Consultants and business advisors love to use witless cliches and platitudes. Not only that, when they utter this crapola, they say it as if it’s deep insight or profound, original thought.

I know this because I, like you, am forced to attend stupid seminars and conferences in order to rack up professional continuing education credits.

PestWorld is coming up in less than a month. If you want to hear some nonsense, just show up and listen in on some of the mind-numbing BS seeping through the hallowed halls of PestWorld business educational sessions. You’re guaranteed to hear some pencil neck, standing in front of a circa 1991 powerpoint presentation, spouting such drivel as, “If you don’t measure it, you can’t manage it.”

Or better yet, you’ll hear something like, “Run your business every day like you have to sell it tomorrow”… or is it, “run your business like you’ll never sell it?” Who knows. I guess it depends on who’s talking. Of course, after delivering that line of cheese, the speaker will pause for a second, scan the crowd with that little smirk on his face. In his mind, he’s serving up a platter of profound business wisdom akin to delivering a modern-day version of the Sermon on the Mount.

Unfortunately for me, this stupidity is not limited to pest control conferences. I was forced to attend a business valuation conference recently and learned some mighty useful things. I scribbled down these pearls of wisdom so I would never forget them. So just what did I learn, you ask?

- I learned that if I can’t stand the heat, I should get out of the kitchen

- I learned that Rome wasn’t built in a day (which was very timely, as I was to get on a plane for Rome the following weekend)

- I learned that people are our most important assets

- I also learned, in just about every presentation that day, that the definition of insanity is doing the same thing over and over and expecting different results… though, as it turns out, this one might be wrong. I asked my older sister, who is a forensic pyschologist like Clarice Starling from Silence of Lambs (though I always thought of her more like Hannibal Lecter than Clarice), and she said that “insanity is best defined as the state of being seriously mentally ill.”

Since we all hear the same tripe over and over and over again, I thought I would take a few minutes over the next few weeks to say a few things that you probably haven’t heard, but will be far more useful to you than the history of Rome’s construction or a vocabulary lesson on mental illness.

In today’s Commentary, I want to touch on a few timely issues:

- All Eyes on Rollins: The ROL Complex and Asset Prices in the Pest Control Industry

- Next week will discuss the Unsolicited Offer and Calls from Terminix

But first, since this is my real estate, I get to announce another Potomac transaction:

Rentokil North America Acquires Hudson Valley’s Liberty Pest Control

Founded in 1959 and operating from Albany, NY to Scranton, PA, Liberty is one of the oldest and largest pest control operations in New York’s Hudson Valley.

Dan Tulp, President of Liberty commented on his experience with Potomac: “Paul Giannamore of The Potomac Company was a phenomenal advisor to Liberty. I was completely blown away with Paul’s, well… everything. I don’t have the words to say how impressed I was and still am with Paul’s sincerity and dedication to not just my project but with his dedication to me personally. I truly can’t say enough about him as a person and also at this point, a friend for life. Anyone that connects with Paul will be amazingly surprised. Paul, thank you for one of the most exhilarating moments of my life.”

You can read more about the transaction here.

All Eyes on Rollins: The Making of a Billionaire, The ROL Complex and Asset Prices in the Pest Control Industry

“We could take this business public for $1 billion, no question. We’ve raised a boatload of cash and can grow the hell out of it,” said Eric.

“Well then, why not just take it public?” I asked.

“This merger will allow us to revolutionize this industry. It’s much less risky for the business, and it’s less risky for the shareholders to take the chips off the table today. So quit asking questions, Paul, and let’s do this. I’ve got places to be,” Eric replied, taking a sip of his coffee, while peering off in the distance as I scrambled to get the deal folders out of my bag.

“Are you scared that the market is going to take a crap?” I asked.

Brad didn’t blink, “There is no end in sight and if we were smart, we’d hold on to this and take it public next year. We just think that we can do big things by combining these businesses, that’s all.”

