As you’ve noticed, the Weekly Commentary (my night job) has once again been forced to take a back seat to M&A (my day job).

Over the course of the summer we’ve completed a dozen transactions and over the next few weeks we’ll be announcing approximately $300 million in global pest control transactions. We’ll start with a brief announcement today at the end of the Commentary.

Today’s Commentary will be very short and I will focus on what’s going on in the market today.

Acquisition Spend is on the Rise

Transaction multiples have remained elevated throughout 2019, fueled by cheap debt, very competitive M&A dynamics and what I believe to be a fundamental rerating of pest control as an asset class by the public markets.

As we stand at the end of 2019, Potomac has never had more clients under LOI than we do today (which should give you an idea as to how full the pipelines are), one of the main reasons why I haven’t been able to pick up my pen recently.

This should make a lot of pest control operators very happy and a lot of equity research analysts with “Buy” ratings out there worry just a little bit less about their coverage universe closing the gap on their EBITDA bridges through acquisitive growth. At some point, these “Buy” ratings will end up becoming “Sell” ratings as the insanity continues, but for now, with central banks around the world embracing negative rates, this market probably still has some legs.

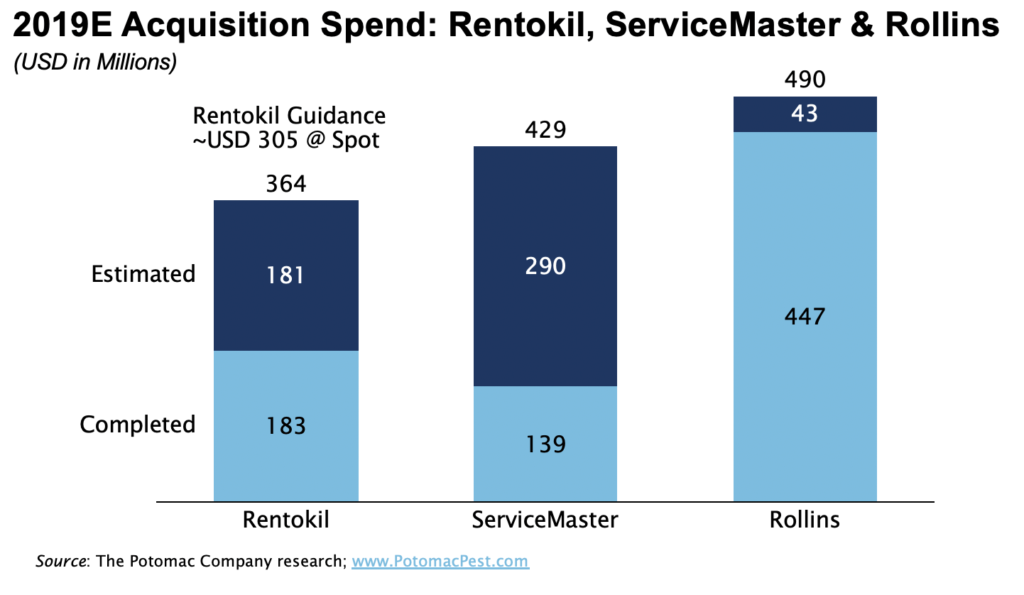

The chart below illustrates where each of the publicly traded acquirers is in terms of acquisition spend in 2019.

With pipelines full and more coming to market every day, we believe that Rentokil will safely exceed Ranson’s guidance on 2019 spend — so you can check that box.

Rollins is still bloated with its pants unbuttoned (I’m still not sure if it unbuttoned the pants itself or if the button popped off) after the Clark acquisition (and by the way, don’t be dirty, that has nothing to do with all of the strip clubs across the street from the Rollins’s HQ, I’m talking indigestion here). Clark clocked in at total spend of $426 million and since the beginning of the year, Potomac has done another $20 million or so in deals with Rollins.

Rollins seems to be on track spending between $465 and $475 million and we’ve added a little cushion in case something interesting pops up now that we are about to cross into M&A season (September 1) and there is still time left in 2019.

ServiceMaster is the wild card in the bunch. I think that there are a lot of opportunities for SvM both inside and outside of the pest control industry. We believe a very safe estimate for SvM’s acquisition spend is $430 million. We don’t see them doing less than that in 2019 and I have a feeling that it could be much higher depending on what happens the remainder of 2019.

While AX isn’t in the charts, they’ve already spent north of $160 million thus far this year in North America. They should definitely breach $200 million mark by the end of 2019. After all, for the Swedes, holding cash now has a very real cost to it and as AX eyes a 2021 public offering, scale and density in the US market will be the name of the game for them.

