7 November 2018

Stockholm, Sweden

Well, this is going to be a long one.

I intended to write a short post-Pestworld piece, but I just had so much great material from Pestworld and the subsequent two weeks of meetings that this post has really taken on a life of its own.

I had meetings in Stockholm this week and now I am on the flight back to Switzerland — which is going to act as my tomato timer on writing this article. So, I apologize in advance if this one gets a little messy.

I am going to make a risky move and officially call a top in the pest control M&A market for this cycle. In doing so, I am going to attempt to provide you more fact than opinion and you can come up with your own conclusions. If I’m wrong, at some point, this will provide some great fodder for the glorified real estate agents out there.

But as usual, before we get to the juicy stuff, we’ve got some transactions to announce.

Potomac Announces Six Transactions

American / Anticimex Acquires Triple S Services

On the first day of Pestworld we closed Anticimex’s largest add-on acquisition in the United States. AX’s portfolio company American Pest acquired Triple S Services from Tony and Phil Sfreddo.

Triple S is a great story of family business done right. The business was founded by Tony and Phil’s father. Neither of the boys aspired to work in the pest control space, but when their father passed away at a relatively young age, it was time for them to step up. And step up they did.

Tony and Phil built that business from a small one-man shop to a DC-area commercial powerhouse generating almost $9 million in revenue with most of that being recurring. With almost 80% of the business being high margin commercial, Triple S also has also serviced important government institutions for decades, like the Pentagon and the CIA, among others. This acquisition brings serious commercial firepower to AX’s mid-atlantic platform.

As a former C corporation, we needed expert tax advice, and after interviewing a few potential advisors, Tony and Phil brought Cory Vargo onto the team within the first 2 minutes of speaking with him. I’ve mentioned Cory before, and once again, he has proven that he runs circles around just about everyone when it comes to taxes and transactions.

I learned a lot by working with Tony and Phil and I am thrilled that they chose Potomac as their advisor for this very important transaction. If you are focused on building a pest control business, this is a great one to emulate. Tony and Phil are brilliant businessmen and all-round great guys. If you’re ever looking for advice on a growing a pest control business, if you can find them, these are two guys that I would track down for advice.

Over the years, my circle of close friends has become more and more pest control-centric. When you do a deal, you work very closely and intimately on a day-to-day basis with your clients. Once the deal closes, that interaction changes and I often find myself missing certain clients — Tony and Phil certainly find themselves on that list.

Tony and Phil commented on the transaction:

Simply put, Paul delivers precisely what he promises and he doesn’t make promises hecan’t deliver. My initial thought was an advisor would only be concerned with the deal and not me. Paul Giannamore wins your trust by earning it. Would never work with anyone else, he and Potomac are the best.

Paul is very knowledgeable generally about business, but more importantly understands our industry very well, which gives him an advantage over most other generic advisors. Equally as important is Paul’s humility and ability to admit what he doesn’t know. His honesty, candor and truthfulness are both unique, rare and refreshing.

Paul started as our advisor and ended as a dear friend. I love the guy. He is simply the best at what he does and I would highly recommend him, in fact I would only recommend Paul Giannamore hands down to anyone considering selling their business. Honest, trustworthy and forthright, he brings a skill set that is invaluable and second to none. Our successful consummation of this transaction would not have been possible without the diligent efforts and tenacity of Paul Giannamore and Potomac. Thank you, Paul!

Thank you Tony and Phil.

Although I like to beat the hell out of acquirers, I have to give recognition when it’s due. David Billingsly, Jen Blondo, and the American Team did an excellent job executing this transaction under a very short timeframe and intense pressure. Without David’s leadership and communication skills, it’s unlikely that AX would have won this deal in the first place.

Orkin Acquires Five EcoShield Offices

In January and February of 2018 we closed five transactions in four states collectively generating over $14 million in revenue. These transactions mark our 14th EcoShield transaction over the last three years. We’ve delayed the announcement to ensure that valued customers and employees have smoothly transitioned to Orkin’s operations.

Since these transactions closed, EcoShield has significantly invested in the business and is focusing on building the platform to $200 million in revenue.

