7 April 2019, Gulf of Suez, Egypt

It’s been a busy start to 2019. Multiples peaked in late 2018 and have remained relatively constant, drawing a continuous supply of sellers to the bargaining table.

As we rapidly approach the start of the pest control season in North America, I’ve received quite a few questions over the last few weeks as to whether or not I think that this market will continue to run. Given the fact that the ECB and the Federal Reserve have reversed course on monetary policy (i.e., they’ve finally admitted to the public that it’s impossible for them to tighten), my guess is that this buoyant M&A market will continue throughout 2019 unless we get a repeat of 2008. One thing I will say, it’s clear to me, through first-hand experience in dozens of emerging markets that global growth is beginning to slow.

This week I am on the Gulf of Suez, right south of the Suez Canal, one of the busiest waterways on the globe. Egypt, one of the more important emerging economies in the region, is experiencing asset price inflation (particularly in the real estate sectors) like the US did in the early to mid-2000s. Although I fear that this is going to end very badly for the Egyptians, the real estate booms in the middle east are making for a rapidly growing pest control sector. I took the photo above from a restaurant in Ein Sokhna, on the Red Sea. As you can see, they are literally carving new cities and towns right out of sand and rock along the sea. I had a meeting here last June and I wish I would have taken a photo because there was nothing here but sand, rock sea and industrial complexes.

Egypt, the epicenter of the Arab Spring had the opportunity to clean out its government and unfortunately they’ve brought in one retard after the next. There are 95 million people here struggling to make ends meet on a few hundred bucks a month and I watched the president give this sage advice to a suffering nation over live TV the other night: “You want to control prices, don’t buy things that get more expensive. The matter is simple.” Looks like he’s taking his economic lessons from US politicians…. but unlike in the US, Egyptians don’t believe their politicians … which gives me a glimmer of hope for this place.

I’ve had a multi-decade love / hate relationship with Egypt and I often knock on them, but I can say that the Egyptian people are really some of the nicest people you’ll meet anywhere. If you get the opportunity to visit, it’s worth it.

Since I’ve just acquired a new camera, I took a lot more photographs on this trip than I normally would. Below is an evening shot of a tanker heading toward the Suez Canal.

I am leaving Cairo tomorrow heading over to the Arabian peninsula for a few days to take care of some business at PestWorld East in Abu Dhabi. I appreciate everyone who has reached out to me about getting together in the UAE, unfortunately my schedule is super tight this time as we have all day / every day investor and M&A meetings.

Here is what’s on tap for this week’s Commentary:

- Announcements: Rentokil has substantially bolstered its position as the undisputed leader in the vector control space with its acquisition of our client, private equity-owned Mosquito Control Services. Further, Rentokil has acquired Aquatic Services in January 2019, we discuss this transaction in detail in the Institutional Investor’s section below. Finally, we announced the sale of our client, ProForce Pest Control in North Carolina to EPS.

- The Pest Control Executive: Today’s Executive will be very brief … a simple discussion on pest control operations software.

- The Institutional Investor: Rentokil, Vector Control and Lake Management: Given that Rentokil has finally announced the acquisition of MCS and I get a lot of questions about Rentokil in general, today we are going to focus on Rentokil. Unbeknownst to many, there was a time that I myself tried to acquire Rentokil North America … you’ll learn about that and more below in The Institutional Investor’s section.

- The Back Page: This is a new section. In it, I’ll answer questions that I receive that are not directly related to pest control, M&A, valuation, etc. Today, I give one of our readers the inside track on his family vacation to Paris.

Announcement: Rentokil Acquires MCS and Bolsters Position as Undisputed Global Leader in Vector Disease Control

In late Q4, in one of Rentokil North America’s largest transactions of the year (if not largest), we advised on the sale of private equity-owned Mosquito Control Services (“MCS”), to Rentokil North America. This business was owned by Scott Capital, which it originally acquired from the founders in 2014. MCS operates out of ten offices in five Southeastern US states.

This is both Potomac’s and Rentokil’s second transaction in the vector control space, taking out 2 of the 3 largest firms in the space. The prior year we advised on the sale of VDA, the largest vector control business in the world (with almost $50m in revenue) and Rentokil North America’s largest transaction of 2017.

While the VDA transaction put Rentokil on the map in terms of vector control, making it the largest provider in the world, I believe that it’s the MCS acquisition that is going to allow Rentokil to really accelerate growth in the vector space.

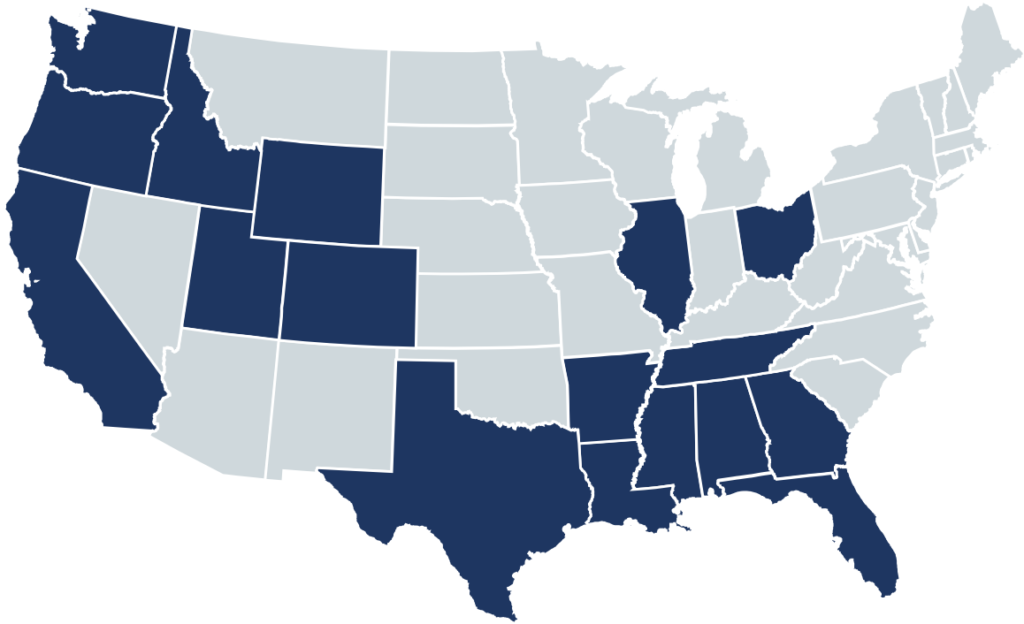

The map below illustrates Rentokil Steritech’s current vector control footprint in the United States. The acquisitions of MCS added ten offices and dramatically bolstered services offering in the Southeast US.

