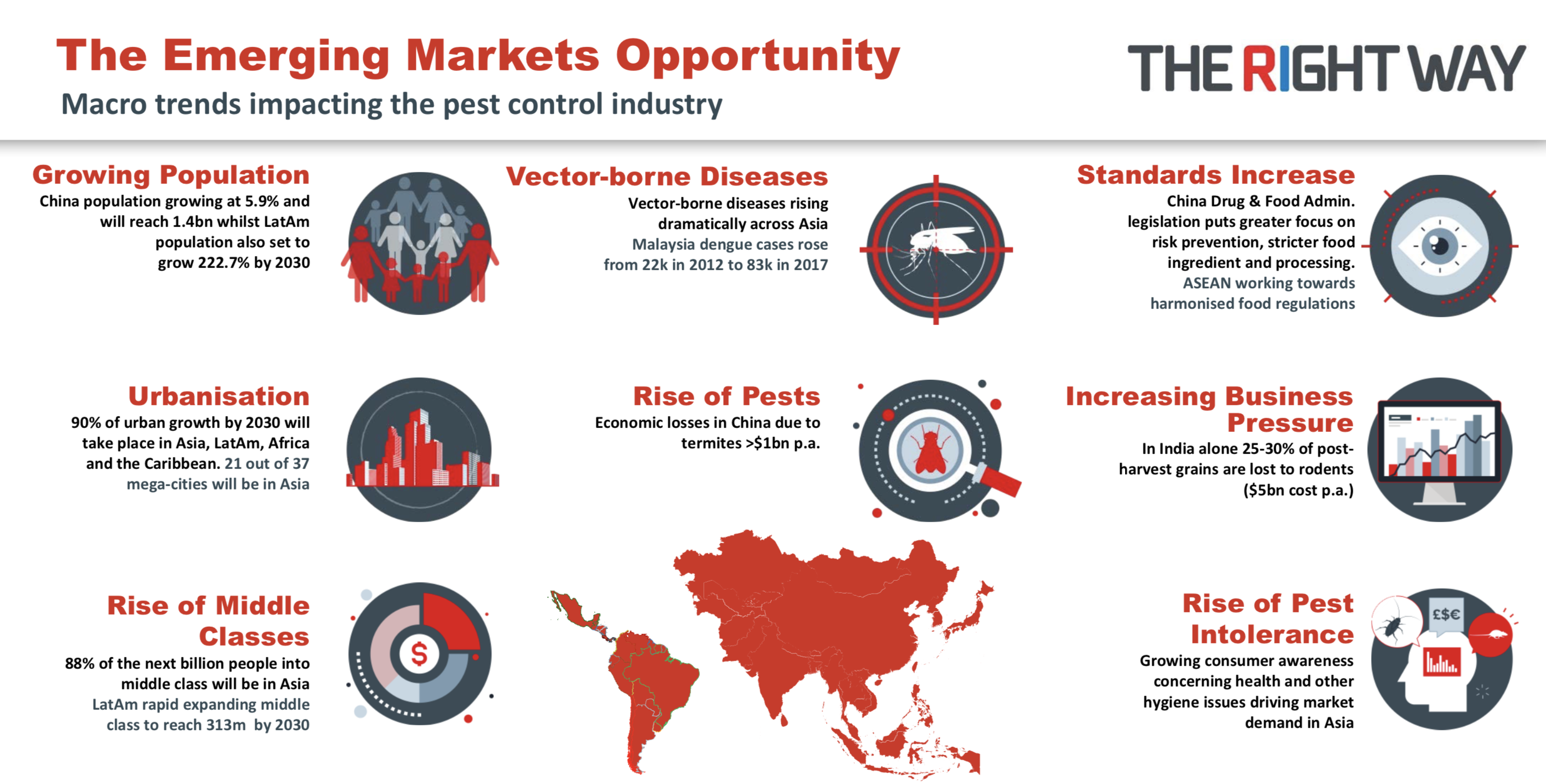

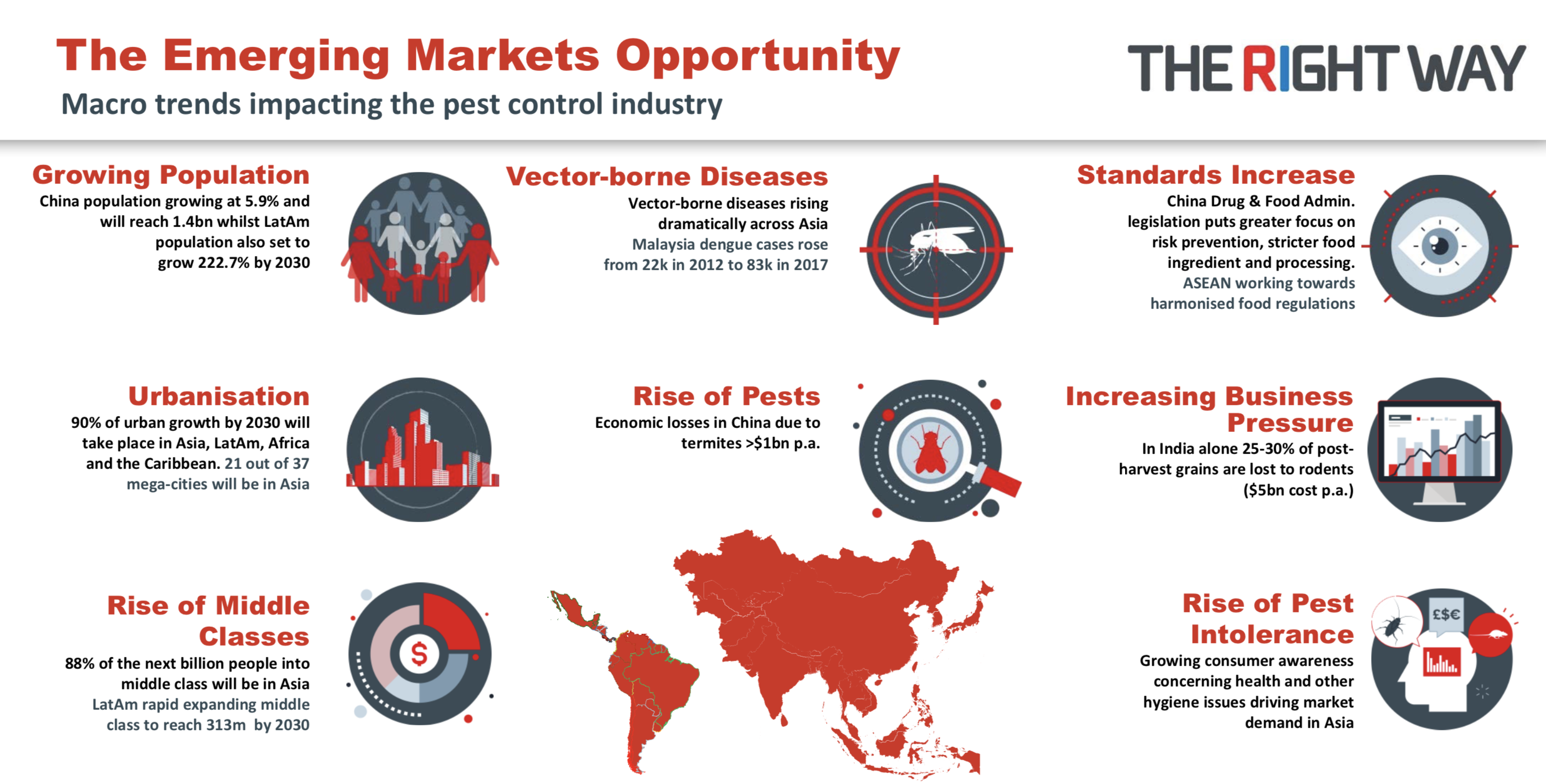

As bond yields in the US rise, that liquidity is being sucked out the emerging market economies causing their currencies to get hit hard. Although there is likely to be some trouble in the emerging markets in the short-term, the long-term prospects are great. Rentokil is focused on the emerging markets (e.g, China, India, Latin America and the Middle East) in a big way.

In the Middle East we’re seeing pest control companies growing at 25%+ percent per year with cash flow margins north of 25%. Rentokil has a big head start on the other big players, but it’s a big world out there and at some point Rollins and ServiceMaster are going to be in this game as well.

Rentokil lays out their emerging market thesis below:

A Little More on Knocking Doors

Lenny Gray, author of Door-to-Door Millionaire, wrote a response, or rather a rebuttal, to my article last month. I’ll publish that next week.

In the meantime, we’ve been contacted by a variety door-to-door companies that are interested in doing marketing deals with traditional pest control companies. Terminix has been doing this for years.

I don’t have an opinion on it one way or another, nor do we make any money by referring these guys. If you’re interested in speaking to someone, let me know and I’ll put you in contact.