It’s Official, I’m Calling a Top: The Long Read

In March of 2006, Rentokil North America, at the time, only generating about $26 million per year in revenue, acquired JC Ehrlich for $141.8 million.

That purchase price — 1.14x Ehrlich’s 2005 full-year revenue of $124 million and approximately 10x EBITA — was a whopper at the time. In fact, Rentokil’s 2006 annual report defends the “premium paid” in order “to gain a substantial presence in the US pest control market and … benefit from further potential synergies available through further acquisition and integration of smaller pest control businesses in the USA.”

That’s right, in Rentokil’s annual report they felt the need to justify the price. Oh, how times have changed. If Rentokil paid the same price today for a business, the annual report would say something like “We punched the owner in his face and took the keys off his punkass … and we’d do it again. Quit asking stupid questions and buy our stock…” Andy Ransom, the CEO, would be dressed like Ali G in a bright yellow tracksuit on the cover of the annual report with the caption reading: Rentokil Initial Joins da West Staines Massive.

OK, maybe they wouldn’t be that dramatic about it, but if I were in charge this is how I would roll:

At the time of the Ehrlich acquisition, Rollins (NYSE: ROL), the industry benchmark, was trading at 1.6x revenue and 12.6x EBITDA (versus where ROL is today). Let that sink in for a second. Rollins, at the time, one of the two largest pest control companies on the planet, generating over $800 million in revenue and $100 million in cash flow, was trading right in the middle of its historical range, 12x EBITDA. I remember those days very well, when selling a pest control business for north of 10x EBITA and 1.2x revenue was almost impossible.

A decade later, Rentokil North America would buy Steritech, only slightly larger in size, for $425 million (2.8x revenue and 28x expected LTM EV/EBITA). To be fair, that doesn’t take into consideration $25M+ in expected synergies, thereby lowering the implied EV/EBITA over a three-year period to 8x EV / EBITA.

In late 2015, right after the Steritech announcement, everyone and his brother wanted to be the company to get the big 3.0.

And I wanted to be the advisor to get their first.

It would take almost a year from the closing of Rentokil / Steritech before I would sign a material deal at 3.0x revenue (12.0x EBITA) — which was the first such deal. Quite frankly, it wasn’t until late 2016 that I even believed that that was possible.

As time has marched on, we’ve seen similar transaction statistics on other material deals, and in certain cases, we’ve seen better. As we rapidly head toward the end of the year, I think that we are late cycle and the market has, to a certain degree, crested.

I feel as though the pest control industry has finally put in a high and I really don’t expect multiples to rise any further except perhaps in very rare circumstances for very unique and scarce assets.

On the way out of Pestworld last week, I mentioned to a friend of mine — an equity research analyst covering the pest control industry for large investment bank — that my next Weekly Commentary would “call a top.”

He said, “Be careful.”

Clearly, he’s right.

When you think a market can’t go any higher, the next thing that it usually does is … well, go higher. I was on the front lines of the tech bubble and I remember the market marching higher and higher, until the floor fell out.

I am NOT saying that the run is over, rather I am saying that it’s likely that we’ve seen the market put in its high for this cycle. Could this elevated state last another six months, a year, two years? Sure, anything can happen, especially with politicians and central bankers in charge of the markets.

At Pestworld, the head of M&A at a Big Four said, “For two years I’ve been saying that this market was going to recede, and it’s continued to prove me wrong at every turn. I’ve given up. With that said, I believe there is a lot of evidence that we’ve hit the peak. So, the question in my mind is not really whether or not we’ve topped, but how long this will run.”

Multiple Expansion Widens in 2018

In order to understand where we are today, I think it’s important to first look at where we’ve been, which will be a theme for this article.

Over the last 20 years, transaction multiples in the pest control industry have been relatively static, ranging from 5x to 8x EBITDA (0.9x to 1.2x revenue), with very little multiple expansion. If you’re unfamiliar with that term, multiple expansion refers to the fact that a larger business is more valuable than a similar, yet smaller firm. The logic behind this is that a larger firm would tend to be: (1) scarcer, (2) less risky and (3) have more resources and capabilities than a smaller firm. Therefore, a $4 million in revenue pest control business, for example, would sell for a lower multiple (e.g., 5x EBITDA) than a $30 million in revenue business (e.g., 9x EBITDA). [By the way, I just made those multiples up for illustrative purposes].