Rentokil’s North American Vector Control Footprint

I really enjoyed working with Scott Capital and MCS’s management team. Scott Capital did a phenomenal job taking MCS from a large family business and turning it into a high-margin, multi-state powerhouse. Greg Scott and Andrew Maurer, both of Scott Capital, were instrumental in the Company’s growth and great partners for management. For privately held businesses that might be looking for a partner in growth, it would be worth making the call to Greg and Andrew. Scott Capital seems to provide just the right amount of hands-on attention without becoming overbearing or an otherwise pain in the ass to the management team.

Steve Pavlovich, Mosquito Control Services’ CEO, not only has the technical expertise in mosquito control but he’s a great leader and manager for the business. Steve and Sam, the COO, along with VDA team and their unparalleled capabilities in the space, have the right stuff to ramp up that business. There is a tremendous amount of opportunity in the United States, but when you start thinking about Latin America, Europe and Asia, this may be very big for Rentokil… if they can get it right. We’ll discuss this in greater detail in today’s Institutional Investor’s section below.

On working with Potomac, Pavlovich stated: “The Potomac Company and specifically, Paul Giannamore, was extraordinary. His unsurpassed knowledge of the pest control and vector control landscape was invaluable to us. The professionalism and M&A expertise of Paul and his team was evident throughout, at each and every phase of the Mosquito Control Services transaction process. His guidance and expertise were imperative for Mosquito Control Services and getting this transaction done with a great partner.

Announcement: EPS Acquires ProForce

In other news, we completed the sale of ProForce Pest Control of Raleigh, NC, to EPS. This was EPS’s first acquisition in the door-to-door sales arena.

As you well know, there are only a small handful of door-to-door companies that I respect, and ProForce is one of them. You can read more about it here if you so desire.

I really enjoyed working with Spenser Morgan, the Company’s president, and I am excited to see what’s in store for him next.

Announcement: Rentokil Acquires Aquatic Systems and Bolsters Position as Leading Provider of Lake Management Services

Rentokil Steritech has acquired the leading lake management services firm in the state of Florida. Aquatic Systems, along with Rentokil’s Solitude brand, now have a 30% market share in Florida, generating over $30m per year in revenue.

This acquisition brings Rentokil over $20m in revenue, eleven new field offices and over 150 employees.

Similar to the MCS transaction, we’ll discuss this transaction in far greater detail in the Institution Investor’s section below.

The Pest Control Executive: Short Q&A on PestPac, PestRoutes & Evolve

Due to intense time constraints and a nasty travel schedule, this week’s Pest Control Executive section will be very brief. Below is a question from one of our readers on software.

Hi Paul,

I was wondering what most of faster-growing companies are using for technology/CRM these days? I’m sick of Pest Pac and all the nonsense. Seems like there has to be better options out there.

I really appreciate any insight. Talk soon!

I tend to come in contact with three vendors most often (at least in the US): PestPec, ServicePro and PestRoutes.

Both PestPac and ServicePro make you feel like you’ve taken a time machine back to 1993 (in terms of their graphical user interface). I remember being at a closing a few years ago and I needed to log into one of them to pull a report and I couldn’t.

Why?

Well, I use a Mac and you could only open the software in Internet Explorer, which is not available on Mac.

I’ve only been impressed by one pest control software that I’ve seen firsthand. It’s a software package that I discovered when doing the Killingsworth transaction… it’s called Evolve. It’s used by both Killingsworth and the Jenkins boys’ ABC operations in Texas. I think that this one holds a lot of promise and it’s proven to work for businesses both large and small.

I think that PestRoutes might be on to something as well and I need to spend more time investigating that software before I can speak intelligently on it.

I am not going to go into the details as to why I like Evolve personally, but if Pepsi and Coke aren’t quenching your thirst, there are other options out there for you.

You can take a look at it here: https://www.evolveone.com

Bottom line, the software doesn’t make the company. Americans tend to get caught up in operating software more than folks abroad. I’ve come across extremely successful and highly profitable pest control companies running their $5m+ enterprises on QuickBooks with a plugin. It might not be ideal, but don’t get too hung up on software. Build a strong culture of trust and growth, overdeliver on your services and market the hell out of your business… then worry about the software.

The Institutional Investor: Rentokil, Vector Control & Lake Management

Question

Hi Paul,

I came across your newsletter recently and, having been an equity analyst following the trials and tribulations of Rentokil over the last 20 years (and in more recent years quite a significant turnaround in equity investors’ eyes), was very interested in your thoughts on the US pest control industry. I also enjoyed your broader commentary on central banks’ intervention in the global economy since the Financial Crisis, and wholeheartedly agree that they are the biggest culprits for the rise of inequality and frothy asset valuations. Right now, I’m very intrigued by how Terminix is going to perform following ServiceMaster’s disposal (at last!) of American Home Shield, as well as Anticimex’s more aggressive push into the US market, and Rollin’s seemingly greater appetite for acquisitions, and whether all of these factors will encroach on Rentokil’s progress in the US market; I’d be very interested to hear any thoughts you might have on these topics.

This a great question, and while I am going to discuss Rollins, Anticimex and ServiceMaster later in April (and believe me, I’ll have a lot to say), today we’re going to focus on Rentokil.

For the Seinfeld fans among us, in the episode The Burning, George Costanza learned to exit on a high note. If I were Andy Ransom, I would think about doing that myself right about now.

As we all know, before Ransom took the helm of Rentokil, the place was a real shit show. Some of their competitors would argue that that is still the case. However, when I look at Rentokil, I can’t help but be impressed with what Ransom and his team have accomplished. The Company is growing organically at a faster clip that Rollins and ServiceMaster and unlike ServiceMaster, Rentokil North America actually has a real commercial business.