It was the fall of 1999 on a cool, crisp and beautifully sunny Saturday morning in the Rogers Park area of Chicago. I was a newly minted investment banking analyst right out of university working on my first “live deal.” The two guys sitting across the table, both 29-years-old, and soon-to-be Forbes 400 billionaires, were in the process of selling not much more than a website to our idiotic publicly traded client for $240 million in stock and cash.

As the three of us dined on donut holes and coffee, all I could think about was getting out of there. At age 22, “getting down to business” didn’t mean hanging out all day Saturday with two tech dorks. But I had a mission, and that was to write the Project Porterhouse board book. In order to do that, I needed to go through some numbers with these guys lickity split.

The investment bank that I was working for was one of the largest bulge bracket firms in the world, and at the time, it was by far the most important advisor in the tech space — taking at least one business public per week. The head of the Technology Group was the famed Frank Quattrone, who according to The Guardian, “wielded enormous power during the dotcom mania of the 1990s.” In a lot of ways, Quattrone kicked off the mania in 1995 when he took Netscape public in striking fashion, but that’s a different story for a different time.

We had been engaged by HA-LO Industries, a publicly-traded promotional products business, that was managed by a spectacularly idiotic group of people. In 1999, HA-LO was the largest company in the promotional products space. In other words, they sold IBM mugs to IBM, and Quaker pens to Quaker, so on and so forth.

Our friends Brad and Eric woke up one day and thought to themselves, “Maybe we should build a website and sell all that branded shit online, we could be the next Bills Gates.” Of course, since it was 1999, traditional companies were actually scared of websites, so the morons who were running HA-LO decided it would be a great idea to pay $240 million for Eric and Brad’s website, called Starbelly.com.

That’s where I came in. I had to build a valuation model to substantiate the board approving a certifiably insane transaction. Well, I was two weeks on the job and could barely spell acquisition, so I was clearly the right guy for the job.

I spent months with Brad and Eric as we worked through this transaction. At 22, it was hard for me to imagine what it would be like to sell a business for $240 million. What was unbeknownst to me at the time, and clearly far more impressive, was the fact that this transaction was only the first occurrence in a chain of events that would ultimately make Eric Lefkofsky and Brad Keywell two of the wealthiest individuals on the planet. After the HA-LO / Starbelly deal, they would go on to co-found Groupon and a small handful of other public companies, making them both billionaires and catapulting Eric to the ranks of the Forbes 400 list of billionaires (he was number 374 on the 2016 list).