Back in 2006, when Ehrlich sold for 1.14x revenue, I can think of a handful of much smaller firms (sub-$5 million) that sold for roughly the same revenue and EBITDA multiple. In fact, I have a wonderful example. The very same week that the Rentokil / Ehrlich transaction closed, we signed a purchase agreement with Rollins for a business that was located in NJ, less than 100 miles away from Ehrlich’s HQ in Reading, PA. The purchase price was exactly $3,628K on $3,210K in revenue (1.13x revenue and 9.1x EBITA).

So in 2006, two pest control businesses located less than 100 miles apart sold for almost the exact same multiple, down to the decimal point. One was generating over $100 million per year in revenue the other one $3 million.

On the $3 million business, there were three bidders. Rentokil wasn’t even invited to the dance because at the time they were only doing $26 million in revenue in the US and not operating in the area.

The first two offers on that business were 0.95x and 0.90x revenue. In three quick rounds of bidding, what was a competitive process back in those days, the price settled at 1.13x revenue. We’re all looking at this now feeling bad for the sellers. However, as I look through my notes on this deal, based on the prior year’s transaction statistics, this business sold at a premium. Multiples in 2005 for the same size business were in the 1.00x to 1.05x revenue range (5x to 7x EBITA).

It wasn’t until 2012 that we actually began to witness multiple expansion in the industry, which would accelerate to an all-time high in 2018.

Multiple expansion has provided a lot of opportunity for companies to play the arbitrage game. Which simply means the simultaneous purchase and sale of securities in different markets in order to profit from price discrepancies.

For example, prior to selling APM to Rentokil earlier this year, we bought a smaller business at a lower multiple and then turned around and sold the whole package to Rentokil. This allowed us to buy a business in the private capital markets and then sell it in the public capital markets (Rentokil), taking advantage of multiple expansion. In other words, you buy a business for a buck and sell it for two, pocketing the spread and enriching yourself in the process. Last year we were successful in doing the exact same thing on multiple occasions. In one example, we bought a $10 million in revenue business, adding it to our current $35 million in revenue and then selling that combined package, again, pocketing the spread.

If you are starring down the barrel of a sale, you should be thinking about how you can take advantage of multiple expansion to realize relatively riskless return through arbitrage. Since I get a ton of questions on this and it’s one of my favorite things to do, I’ll put some facts out on the topic in the coming weeks.

Over the course of 2018, we’ve noticed a material widening of the spreads on transaction multiples across size segments in the industry. This is beginning to happen because acquisition pipelines are at an all time high and acquirers are beginning to get more selective.

In 2017, acquirers bought everything that moved. This impacted the lower end of the market, pushing valuations up in that segment and narrowing the spread.

In 2018, acquirers are passing on more opportunities than I have seen in the last three years. They are more aggressive with assets that they deem premium and just altogether passing on opportunities that they don’t view as premium. This has widened the spread between the high end and the low end of the market.

In 2006, narrow spreads across size segments indicated a relatively uncompetitive and moribund market (remember, there were only two large, national acquirers then, Terminix and Orkin). In 2017, narrow spreads indicated a relative supply / demand imbalance (which I’ll touch on below) whereby the lower end of the market moved up more rapidly than the higher end of the market.

Another head of M&A at a Big Four commented at Pestworld:

What’s the takeaway?

Multiple expansion is the sign of well-functioning capital markets. When I first got into the pest control industry, I was always surprised by the lack of multiple expansion across size segments.

One thing that I will mention here, because someone will send me an email if I don’t. The sub-$1 million firms have always sold at discounts to larger firms — then and now. Buying these small businesses remain a great way to create value in your own business and you won’t face much — if any — competition from the large acquirers.

In summary, we began to see multiples expand from 2012 through present with transient narrowing in 2017 due to supply and demand. We expect transaction multiples to remain elevated across the industry as a whole for a period of time. However, we are noticing relative softness at the low end of the market, which takes me to my next point. Supply and demand.

Supply & Demand Dynamics Shifting

In November 2017, we couldn’t keep up with the demand side of the market. There was a relative scarcity of sell-side supply versus demand — narrowing multiple spreads.