Back in 2008, Rentokil was having some problems. Alan Brown was running the show, the global equity and debt markets were beginning to reel from the global financial crisis. That’s when I decided that it would be a great time to acquire Rentokil North America.

It’s true, I was barely 30-years-old and could neither balance my own checkbook, nor had any experience whatsoever in operating a pest control business. But hey, at the time, neither could some of the guys at Terminix. They could barely get out of bed in the morning they were so hung over from the night before … I reasoned if they couldn’t break that business, then I had a damn good shot.

I put together a group of US private equity firms, got the commitments for cash and grabbed a coffee with Alan Brown in London to make my pitch.

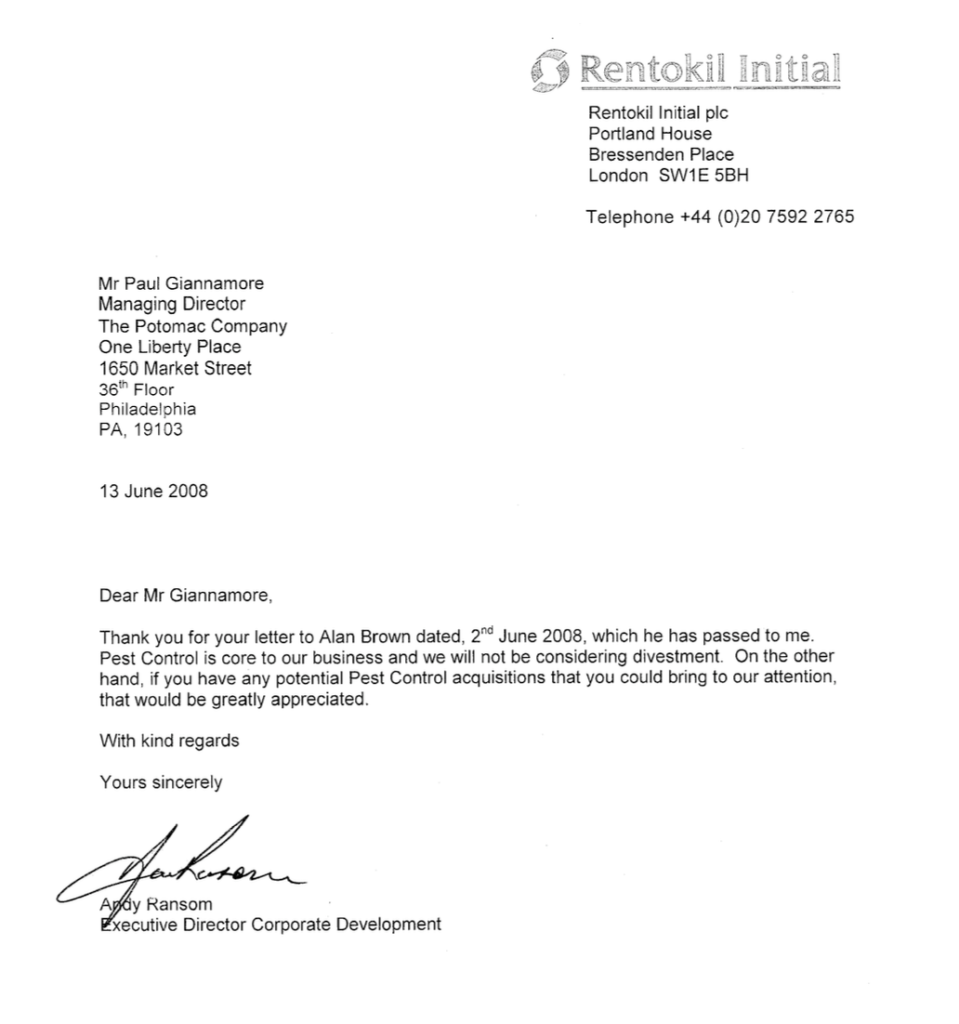

At the time, I believed that Rentokil needed the cash, and I had it. I needed a pest control platform in the US, and they had one. Shortly after my visit, I sent over a very brief, written proposal to Alan Brown who apparently didn’t think it was as exciting as I did. He handed it off to his consigliere, Andy Ransom, who at the time, was the head of Corporate Development for the firm.

I still have his short and sweet letter. As you can see, he told me that they are staying in North American pest control, which worked out well for them. As for me, I took his advice and continued getting them in front of deals, which has worked for me.

Although others in the industry called me a moron for trying to buy Rentokil’s “broken” platform at the worst time possible, I disagreed. The best time to acquire assets is in the depths of recession or when the seller is on the balls of his ass and needs cash. Rentokil was clearly not in dire straits, but under Brown, still plagued by the City Link mess, I didn’t see a Ransom-style turnaround in sight. In hindsight, had I been able to pull that off and then exit in this current market, you wouldn’t be reading this commentary right now, you’d instead be watching me drive around in my diamond-encrusted, solid gold Rolls Royce in a rap video (and it’s possible I might even be the one rapping).

As it turns out, Rentokil North America was clearly better in the hands of Andy Ransom than my own.

Rentokil, likes it competitors, has some challenges in the years ahead. However, as the saying goes, while ServiceMaster has been playing checkers for the last ten years or so, Rentokil has been playing chess. Although ServiceMaster has appeared to finally awake from its slumber (with once again a brand new management team), while it slept, Rentokil went from a $25m US pest control business to what it is today, built a North American national accounts business, acquired tremendous, industry-leading capabilities in vector control as well as lake and aquatics management, dramatically fortified certain international markets and last but certainly not least, sold off that shit box, City Link.

I believe that Rentokil, more than any other firm, has made life difficult for ServiceMaster and will continue to do so. Though Anticimex has certainly joined that club in recent years.

“But Paul, ServiceMaster locked up all of the Copesan partners by buying Copesan.”

I think that’s a good theory, but it’s not going to work out in practice. Sure, ServiceMaster is going to lock up a few of the shareholders that don’t really have a choice… the ones doing a ton of Copesan work. But it will be open season on all the rest.

Money talks in the acquisition game and I just don’t think Rentokil and Anticimex are going to let ServiceMaster get away with it. Time will tell, but I think the next Copesan partner that sells will probably go to an acquirer other than ServiceMaster.

