In my last Weekly Commentary I said that I would be trying hard to write on a weekly basis… and then I disappeared for five weeks (my lame excuses to follow). I guess even I dramatically underestimated how busy it was going to be this M&A season.

Labor day (early September) officially marks the start of pest control M&A season in North America and it’s begun as the busiest one I’ve seen in my 15 years in the industry. Transaction multiples have continued to edge higher. Every time I think we hit a top…. well, we don’t.

Right out of the gate, three PCT Top 100 companies are already under LOI and this morning we closed a transaction with ServiceMaster that would have been in the 80’s on the PCT Top 100 had the company reported. That transaction will be announced next week and with it comes with some interesting learning opportunities for all of us, which I’ll discuss next week.

On Monday, we advised on the sale of Guaranty Pest Elimination to Modern Pest Services, which is Anticimex’s largest acquisition in New England since the acquisition of Modern. The target operates in four states and will help Modern accelerate growth in New England, more on that below.

In this Weekly Commentary, we’re going to discuss:

- Modern Acquires Guaranty Pest Elimination

- Orkin Acquires YPCC

- Brief thoughts on the evolution of transaction structures at the height of the consolidation bubble

- Your Son is an S.O.B. and it’s Your Fault

- My 3-week trip to SE Asia and my musings on pest control in developing markets

Modern Acquires Guaranty Pest Elimination

Back in the 2005, I spoke at the first and only in-person PCT M&A Seminar — for you old timers that were there you’ll recall it was held at Disney World. It was at that event, when I walked up on the stage, that I discovered that PCT Magazine would pretty much give a microphone to anybody who asked for one.

At the time I was still relatively new to the industry and didn’t know many people. While roaming around a golf course after my speech I met Andy Kacavich, the owner of Guaranty Pest Elimination, who also didn’t know many people there. Andy had known me prior to the event solely as a reader of this very newsletter.

Fast forward 12 years later and I am guiding him through the most important transaction of his life. In closing this transaction on Monday I started to think that almost all of my early friends in the industry have sold or are in the process of selling.

Although Andy built a great business servicing Connecticut, Rhode Island, New York and Massachusetts, and will have a comfortable retirement, one of his greatest achievements is the relationships that he built with his people. It’s rare to see what Andy did for his key employees on the way out the door. In fact, I don’t think that I’ve ever had a client that has been as generous with his people as Andy.

Andy, you’ve been reading my writings for 13 years so you’re probably reading this now. I am fortunate to call you a friend and I am very happy that you were able to retire now. You exited gracefully and couldn’t have treated your team any better than you did. I know you always tell me to stop and smell the roses, and I will, once this M&A market cools down, but for now, you can relax for me. I am going to publish the letter that you sent over to the office this morning:

Many years ago, I had subscribed to Paul’s emails to keep up to date on what was happening with Mergers and Acquisitions in the Pest Control Industry. I found his articles to be fascinating and informative. I had met Paul at a Golf Outing when he was a young man in his 20s. He impressed me then and only grew to impress me more and more over the years. We had talked on several occasions over the next 20 years. He had at times offered me advise on growing my business with an attempt to do a few acquisitions ourselves.

No one in his field can compete with his knowledge or professionalism. I don’t think Paul has anyone even close to an equal in his field of expertise. Not only is he the best at what he does but I can feel comfortable in saying, I truly trust him to always do what’s right. In my own situation, he made the entire transaction so much faster and easier than I ever thought possible. Paul was not only able to get me the best price but also found us an acquirer that was the right fit for my people. Paul not only acting as my advisor on the deal but (at times) as my Therapist.

I hope that Paul does find time to smell the roses. He is the hardest working, globetrotting man I know. Paul makes a comfortable retirement possible for so many people, I pray that one day he can kick back and enjoy many years of the same for himself. Paul has made yet another lifelong friend in me. Andy Kacavich

You can read more about the Modern Pest Services / Guaranty Pest Elimination transaction here.

Orkin Acquires YPCC of Forth Worth, TX

We announced the acquisition of Your Pest Control Company, which is one of the fastest-growing commercial pest control companies in the DFW metro area you can read more about it here if you so desire.