In November 2018, we can’t keep up with the supply side, with overall market supply of acquisition targets easily doubling year-over-year.

We don’t believe that the shift in supply has materially impacted valuations (yet) for the extreme majority of sellers, except, perhaps, on the very low end of the market.

To give you an example, as the industry stands today, there is over $600 million in pest control transaction volume under LOI. Between now and the end of the year, Potomac will close at least $100 million in volume. Currently, we have a transaction under LOI that I can say with confidence is the highest transaction multiple ever paid in the pest control industry. It’s a rare and premium asset. This is great news for those of you who own premium assets because as acquirers have become more selective, premium assets have continued to price at cycle highs.

As elevated valuations continue to bring additional sellers into the market, supply will begin to catch up with demand which will impact valuations on the margin.

Over dinner at Pestworld, I asked the president of a Big Four for his thoughts on current market dynamics:

How Did We Get Here?

Over the summer, PCT interviewed a handful of us on the topic of what has caused / is causing the run up in valuations.

The other interviewees gave the party-line talk, “Large corporations … have a lot of cash on their balance sheets right now. They’re looking to invest that cash.” Another rather comical one stated: “Private equity companies have learned how valuable pest control companies are — they’re real companies making real money — and they will continue to have an interest in acquiring these businesses.”

When I look at Rollins’s balance sheet, the company had more cash on the books in September 2007 than it did in March of 2014. Notwithstanding, excess cash on the books is more a symptom than a cause. Same thing with private equity. Sophisticated investors didn’t just realize that pest control companies are “real companies making money.” These businesses, like every pension fund, insurance company, mutual fund, endowment, etc, on the planet are simply chasing yield.

The point that I made in the article was this: ‘“The Federal Reserve and other central banks have created trillions of dollars of excess liquidity, driving down interest rates and dramatically increasing the prices of all assets — bonds, equities, real estate, collectibles, etc.,” Giannamore added. “Owners of pest control companies have been direct beneficiaries of this monetary madness. By nailing interest rates to the floor, the Fed has nailed asset prices to the ceiling.”’

After the article was published, I received this from a reader:

Hey Paul,

I just finished the most recent PCT Magazine and I wanted to tell you that you are right on with your analysis of how the QE over the last 9 years has caused major asset inflation. I am glad you have the guts to tell our industry that part of the story. I think most people have no idea.

I certainly appreciated receiving his email and I wish it were actually guts that I had; however, I think it’s just common sense.

All of the discussion we had above about multiple expansion, supply and demand, competitive dynamics amongst acquirers, etc., makes for fun conversation, but again, these are all symptoms, not root causes.

The bottom line story here is this.

Since the creation of the Federal Reserve as a lender of last resort, and more acutely since Nixon closed the gold window in 1971, the US has been on an entirely elastic monetary system whereby the central bank, to a large degree, sets the most important price — interest rates.

In the last 20 years alone, the Fed (and its global central banking comrades in Europe and Asia) has blown air into the dotcom bubble, the housing bubble, and now the everything bubble. And since you can’t engineer prosperity by printing money (otherwise Venezuela would be the richest place on earth), there is always a hangover (recession) when the party ends.

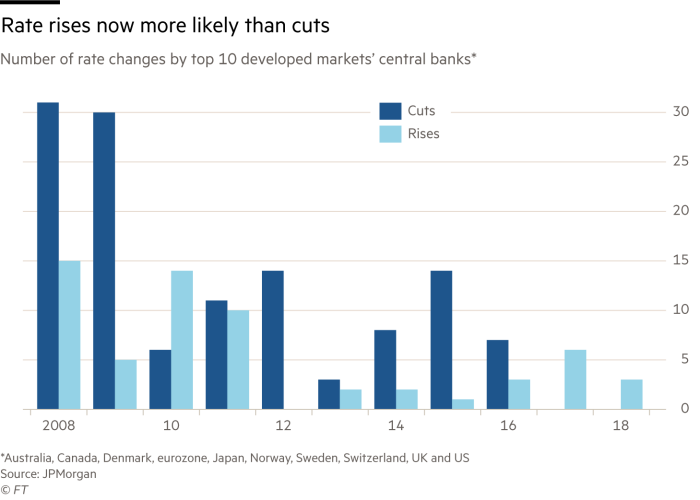

During the recession that followed the global financial crisis, central banks around the world have attempted to engineer prosperity by pushing up the prices of assets to create a wealth effect. In just over a decade from the start of the crisis there have been over 700 rate cuts by central banks and more than $25 trillion in fiscal and monetary expansion.