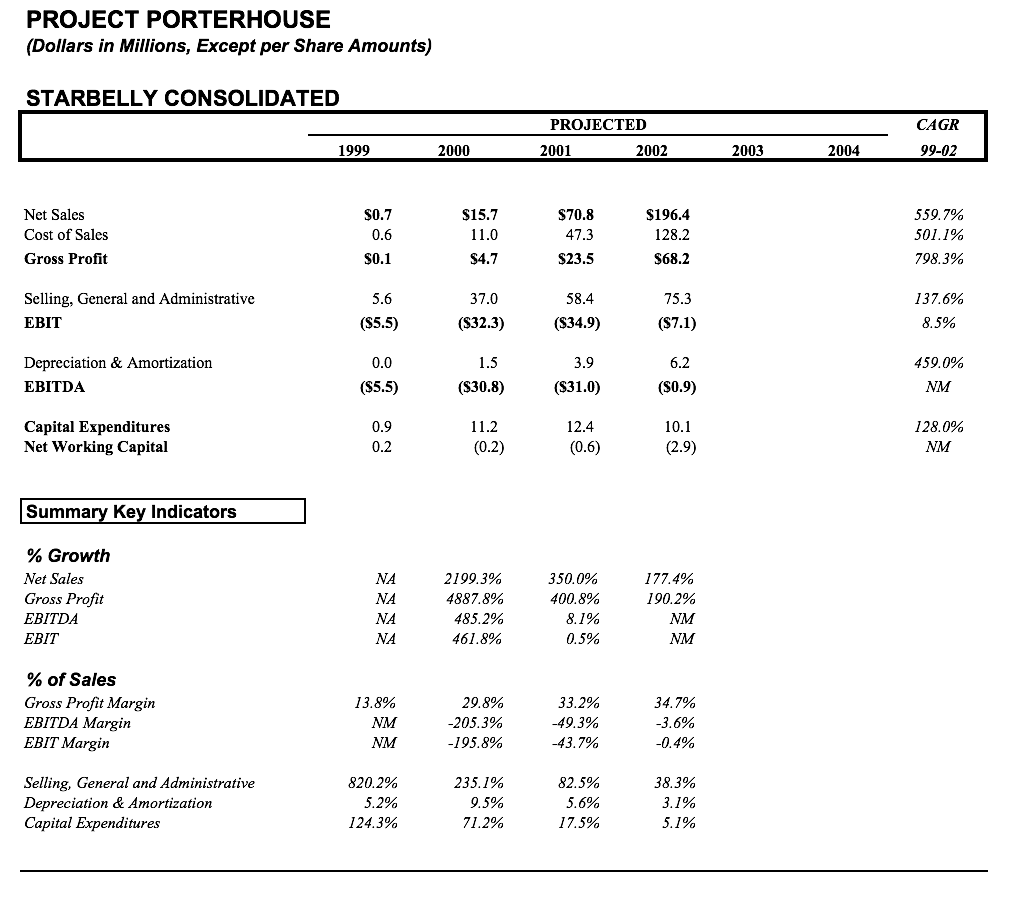

At the time, Starbelly was on track to do about $800K in revenue for the entire year of 1999, and lose more than $5 million. The sellers thought they could take the business public for $1 billion, and the idiots at HA-LO decided it would be a great idea to pay $240 million for a website, run by two 29-year-olds, losing $5.5 million per year and generating almost no revenue.

I’ve saved a copy of the board book and financial models for almost 20 years (it’s safe to say that the NDA has since expired). As you can see by the below, Starbelly had revenue of $740,000 in 1999, and the management team of the acquirer projected that it would be doing almost $200 million in revenue by 2002 — I guess that seemed reasonable to them.

But how did we come up the $240 million purchase?

Well, Brad and Eric thought that they would be able to take it public in 2000 at north of $1 billion. And you know what, they were probably right given the fact that fundamentals had long gone out the door in the late 1990s.

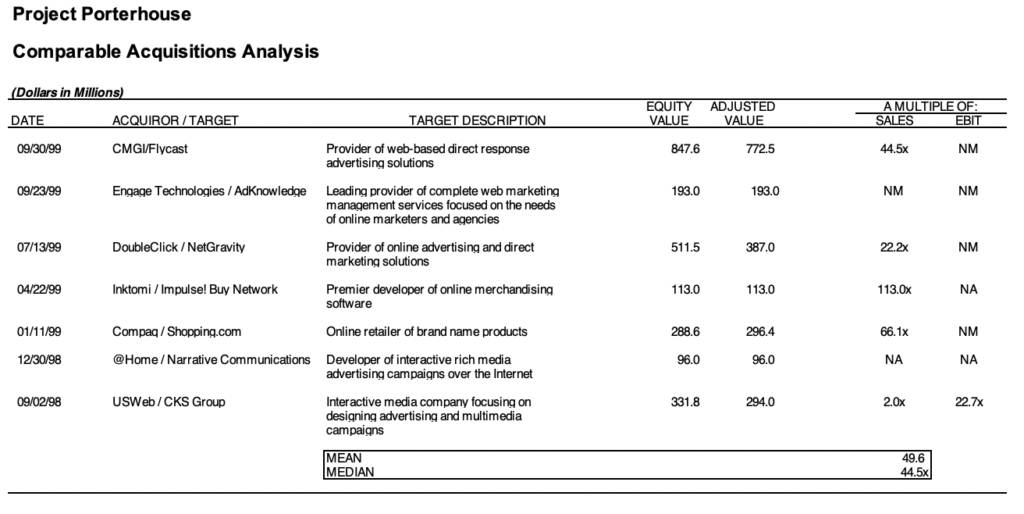

However, we needed hard statistics for the board. So we did what any good investment banker would do when trying to get an absurd deal past the board of the directors. We looked to comparable acquisition statistics… and we didn’t have to look very far to support our thesis.