Since this is my blog, I get to toot my own horn, which I’ll do by quoting the sellers below:

In regard to working with Potomac, David and Dorene said: “Paul Giannamore is extremely knowledgeable in the pest control arena and has excellent negotiation skills. He has extensive connections across the world and was able to bring sold, quality companies to a competitive bidding process. It was a pleasure working with Paul. We are very happy with the outcome of the acquisition and highly recommend Potomac to all looking to sell their business.”

The Evolution of Transaction Structures in the Pest Control Industry

If I doubted it before (which I didn’t, just to be clear), the month of August 2018 showed me that the global pest control companies are playing with Monopoly money. I’ll save all of my valuation comments for our valuation report, which, by the way, was supposed to be done by now, but should be out soon.

Today, however, I want to discuss deal terms since those are just as meaningful as purchase price and we often don’t talk much about them.

First, a little stroll down memory lane.

From the early 2000s through about 2013, a standard pest control transaction in the United States was structured as 70% to 80% of the proceeds in cash at the closing and the rest held back for a period of one to five years. Terminix’s standard structure was 70% upfront and 30% paid in equal installments over the subsequent five years.

By the end of 2013 / early 2014, things started to get more and more competitive and we began to see upfront consideration move into the mid-80% range. In those days, the holdback was typically tied to performance (Orkin and Terminix favored the take and pay structure — more on that below) while Rentokil focused on a revenue target 12-months out.

A take and pay clause looks something like this: “In order for a customer to be deemed “acquired,” a customer must take and pay for their first regularly scheduled service post-closing. There will be a basket or threshold amount (x% of recurring revenue) that the cancellations must exceed before the seller would be liable for any setoff or reimbursement to the acquirer.” Basically, what this is saying is, after the closing, your customers have to take an pay for one service, if they don’t, you owe the acquirer some money. In the mid 2000s, we saw a lot of three service take and pays, then two services… and now, well, you get it.

By 2017, on material deals, we began to see the structures go to 90%, and at times, in very competitive auctions, 95% cash at the closing. Further, we began to see the use of third party escrows (keep in mind, this is still very rare… I think I’ve only gotten away with it three times in the last two years). Now, we’re seeing performance requirements post-closing disappearing on heavily bid deals.

I find that in the US, holdbacks for PCT Top 100-sized businesses tend to be largely focused on reps, warranties and indemnifications, rather than performance. On smaller deals, they are certainly still out there, however, they are much less scary than they were just three or four years ago.

Outside the US, the M&A market is not nearly as competitive and acquirers worry about the enforcement of restrictive covenants as well as property rights in general, so holdbacks and earnouts haven’t changed much… thought they are better than they were just a few years ago.

Finally, I remember a day when it was hard to get an acquirer to cap indemnification exposure at 75% of the purchase price. Now, market seems to be somewhere in the 20% to 50%, depending on how competitive the process is. As a standard course of practice, I recommended sellers negotiate reps, warranties, caps and baskets at the LOI stage while they still have maximum leverage.

Your Son is an S.O.B… and It’s Your Fault

The pest control industry is littered with family businesses, from Europe, to Latin America to Asia. I think half the businesses that I met with in Asia last month were family businesses, fathers working side-by-side with their sons and daughters.

While it might be many a father’s dream to have his son perpetuate the family business, it often doesn’t work out like that. In fact, it often turns into estrangement and litigation (hint: Atlanta).

I often refer to the adult child of an owner working in the family business as an S.O.B., or Son of a Businessman. Children in the family business tend to come in the following three flavors, we refer to the first two groups as S.O.B.s:

- Morons just trying to do the right thing. These are kids who just don’t have it in them to run the family business. They, and their parents, are well-intentioned. However, they just aren’t good business people… or they might just be idiots. They should be following their dreams to be a professor, doctor, cartoon artist or bouncer at a Parisian swingers club (this is the one that Dominique Strauss-Kahn used to go to when he wasn’t raping hotel maids) … not running the family pest control business.

- Spoiled brats who need a good ass-whoopin’. These are the entitled children who end not talking to you ever again if they don’t get their way… or worse yet, suing you.

- The Real Professionals. These are the rare birds, like Emily Thomas of Arrow or Josh Kramer of Innovative. They are smart and capable and their title isn’t dependent upon their last name, but rather their capabilities. Their parents didn’t spoil them and turn them into entitled, worthless cokeheads.

If you’re a parent, and you want to die alone, then either buy your kids a semiautomatic pistol for their fifth birthday or give them a job in the family business.