So here is what I like about Rentokil in 2019 and beyond…

Global Footprint

Rentokil is the only global pest control company in the world. Sure, Anticimex is in 15 or so countries and Rollins is slowly creeping into former British colonies, but Rentokil dwarfs Anticimex in terms of scale and managerial capabilities in emerging markets. That’s no knock on Anticimex, as they have really been cooking with gas over the last three years, Rentokil has just been in the game much longer, made many more mistakes, and has learned from those mistakes.

In order to consolidate globally, you’ve got to have regional and country-specific platforms with competent management. When Anticimex entered the US, it entered with the acquisition of Bug Doctor, a small, inefficient business with relatively low recurring revenue and no managerial capabilities. Due to the plentiful (at least at the time) availability of platforms in the Mid Atlantic, it wasn’t long before AX brought American and Viking into the fold and canned Bug Doctor — problem solved. AX now has a very strong business up and down the US Eastern corridor, but they couldn’t have done that by buying $2m pest control businesses. They needed companies (and more importantly, management) like Modern, Viking, American, Killingsworth, Triple S and Turner to help them get the job done.

Unfortunately, there’s not a lot of large platforms (with management with expertise at operating at scale) in many countries around the world. In Europe, parts of Asia and South America, there is a lot of low hanging fruit (e.g, small $1m to $3m businesses). But given the fragmented nature of these markets, it’s almost impossible to consolidate unless you’ve got some sort of platform in that market… and those are extremely hard to come by. This is where Rentokil has a leg up on all of its competitors.

I recently spent some time in Spain and Italy meeting with scores of pest control firms. In Spain there must be 2,000 pest control companies, but the market is so fragmented that some of the biggest players there are only doing 5m EUR per annum in revenue. Hundreds of millions of Euro are generated per annum in Spain, but those services are performed by companies doing between 100K and 2,000K EUR per year. Could Rollins or ServiceMaster operate in Spain? Sure, but they have to have local management and some sort of a platform and the extreme majority of these small business are just that, small, inefficient businesses without capable management. The juice isn’t worth the squeeze for ServiceMaster or Rollins to acquire a 2M EUR business in Spain or Italy or a variety of other countries without a platform. Again, this is where Rentokil and to a lesser degree, Anticimex, have a leg up on their US competitors.

Last I checked Rentokil operates out of about 75 countries (I guess I could pick up the annual report to verify that, but it’s got to be somewhere between 70 and 90 countries). When you compare Rentokil to Rollins, ServiceMaster and Anticimex, I think they take the prize on international capabilities and that is going to be were a lot of future growth is as the North American market gets more and more consolidated and competitive.

Management

Whenever I think about Rollins I can’t help but think about what strategy scholar Danny Miller’s 1991 said in his article in the journal Management Science entitled Stale in the Saddle: CEO Tenure and the Match Between Organization and Environment. Miller found that when CEO’s serve for greater than 10 years, there is less “fit” between their organizations and the external environment. The result of this mismatch is lower firm performance.

But what about Rollins? Gary Rollins and his older brother Randall have been around for a long time. I think the two of them found out about the US Civil War when they heard the gunshots … but still, Rollins is a star performer. However, I think I can make the argument that there is less “fit” between Rollins and the external environment than, say, Rentokil, Anticimex or ServiceMaster.

If Rollins were a software company, it would have gone bust a long time ago. It’s a machine bureaucracy and that organizational archetype fits quite well with the slow-changing pest control environment which has served Rollins very well… but is the rate of change in the industry beginning to accelerate? When I first got into pest control, the big players were using propriety operations software and all of the privately-held firms were running their businesses on index cards and software like the computer below. However, in 2019, Terminix is back to Salesforce, something that anyone can buy. Rollins is on a customized version of ServeSuite, again something anyone can buy. Anticimx is using the same phone technology that 50 other privately-held pest control companies are using. Online marketing and digital technology are ubiquitous, again, the big firms don’t have any special sauce here.

Everyone is talking about online reviews… guess what, the big companies are using the same technology that you and I could begin using tomorrow with an internet connection and a credit. Same with fleet management technology and Univar has allowed inventory to move to just-in-time for even the smallest firms out there. This list goes on and on.

At no other time in the industry’s history has real, old-fashioned competitive strategy become this important. Fifteen years ago, if you ran a business of scale, you could acquire all of the things I just mentioned while your small, underfunded, regional competitor was stuck using pay phones, paper maps, and a ton of inventory collecting dust and costing money. These things in and of themselves gave rise to a competitive advantage in years past … but as we all know, there is no such thing a sustainable competitive advantage in this life.

Very basic strategic management and organizational design concepts are now more important than ever. Things likes strategy, people, architecture and incentive structures, culture and routines. It is in this arena, that fortunes will be gained and lost in the pest control industry. The managers that can anticipate and identify key points of leverage and then marshal the resources and capabilities of the firm to those pivot points will be the leaders of the future.

In the near-to-mid term Rollins will continue to be the darling of the industry. However, there are dark clouds on the horizon as the US and international pest control industries continue to get more and more competitive. Further, it’s not 1999, when Rollins’s competitors were all managed by the B teams and C teams. Nik Varty, Jarl Dahlfors and Andy Ransom are very sharp and very capable operators and I think in 2019 and beyond, each one of them will continue to make bold moves, for better or for worse.

Pest control is a global business and although North America is still the largest market on the globe, that is changing. Rentokil has management with the experience of operating businesses around the world. For Rentokil, though, it hasn’t always sunshine and roses. Historically, Asia has been a tough market for Rentokil, particularly China and the SE Asian peninsula. However, Rentokil has learned its lessons and is a better firm for it today. Its US competitors have a lot to learn in the non-Anglo world and there will absolutely be a lot of growing pains for them as they continue to move abroad.

While the main theatre of the global pest control war has centered on North America for the last ten years, my prediction is that in 2019 and 2020, the battleground will begin to shift to Europe, Asia and South America. ServiceMaster has gotten clobbered by Rentokil on US soil in recent years, but ServiceMaster is no longer asleep at the switch. No matter what you think of Nik and Dion’s strategy, they are going to be willing to make some bold moves that their predecessors were either too scared, too dumb (or perhaps too smart) to make.