Back in the late 1990s, the extreme majority of tech companies being acquired or going public had no earnings — rather, they burned through cash faster than Vanilla Ice’s music career. Afterall, ping pong tables and lemongrass and alfalfa smoothies aren’t cheap.

The table above is the comparable acquisition analysis that we did. The median comp on our list had recently been acquired for 44.5x sales (the “NM” fields in the EBIT column mean “Not Meaningful,” or in other words, not making a single penny in profit).

Starbelly was only projected to do $740,000 in revenue in 1999, but by the end of 2000, it was projected to do $15.7 million. Since $5 million in revenue was only a few months away, our analysis was easy. Approximately $5 million x 44.5 = $222.5 million. Add a few bucks for good measure and presto… we’ve got a $240 million company.

Are you sure we’re not overpaying by writing a check for $240 million for a website with no earnings and barely any revenue at all?

Well, we weren’t about to be lazy investment bankers in case the board snuck in that showstopper of a question.

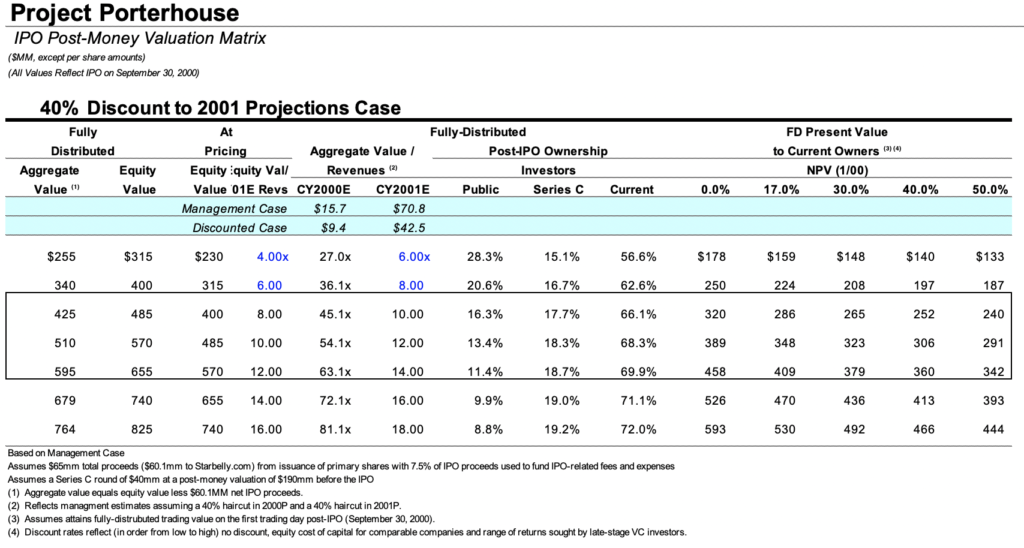

So we whipped up a little spreadsheet and what do you know? $570 million seemed like a good IPO valuation in 2000.

The HA-LO / Starbelly acquisition closed in January 2000 — for $240 million in cash and stock — barely

two months later the tech bubble burst and HA-LO Industries was in the express lane to bankrupcty court. As it turns out, that $240 million deal was the least of their successes, as Eric Lefkofsky and Brad Keywell went on to co-found Groupon and a variety of other public companies that landed Eric on the Forbes 400 list and made them both two of the wealthiest billionaires in the country.

The Rollins Complex

What does this all have to do with pest control, you ask?

Well, we’re living in an environement now, where, just like in 1999, fundamentals have gone out the window. The central banks of the world have flooded the markets with unprecendented liquity that is driving up the prices of assets in some markets to the level of absurdity of the tech bubble hayday.