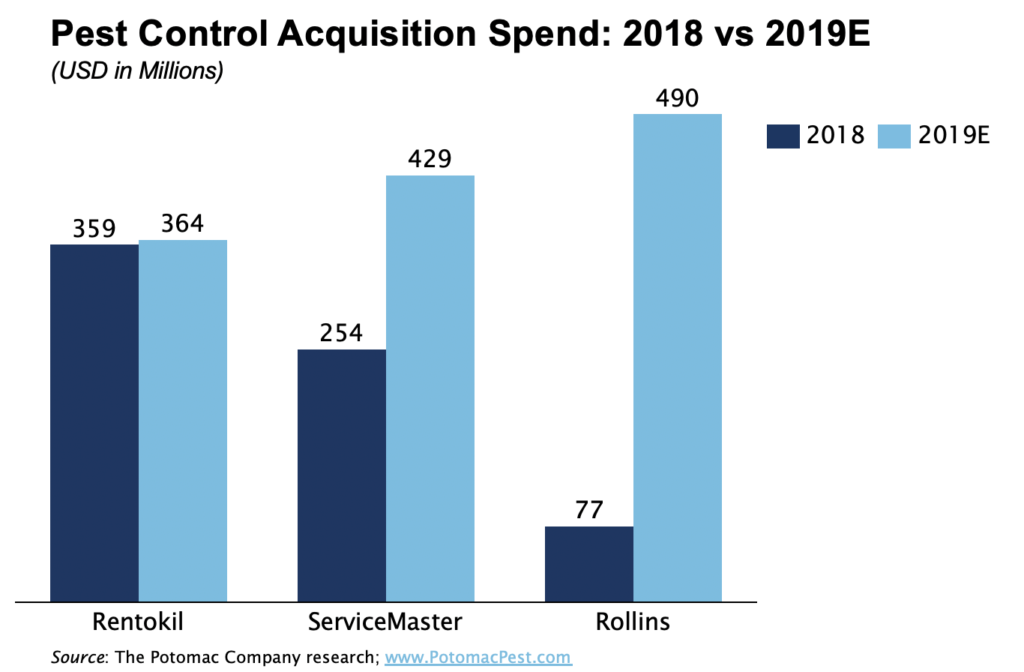

The chart below illustrates 2018 acquisition spend versus Potomac’s projected 2019E spend. While skewed by Clark, total spend in 2019 should almost double, with AX remaining pretty constant from last year.

For equity research analysts out there, I believe that the only revisions that we’ll see between now and the end of the year will be upward revisions in spend.

The Great Rotation into Smaller Acquisitions

A few months ago I suggested that we would begin to see the large acquirers double down on smaller acquisition targets. That’s been happening in earnest over the recent months.

2019 has seen the most marked uptick in valuations for sub-$5m players that I’ve seen in this cycle. This has been narrowing the multiple spread between small and large deals further compressing multiple expansion.

This month we’ve already seen more than one acquirer toy with locking up larger deals ($50m EV+) in the autumn and pushing closing into 2020 while focusing on smaller density plays. This allows them to better manage 2019 spend and get a jump start on the beginning of the year in 2020. AX should be able to take advantage of this given that it doesn’t have the same capital allocation considerations as its publicly-traded brethren.

The market should see the spring / summer closings of material deals in the next 30 to 60 days and then a focus on small deals heading into the end of the year.

For sellers, appropriately timing capital allocation decisions quarter-by-quarter and over fiscal year calendars can often mean a better or worse deal for you.

As the pest control market has heated up in recent years, there are half dozen or so former pest control guys out there dabling in M&A and learning the craft on someone else’s dime. This is very good news for acquirers as we are seeing what sort of deals they are getting and how they are taking advantage of the situation. I recently did a presentation for corporate development professionals on how to fight the auction and use a variety of tactical shutdown moves to confuse and disorient unexperienced brokers to get yourself a sizable discount. That recording will be available in September by request only, I don’t plan on broadly publishing it, so if you want to see it, just send me an email.

Rentokil Invites ServiceMaster to Compete with them the UK

As I’ve said for the better part of 2019, we’ll see SvM get real about international expansion.

In September of 2018, Rentokil acquired the pest control business of Mitie, a UK-based facilities management firm for GBP 40 million. It didn’t take the UK Competition & Market Authority (“CMA”) very long to start squealing about antitrust issues with the acquisition.

In the end, the CMA is forcing Rentokil to sell a piece of the acquired business to another service provider. But being a government regulatory agency, it’s not a simple process. Rentokil has to sell the business to another firm that the CMA deems is capable of actually operating that business, otherwise the demise of the business would create competition issues in and of itself.

Over the course of the summer, Rentokil and ServiceMaster have put in a proposal to the CMA whereby ServiceMaster would purchase a portion of the acquired business, giving SvM an entry opportunity in a market that is controlled (80%) by Rentokil.

If the CMA ends up approving the deal, the UK will enjoy the services provided by not just Rentokil and Rollins, but also ServiceMaster.

If you’re a Brit and you’re thinking about selling your business, cross your fingers that SvM gets in.

Accouncement: Orkin Acquires Greenleaf Pest Management

This transaction is a sub-$5m deal and one that I really enjoyed working on. It’s a prime example of what has been going on over the last four or five months in the low end of the middle-market in pest control.

Greenleaf, based in North Hollywood, California, was founded by Stan and Lori Lake in 1998. While predominantly a traditional pest control company, Greenleaf does provide organic services to some of its Los Angeles clients that desire organic treatment options.

Lori Lake said:

“I am very happy to be able to close this chapter of our lives and move on to the next. We began to search for an advisor because we had no idea what we should sell our business for, after all, this was for our retirement and it was a very important decision.

I was impressed with Paul Giannamore beginning with our initial phone conversation. Paul is very knowledgeable, patient and kind. He was always professional, yet very personable. He explained the process in minute detail, answered all of our questions and was easily available to us, even though we knew he was constantly on all corners of the globe. Not only was he able to run a very effective process with buyers, he also helped us in choosing the one that would be best not only for us, but our employees as well. Before hiring an advisor, we were concerned about spending money and not getting a satisfactory result. With Potomac, we truly couldn’t be more pleased with the results.”