If you have more than one kid and you want them to hate each other, then give them equal ownership in the business AND equal decision-making responsibility. One of them will work his or her ass off while the other one freeloads. Resentment will build over the years and then one of your kids will never speak to you or your other kid again. Ever. Is that what you want?

If you’ve been in the industry for any period of time, you know exactly what I am talking about.

On the PCT Top 100, in fact, there are businesses run by children who are (1) total morons and / or (2) spoiled, entitled #$%#.

Every single year for the last fifteen years I’ve sold at least one business where the father and son weren’t speaking to each other. Once every two years, a father suing a son or a son suing a father.

In fact, just last month I got a call from a father who owns 100% of a pest control business and he wants to sell it. About fifteen minutes into the conversation, he asked me if I wouldn’t mind calling his son for him. His son runs the business but they have ‘t spoken in six months. His son was mad at him and wasn’t talking to him. His son is a spoiled S.O.B… and it’s the father’s fault. He should have never hired him in the first place.

I’ll be coming back to this topic in the near future because I have a lot to say about it. But for now, here’s some further reading on what happens to family businesses: Inside An $8 Billion Family Feud: Who Poisoned The Orkin Fortune?

Pest Control in Southeast Asia and Emerging Markets

In the month of August I spent three weeks in Southeast Asia. I was there working on two pest control transactions but took the opportunity to meet with most of the key players in the Malaysia, Singapore and China market. The last time I was in Singapore was for Anticimex’s acquisition of Clean Environ Pest Management and it was great to be back. If you’ve never been to Singapore and Kuala Lumpur, I urged you to visit both.

I view both Asia and Latin America as key growth areas for the global pest control industry and currently the only one of the Big Four (Rentokil, Rollins, ServiceMaster and Anticimex) that isn’t currently operating in Asia is ServiceMaster — though I don’t think it will take them long to get there.

Rentokil is currently best positioned to accelerate consolidation in Asia, though, like everywhere, when there is a major player in a market for a long time, the local players look for another acquirer. For this reason, I think that Rollins and ServiceMaster have some significant opportunities ahead of them. However, Rollins, being quite conservative, is likely to run PestKare in Singapore for a year or so before they begin further consolidation. For now, my bet is on Rentokil in the emerging markets, at least for the next two or three years.

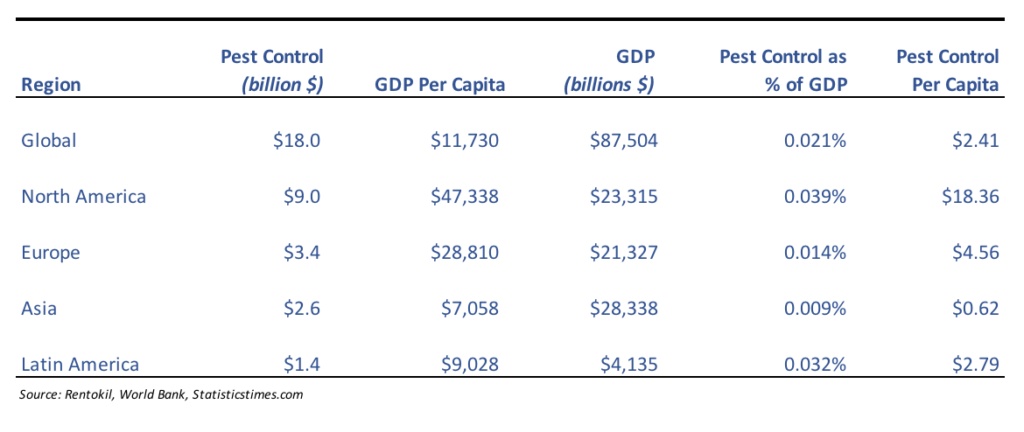

One of the things that I really like about Asia is the low penetration rates. If you look at the chart below, you’ll see that pest control spend as a percentage of GDP in North America is 400% higher than that in Asia. Further, the Asian economies are some of the fastest growing in the world.

Over the last decade, when pest control owners sell their businesses, they move to Florida and look to buy a small company there. Perhaps in the future, they’ll sell their businesses in North America and more to Kuala Lumpur, where the cost of living is dramatically lower than the US and opportunities abound.

I’ll close this week’s Commentary with some photos from Kuala Lumpur… until next week.