Once again, in a variety of industries and asset classes the world over, valuation models are constructed on a Saturday morning by hungover kids in order to justify a competitive price for a deal, that will ultimately end up destroying value.

The purpose of this article is not to go into details on my thoughts on what is driving the markets and assets values, I’ll cover that later this month in the report.

But for now, I want to discuss how the bellwether for all asset prices in the pest control industry is Rollins.

In modern capital markets parlance, there is a notion referred as the Volatility Complex (or Vol Complex). The vol complex can be defined “as the collection of market participants whose allocation decisions is influenced by the level of volatility in the market. Any strategy or instrument that takes a volatility measure into account, ex ante, either directly or indirectly, is part of what we call the volatility complex.*”

As central banks (the Fed, ECB and Bank of Japan) have flooded the market with extraordinarily cheap money, they’ve provided a backstop to the market, pushing asset prices higher and all but eradicating volatility. This has created a feedback loop — the more capital flooding the market, the more volatily has decreased, pushing asset prices higher, which has continued to attract more capital… and the loop continues, pushing volatility down and asset prices up.

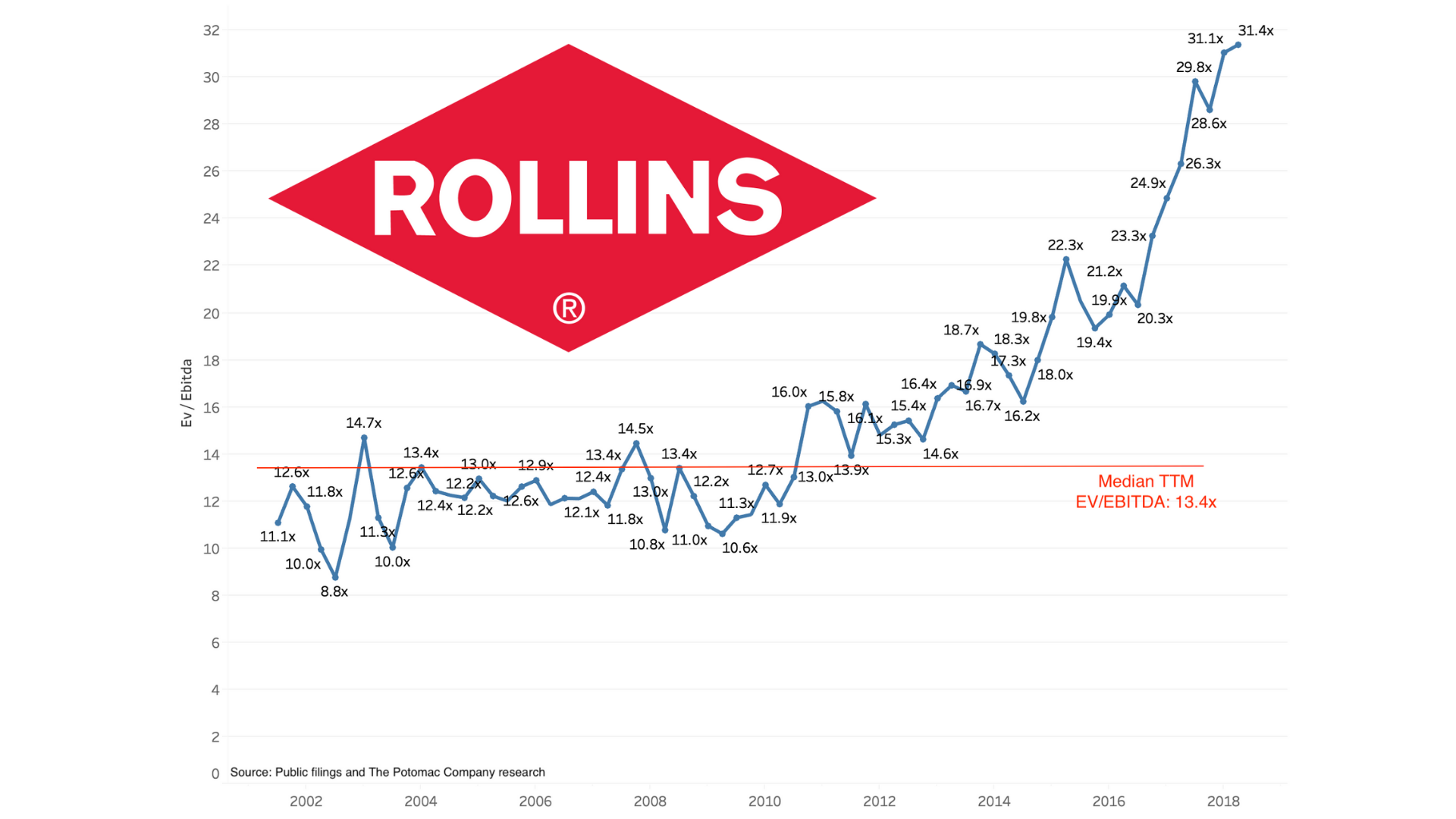

Similarly, in the pest control industry, any strategy that takes the valuation of Rollins (NYSE: ROL) into consideration is part of what I refer to as the Rollins Complex (ROL complex, for short). As capital has flowed into Rollins, pushing the stock to nosebleed valuations, other firms have looked to Rollins with envy and based their strategies on attempting to get a public market valuation similar to Rollins. We are seeing this play out in real time with Rollins’s competitors: ServiceMaster, Rentokil and Anticimex.

In late 2012 / early 2013, Rentokil began to examine its own strategy with regard to its portfolio. The Company reasoned that if it could look more like Rollins (e.g., a pure play pest control company) to the market, it would benefit from Rollins-like valuation multiples. To a large extent, this thesis has proven correct.