As central banks around the world continue to engage in this unprecedented monetary experiment, the risk-free rate and term rates have been pushed down so low that asset prices are at unsustainably high levels.

If you listen closely to central bankers, they will even tell you exactly what they are doing. For example, in October 2012, right after announcing QE3, then Fed Chairman Bernanke said this about his attempt to inflate asset prices in order create a wealth effect:

“The tools we have involve affecting financial asset prices, and … those are the tools of monetary policy. There are a number of different channels—mortgage rates, I mentioned other interest rates, corporate bond rates, but also the prices of various assets, like, for example, the prices of homes. To the extent that home prices begin to rise, consumers will feel wealthier, they’ll feel more disposed to spend. If house prices are rising, people may be more willing to buy homes because they think that they’ll, you know, make a better return on that purchase. So house prices [are] one vehicle. Stock prices—many people own stocks directly or indirectly. The issue here is whether or not improving asset prices generally will make people more willing to spend. One of the main concerns that firms have is there is not enough demand, there’s not enough people coming and demanding their products. And if people feel that their financial situation is better because their 401(k) looks better or for whatever reason, their house is worth more, they are more willing to go out and spend, and that’s going to provide the demand that firms need in order to be willing to hire and to invest.”

The Fed, ECB and the Bank of Japan have been phenomenally successful in inflating financial asset prices over the last six years. What they didn’t anticipate, however, is that this financial repression didn’t create inflation in the real economy and spur economic activity. It did almost the opposite. QE has largely been disinflationary, causing corporates to accelerate share buybacks and load up on debt to pursue acquisitions.

Just look at the price of Ehrlich then vs. Steritech now. And no, it’s not because Rentokil has a lot of cash sitting on its balance sheet or private equity is in the game. It’s because of things like this:

Yes, you read that correctly. Rentokil borrowed almost a half billion dollars at ZERO POINT 95 percent. It’s not excess cash that’s burning a hole in their pocket, it’s that borrowing money is virtually free.

You know why they were able to do that? Because benchmark sovereign debt is trading at negative yields. The risk-free rate is almost zero.

Investors, in a desperate search for yield, are confronted with decisions like: Should I buy sovereign debt at negative 0.50 percent per year, a guaranteed loss, not counting what we’ll lose on inflation, or should we park money with Rentokil for a few crumbs? Crumbs are better than a guaranteed loss, here’s your money Rentokil (and Rollins, and AX, and others).

With over $11 trillion dollars in sovereign debt trading in negative yield territory very strange things are happening. I live in Switzerland where they make it very, very difficult to prepay taxes. Why? This is a real headline… and it’s not the Twilight Zone, though it sure feels like it:

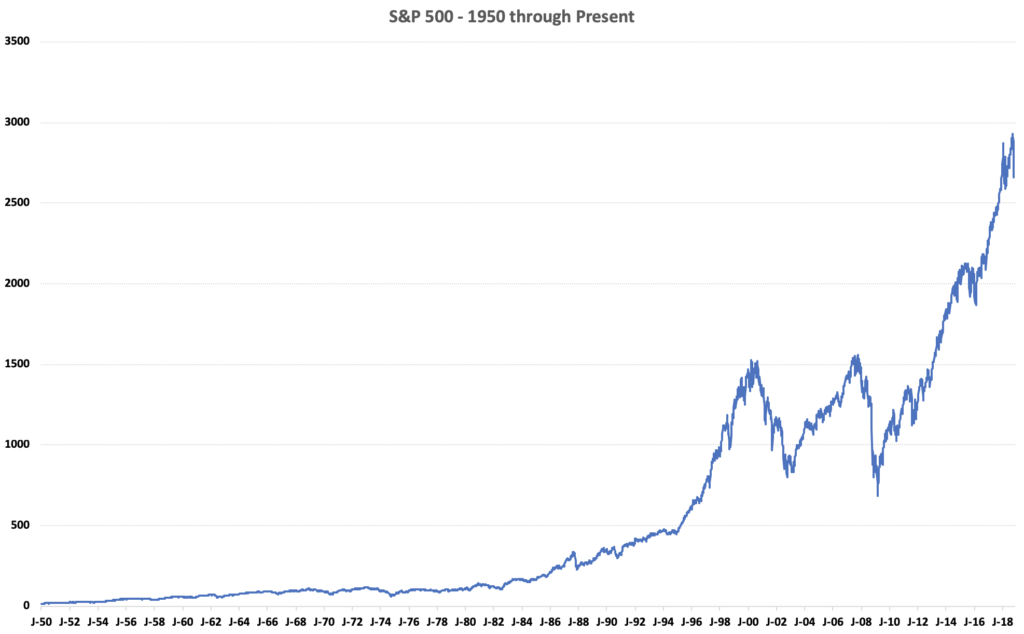

As central banks have continued to purchase government and corporate debt, driving interest rates down to a 5,000-year low, global stock markets have hit nosebleed levels.

For those of you who haven’t been paying attention, below is a chart of the S&P 500 index from 1950 to present.

Eric Peters, CIO of One River Asset Management, and one of my favorite investment managers, put it best in a June 2018 interview when he said.

“All of those things have been intended to pull future financial asset returns to the present. That has been what they [central banks] have attempted to do. And the hope has been that, by doing that, that you would create wealth in the here and now that would lead to greater investment and greater economic activity. And we would deal with the fact that financial asset returns have been pulled to the present – we would deal with that problem later. That’s kind of where we are right now.”

Peters hit the nail on the head and you can see it today in the pest control M&A market — central bank policy has pulled “future financial asset returns to the present.” If you own a $5 million in revenue pest control business, based on decades of history, that business is worth $5 million to $6 million. Today it’s worth $10 million to $15 million. Monetary policy has pulled five to ten years of future financial returns into the present.

Irrespective of what you think of Donald Trump, global central banks were instrumental in sending him to Washintgon. We hear a lot about wealth inequality and governments around the world believe that that can be solved by confiscating wealth (taxing the greedy businessman) and redistributing it. However, the biggest redistributors of wealth on the planet are the Federal Reserve and the European Central Bank. By inflating financial assets, they have dramatically increased the wealth (at least on paper) of those holding financial assets. All the while, wages have stagnated.

Those who are closest to the creator of money (central banks) reap the benefits at the expense of those further away from the money creation. The ECB and the BoE are buying corporate bonds in Europe, with money that they have created out of thin air. This allows firms like Rentokil and Anticimex to raise unimaginably cheap money. With that cheap money, they can pay you more for your business. It’s not just the European firms, as I wrote last year, the Swiss National Bank created money out of thin air and purchased stock in Rollins (NYSE: ROL). It’s insanity.

Think about it for a second. Let’s say you own a pest control business that was worth $3 million five years ago. It might be worth $10 million today, when it otherwise would have only been worth $4 million. Further, as a business owner, you likely own real estate and other financial assets. Zero interest-rate policy (ZIRP) and negative interest-rate policy (NIRP) have been a total windfall for you and others like you.

However, for your 48-year-old technician whose wife is an elementary school teacher, he’s seen nothing but sluggish wage growth and tremendous price inflation in health care, education, foodstuff and other staples.

He, just like most Americans and Europeans, doesn’t understand exactly what’s going on, but he knows that he is being left behind. The far-left is blaming greedy businessmen and corporations and their solution is Bernie Sanders-style confiscatory tax rates and more violent government intervention in markets. The far-right is blaming immigrants, bad trade deals, and whatever else they can come up with and their solution is big military spending, high fences, tax cuts and spending increases and more violent government intervention in markets.

Are You Still the Best Owner of Your Assets?

I spend a lot of time helping our clients make one very important decision: are you still the best owner of your assets?

For a long time, this was a relatively easy question to answer. The decision to sell was typically driven by life events such as sickness, death, divorce and retirement.