At the beginning of this post I joked that Andy Ransom should step out on a high note. However, I personally hope that he does not. Ransom at his core is a deal guy, and it’s surprising to me how involved he gets with even some the smallest deals around the world. From my perspective, whether we’re doing a $100m deal in the US or a $2m deal in SE Asia, Andy Ransom seems to personally look at every single one of them. Further, in the deal arena, the guy really knows when to hold’em and when to fold’em. Andy Ransom is the best deal maker in the industry, and that should come as no surprise, the guy is a former deal attorney and head of M&A.

I’ve been asked by a half dozen equity research analysts if I believe that there is some key-man risk in Ransom. I guess, to a certain degree, there is, in very similar ways to there being key-man risk in Gary Rollins. I’d like to see the guy stick around and I promise to do my part… the next time that I see him I’ll make sure he sticks to the garden salad at dinner and limits his wine consumption to one glass… preferably red wine, as we all know the health benefits of the highly concentrated tannins.

In addition to his deal-making, I think Ransom is a real strategist. When we took VDA to market back in early 2017, I was convinced that Rollins was going to buy that business. In fact, I couldn’t imagine a world where Rollins wasn’t the acquirer of VDA. Just go to Orkin’s homepage and you’ll see that their tagline is Pest Control Down to a Science (R). I have yet to see a pest control business that is more about “science” than VDA… it is a business that is almost entirely built around lab coat-wearing science dorks studying the mating patterns of mosquitos and the transmission of disease.

Not for nothing, I believe that Rentokil’s US team was also lukewarm, at best, on vector control. And I get that, vector control doesn’t seem like a massive opportunity. If you’re a guy like John Myers and you’re charged with running a national pest control business, you can easily buy a half dozen pest control companies that are going to bring more to your bottom line than a vector control business.

However, Ransom wasn’t looking at the here and now, he was looking to the future… and he was looking to the future through the eyes of a global business chief with a keen understanding of industry trends and competitive strategy. It was Ransom who got the VDA deal done, securing Rentokil’s rock-solid position in two business lines with relatively high barriers to entry: vector control and lake management.

In the sections below, I am going to attempt to discuss the business of vector control and lake management. At its core, Rentokil’s move into these two segments of the market, I believe, demonstrate Ransom’s ability to look into the future and anticipate very important industry trends as well as erect significant barriers to imitation by competitors. The investor community is often focused on the here and now, and while these two businesses are a very small component of Rentokil’s portfolio today, I believe that they will both generate significant returns for Rentokil in the future.

The Business of Vector Disease Control

I first got involved in the pest control industry back in 2003 but really didn’t get extremely active in the business until about 2005.

Back then, I kid you not, I didn’t even realize that bed bugs were real.

Further, in 2003, other than municipal and mosquito abatement trucks driving up down the street spraying some sort of fog, I didn’t even realize mosquito control was a service… and apparently, neither did most of the pest control industry.

Fast forward to 2019 and all the cool kids are doing mosquito control. When I look across the spectrum of a lot of our larger North American clients past and present, residential and commercial mosquito control is a very new service (many adding it on in the last few years) for most of them… it is also one of their fastest growing service lines.

Today, it seems like everyone is doing mosquito control. You’ve got the Mormon LDS kids selling mosquito control services door-to-door, Mosquito Squad and Mosquito Joe franchises are en vogue across the USA, and even your one-man-band pest control guy is out there trading mosquito sprays for Big Macs and forty-ounce bottles of Colt 45 Malt Liquor.

With the recent Lyme disease scares in the Northeast, mosquito services have rapidly morphed into tick and mosquito treatments… which makes sense considering the same pesticides are effective on both ticks and mosquitos.

Bottom line, it’s a really good time to be selling vector control services.

However, your run-of-the-mill tick and mosquito control service offered to residential and commercial customers, albeit typically quite profitably, is not a business with a whole lot of barriers to entry. Any knuckle-dragger who can sit for a basic licensing exam can be in business the next day… all he needs is a bus pass (he doesn’t even need a vehicle), a sprayer and 50 bucks in chemical.

When I talk about vector control, or VDA / MCS-style vector control, this isn’t the type of service that I am talking about.

Any moron can spray bifenthrin on foliage around a structure. Where the rubber meets the road in vector control is really understanding the ins and outs of the mosquito and its life cycle as well as certain species’ propensity to carry disease.

So what exactly does Rentokil do in the vector control space? I’m glad you asked.

Rentokil’s vector program provides surveillance through weekly monitoring of mosquito levels, species identification, and disease testing. The Company conducts inspections of breeding sites and controls both adult and larval mosquitoes we well as records all relevant information and provides data management and routine reporting to its customer base using a proprietary database. With a collection of very sophisticated labs across the country, Rentokil’s team of vector scientists are able to track vector-borne diseases at their source, and can move rapidly to control the spread of such diseases.

If we take Rentokil’s VDA / MCS business, for example, the Company maintains a proprietary database used to collect field data during the performance of its service. All surveillance, larviciding, adulticide applications, and service requests are input into the database. In other words, all activities the Company performs as part of its contract with a customer are stored, tracked and extensively analyzed. Furthermore, weekly or monthly reports are generated and delivered to customers.

One of the things that really struck me about both VDA and MCS is the level of sophisticated data that they track and analyze. With centralized vector labs and an army of scientists, these vector control businesses rival the US Centers for Disease Control (“CDC”) in the level of knowledge and data that they possess. To me, this is a massive and highly differentiated value proposition for governments trying to control mosquitos and the diseases that they carry. Instead of a government trying to re-create the wheel, companies like VDA / MCS are able to come in and very quickly size up the situation due to their imbedded and tacit scientific expertise and extensive data collected over decades in a variety of geographies. When Zika strikes a new geography, instead of the local government having to scurry to hire vector scientists and start tracking and understanding the outbreak from scratch (and expensive and time-consuming endeavor I might add), Rentokil can show up on scene having ‘been there, done that’ moving very quickly at a lower cost than what the local government would have to spend on its own.

In addition to centralized vector labs, these companies have hundreds of outfitted vehicles for spray missions. Each application vehicle has a variety of computer systems, including laptops and mapping software that shows mosquito activity live, providing the applicator with a real-time map of the spray mission and captures all relevant information about the spray mission, including GPS information, sprayer status, flow rates, and amount of product applied. VDA’s GIS department uses these data to produce maps as can be seen in the truck below.