If Rollins was trading at 18x EBITDA and Rentokil was trading at 8x EBITDA, for example, the more that Rentokil looked like Rollins to the investing public, the closer it would trade to 18x rather than 8x. In order to do that, it had to become a pest control business (at the time, less than half of Rentokil’s global portfolio was pest control). In order to win deals, it had to pay a little more. But if it could pay 8x EBITDA instead of 5x EBITDA, it would be rewarded in the public markets with regard to its overall valuation. So it made sense to do so.

As Rentokil ramped up its acquisition activity in the US in 2013, it slowly began to drive up transaction multiples from 5x EBITDA into the double digits. ServiceMaster, which had gone public again in 2014, began to follow suit, increasing what it was willing to pay in search of Rollins-like valuations.

In late 2016, ServiceMaster hit a speedbump. It’s board decided that management was using acquisitions as a crutch, loading up the balance sheet with debt and using acquisitions to mask poor performance and high customer attrition. So, around November of 2016, it put the breaks on all acquisition activity and for the subsequent 12 months or so, Terminix completed no more than $5 million in transactions. Rob Gilette, the President, departed shortly thereafter… though based on his golden parachute, you won’t see him at any soup kitchens.

In 2014, after EQT, a European powerhouse private equity firm had acquired Anticimex from Ratos (another Scandinavian PE shop), the firm began to look for global growth and began eying the US. After looking at US deals for the latter half of 2014 and 2015, Anticimex finally entered the US market in 2016, which introduced further competition into the US pest control market.

The only way that EQT is going to exit the Anticimex investment is to take it public (or perhaps sell it to another private equity firm, from whence it came). In order to do that, AX is going to need to build scale at a rapid pace and try to get the business out into the market before the equity market collapses — which it will at some point. In order to put a forward value on Anticimex, the company looks to its publicly traded peers: ServiceMaster, Renotkil and Rollins (in a similar manner to how we calculated the sale price of Starbelly above, using comps) — with Rollins leading the pack.