However, as transaction multiples have increased, this decision has gotten much more difficult.

Younger and younger owners have begun to ask themselves: “If I sell now, what can I do with the proceeds? Can I get a better risk-adjusted return by selling now or holding on?”

Sellers have gotten younger and younger. Just look at Anticimex’s five platforms in the US: one was sold by an individual in his early fifties and four were sold by guys in their early forties.

If you’re within five years of retirement, I don’t think you can ignore the current market. I think you need to think long and hard about whether or not to pull the trigger on a sale. No one knows how long this run is going to last, but I think we would all be foolish to think that at some point multiples won’t revert back to their historical mean.

If you’re more than five years out from retirement, you’ve got some high class problems. You’ve got a valuable asset that you can continue to grow, or you could exit with ease.

For those of you who are going to double down on your business and grow it, there is some potentially very good news on the horizon. If you bide your time, once the monetary and fiscal heroin wears off, there will be companies to buy on the cheap and quality employees looking for jobs.

And in 2018, things are beginning to change quickly.

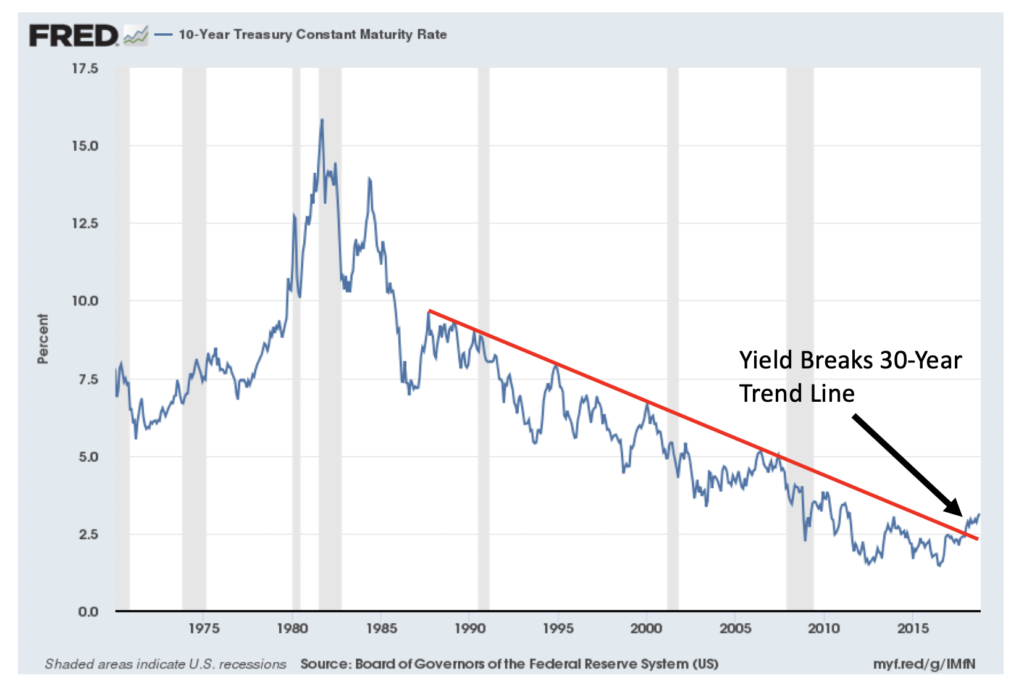

Over the last thirty years we’ve lived in an environment of falling interest rates but this is starting to change as central banks begin to unwind trillions of dollars in monetary stimulus.

The chart below shows that for the first time in almost 30 years, interest rates have broken above a material trend line.

As the Federal Reserve has hiked rates, it has created a vacuum effect draining global liquidity, pummeling emerging market currencies and driving capital flows into the United States in search of higher yields.

As yields rise, asset prices will begin to decline. Because we currently live in a world of unprecedented monetary experimentation, I don’t think anyone has any idea as to exactly how this is going to unwind, but we know that it will.

This is all good news if: (1) you’ve got capital to invest — think 2008 / 2009 — buying at bargain basement prices or (2) you’re focused on growing your business for the long-term.

For everyone else, figure out what your game plan is because sooner or later, things are going to get messy.