Vector Control Customers

The customers for sophisticated vector control services around the world tend to be city or municipal governments. In the United States, approximately 98% of these customers are:

Cities

Cities decide they need mosquito control either because of a

risk of vector-borne disease or because of a significant nuisance problem. Some cities choose to perform this service internally. VDCI’s customers choose to outsource this service. In smaller cities or towns, the customer is often the Mayor or the City Council. In larger cities such as the City of Chicago, the customer can be the Health Department.

Counties

Similar to a city, the customer is a County that has chosen to outsource this service. In this case, Rentokil typically serves the County Commissioners. This customer looks very much like a City customer.

Mosquito Abatement Districts

These districts are separate taxing authorities and exist and operate outside of the municipal budget. These are also considered to be ‘municipal’ customers, but they do operate independently from the municipal government. Taxing Districts are typically voted in by residents and fund a specific service by taxing each water meter, as an example. Like Cities and Counties, some Districts choose to perform this service internally. However, many choose to outsource the management of the program to a company such as VDA / MCS.

The Economics of Vector Control

As we discussed above, VDA / MCS have a substantial endowment of unique resources that are extremely difficult, if not impossible to replicate… or at least very difficult to replicate without significant cost (and distraction).

Further, vector control, given the competitive dynamics of the industry, is more profitable than general pest control [sorry, I don’t want to go too deep into financials, though I know you equity research analysts are looking for numbers].

Rentokil has acknowledged that it views the global vector control market at circa $3.1 billion, with both the US and Brazil ($1b) being a good chunk of the market. There are some differing opinions as to the size of the US market, but we believe it’s probably close to $1b.

The Business of Lake and Aquatic Management

One area that neither Rentokil nor the investor community spends much time discussing is Rentokil’s entry into lake management and aquatics.

When Rentokil acquired VDA, not only did it acquire the largest vector control business in the United States, but it also acquired the country’s largest lake management business, Solitude Lake Management, LLC (which, at the time, accounted for about half of VDA’s revenue). Since then, they’ve acquired what we believe to be the number #2 player in the industry (Aquatic Systems) in January of 2019 (which we will discuss in more detail below).

When we took VDA to market, one of the concerns that I originally had was that the large pest control players were going to look at the lake management business and not like it.

Why?

Because it’s not pest control….. or is it?

As it turns out, most acquirers were not too keen on lake management as they didn’t really understand it (although all of the competing bids contemplated buying the whole business rather than just the vector control business). However, Rentokil took a look at it and decided that it was a very compelling business and checked all of the pest control boxes. After some serious study on my part, I wholeheartedly agree.

The fundamentals of pest control, vector control and lake management are very similar. They are very fragmented industries, with high operating margins and high levels of recurring revenue.

However, there is a very important difference between general pest control and vector control / lake management. Vector control and lake management, in my opinion, are far more insulated businesses than pest control. General pest control, in many ways, is a perpetual game of catchup through imitation. What excites me (and apparently Ransom) about vector control and lake management is that these are far less inimitable business than pest control.

What is Lake Management?

Lake management is basically the management of aquatic pests.

From a more technical perspective, native aquatic plants are typically beneficial to their ecosystem because they have adapted to one another and their environments over very long periods of time, creating a delicate balance. This balance is often destroyed with the introduction of fast growing invasive aquatic weeds from other geographies. According to the Aquatic Plant Management Society, invasive aquatic weeds can negatively impact an ecosystem in a variety of different ways. Essentially, invasive organisms in bodies of water are the pests of the aquatic world.

When invasive species invade an aquatic ecosystem, the deleterious effects include:

- Destroy fish and wildlife habitat

- Block navigation and flood control

- Stop recreation like swimming and fishing

- Reduce tourism and property values

- Clog drinking, irrigation and hydroelectric power water pipes

In other words, these aquatic pests really mess things up and controlling them is a $750m to $1b business in the United States. That doesn’t include Canada and we know the Canadians are fanatical about their water… Clearly Canadian anyone?

Companies like Solitude (VDA) and Aquatic Systems have a small army of scientists, ecologists and aquatic biologists that are focused on measuring, monitoring and restoring the natural balance in just about any body of water that you can think of.

Rentokil’s lake management businesses serve two broad classes of customers: (1) large bodies of water and (2) smaller lakes, ponds, community associations, golf courses, etc.

In many areas of the world, including the Northeastern US, the regulatory oversight from government agencies has created significant barriers to entry and impose tremendous costs on small lake management operators. For example, most annual treatments require permitting at both the state and local level along with pre/post water quality testing and a year-end report.

Most of VDA’s large lake customers have been with the firm for decades. Similar to the pest control we all know and love, it’s impossible to eradicate pests, you can only hope to control them. Same with aquatic pests, they need to be treated every year.

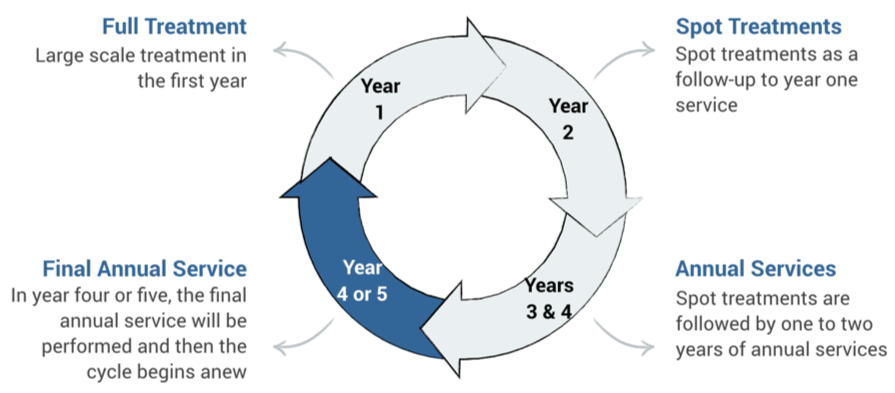

A typical lake will require a multi-year treatment cycle like the one below:

Treating and managing large bodies of water is a very stable, recurring revenue business with high customer retention rates (92%+) and regulatory regime that loves to destroy competition with permits and paperwork.