Final Thoughts on the Rollins Complex

ALL pest control industry valuations models — including our own — are tied to Rollins. When Rollins cracks, asset prices in the pest control industry will come down and pest control companies will once again be selling for a third to half of what they are selling for now. When Rollins is trading at 30x EBITDA, a 15x EBITDA transaction by a competitor doesn’t get people fired. When Rollins is trading at 12x EBITDA, that same deal is a thing of nightmares.

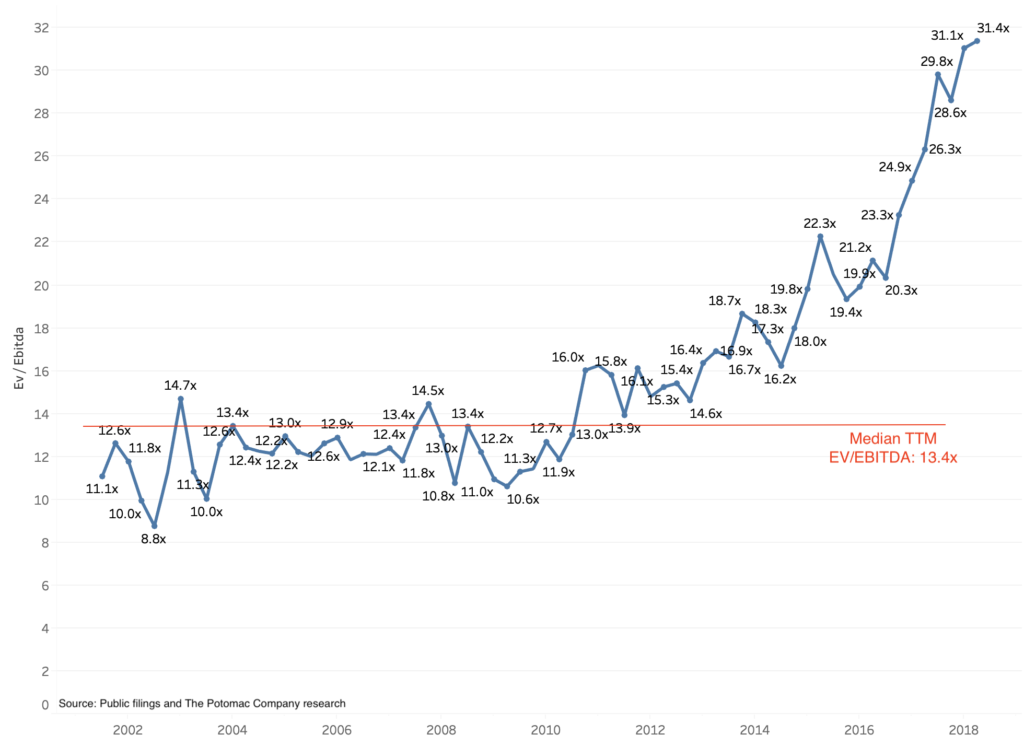

The chart below illustrates Rollins’s spectacular ascent during the era of cheap money and quantitative easing. From 2000 through around 2012, Rollins was a 12x EBITDA business — with its 18-year median TTM EV/EBITDA multiple clocking in at 13.4x. It’s now trading at north of 30x EBITDA, an absurdity once reserved only for tech high flyers of yesteryear.

After being on the front lines of M&A and investment banking during the Dotcom bubble, I am an unshaken believer in the fact that through the manipulation of interest rates and the money supply, central banks can induce asset price booms and euphoria — which they’ve done over and over again (Dotcom, housing, and now the everything bubble). I am also unwavering in my conviction that a bust always follows a boom and assets prices tend to be mean reverting.

You wanna know where valuations are going?

Keep an eye on Rollins… what goes up, must come done, that I know. It’s the timing that’s impossible since the central banks are in control.

Rollins (NYSE: ROL) Enterprise Value / TTM EBITDA

Finally, if you received this Commentary in your email inbox, you’re on the list. But if you didn’t, sign up below to be put on the list to receive our valuation report when it comes out later this month.

*Lisa Brown, Gorgon Capital Research