The real growth driver of lake management is community associations, golf courses, commercial properties, etc. These types of service agreements typically consist of a fixed-price annual maintenance contract, many of which auto-renew annually with price increases. These clients receive a visit once a month year-round and twice a month during the spring and summer months. This is the fastest growing and most attractive revenue stream in lake management and we generally see about a 7% annual churn rate.

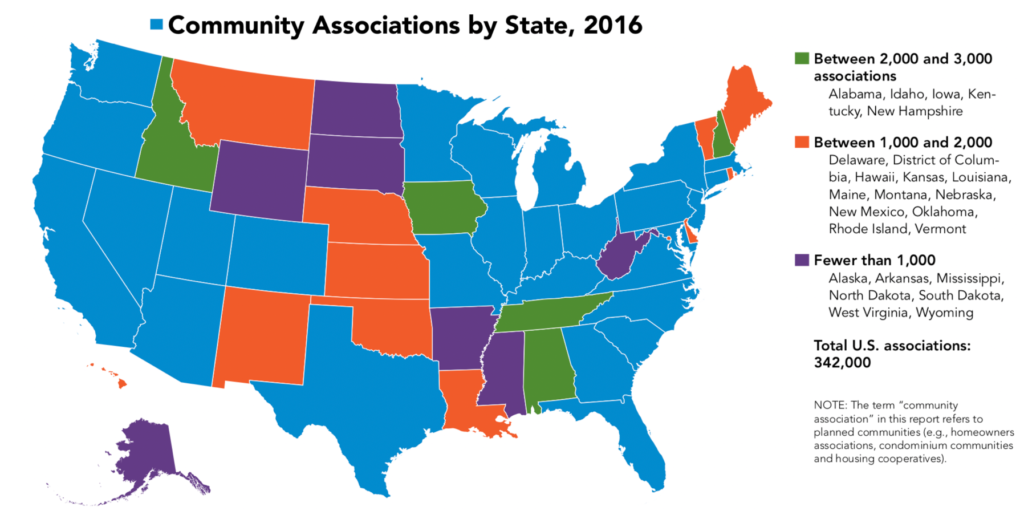

In addition, these customers are prime cross-sell candidates for pest control services. A lot of the lake and pond work is done for community associations which are prime customers for Rentokil’s pest control and mosquito control services. Over time, I think that Rentokil will likely begin to bundle services for theses types of customers.

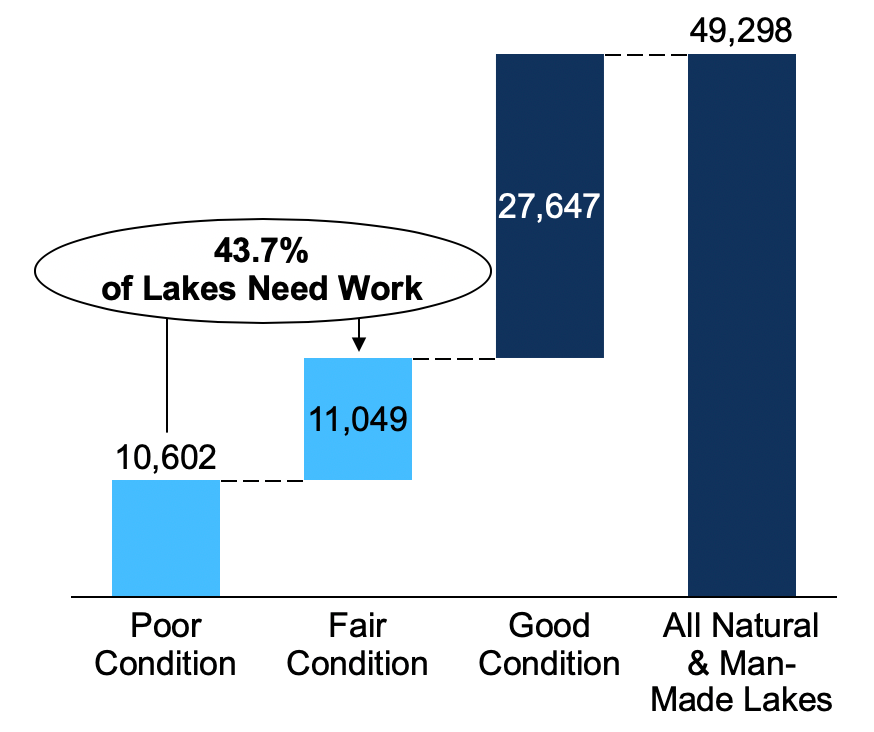

When we first looked at the lake management business we discovered that there are about 50,000 lakes in the United States and over 40% of them are not in such great shape.

Aquatic Systems Joins the Party in 2019

Prior to acquiring Aquatic Systems in January 2019, Rentokil was doing about $12m in lake management revenue in Florida through VDA’s Solitude / Lake Masters business (Lake Masters was acquired by Solitude in January of 2017, immediately prior to us taking the business to market).

We estimate the lake management business in Florida to be about $100m, giving Rentokil a pro forma 30% share of the Florida market.

Aquatic Systems provides lake science and lake management services to over 4,200 customers in Florida and the acquisition brought about 156 employees to Rentokil.

When you parse Aquatic Systems’ business, the fundamentals are strong:

- About 91% of the business is recurring

- Customer concentration is low, the top 15 customers accounted for only about 8% of the business

- The business is very diverse, operating in many different sectors and industries including government, education, golf courses, commercial, and community associations

- The Company has maintained lakes and wetlands in the Southeast for more than 40 years

- The full staff of scientists and technicians in 11 field offices throughout its home state serve private, commercial and public lakes, waterways, wetlands and preserves.

- The Company has invested in research and development to understand the underlying causes of algae blooms and invasive plant growth, midge fly invasions, muck, odors and lake water quality/health issues.

- 13 of the lake services’ top 20 customers in 2017 were comprised of community associations.

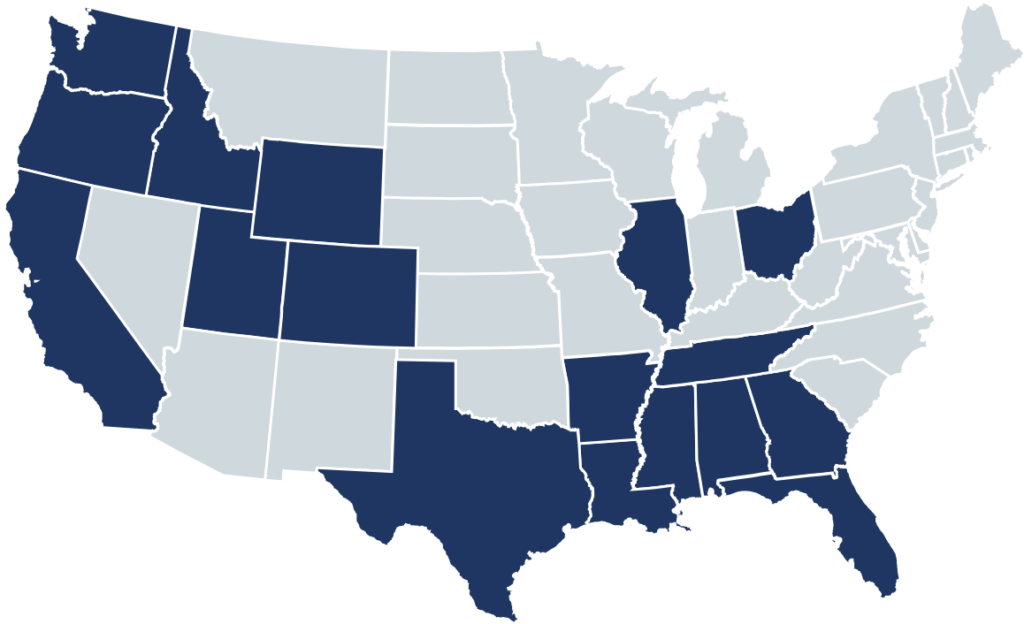

Rentokil’s Lake Management Service Footprint in Florida — 18 Field Offices Producing over $30m in Revenue

Final Thoughts on Vector and Lake Management

As I mentioned, lake and vector are small business lines for Rentokil today, but have significant potential going forward. Here are a few of the industry dynamics that we think about when looking at vector control and lake management.

Barriers to Entry

- Scale– Rentokil is the largest player operating in each industry segment. In the states in which VDA / MCS does business, it enjoys density that allows it to service incremental customers at lower cost than any competitor, creating a meaningful barrier to entry in its existing markets.

- Regulatory Environment – Both industry segments require licensing and permitting. VDA / MCS has the size to handle these requirements, whereas it can be overly burdensome for smaller players. These regulatory requirements serve as a barrier to entry for new participants.

- Data Collection– VDA / MCS creates and stores data related to its customers. This creates efficiency for service delivery year after year, thereby creating a competitive advantage.

Industry Tailwinds

Accelerating tailwinds exist in both vector and lake management. Invasive vegetation, similar to pests and rodents, is virtually impossible to eradicate and therefore can only be managed. Similarly, globalization, climate change, and increased travel are leading to more vector-borne disease outbreaks than ever before. These trends will help continue to drive organic growth.

Fragmentation

In the United States, there are over 600 companies operating in the mosquito control and lake management industries. Rentokil is the largest player operating in these highly under-penetrated segments. Lake management businesses can often be acquired for 5x to 7x trailing EBITDA, literally half of what pest control companies are selling for.

Prince Insensitivity

Invasive vegetation can damage aquatic environments and inhibit recreation and commerce. Similarly, vector-borne diseases represent a serious public health issue. As a result, Rentokil’s customer base is relatively price insensitive when seeking service providers.

Cross-Sell Potential

Lake Management services are purchased by property managers and HOAs throughout North America. This provides a significant cross-sell opportunity for companies that provide pest control services to property managers and HOAs.

The Back Page: An Insider’s Guide to Paris

I receive a lot of emails and questions about travel. After I published my Weekly Commentary on Parasitec in Paris, I probably received more questions on travel to Paris than any other topic I had written on that day. One of those questions is below.

In this section, “the Back Page” I am going to answer questions that are not necessarily related to the pest control industry, valuation, M&A, etc. And today we take on Paris.

Paul,

In your commentary, you had a photo of you at one of your favorite restaurants in Paris. I am taking the family to Paris in the summer and any insider suggestions that you can provide would be greatly appreciated: hotels, areas of the city, restaurants, must-see places, etc.

Thank you,

Robert

Where Should I Stay?

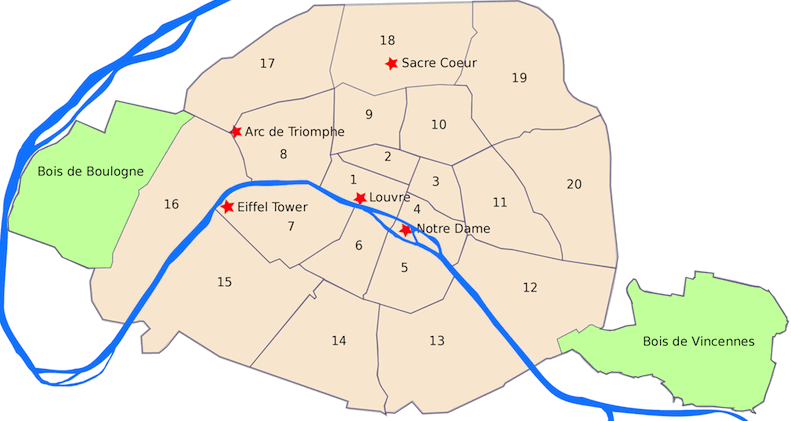

The city of Paris is broken down into 20 districts, or arrondissements. The arrondissements along the Seine river are where you want to stay if you’re in Paris for vacation. These include the 1st, 4th, 5th, 6th, 7th, and 8th.

One of the easiest ways to tell where something is located in Paris is look at the postal code. The first three digits indicate the city (e.g., 750 is Paris) and the last two digits indicate the administrative district.

For example, let’s say that you’re looking online for a hotel and you find one that looks interesting. In this case, you’ve found:

Prince de Galles Hotel

33 Avenue George V

75008 Paris, France

One quick look at the postal code and you know it’s somewhere in the 8th arrondissement.

If you look at the map below, you’ll see that the river cuts the city into what is referred to as the left bank (5th, 6th, 7th, etc.) and the right bank (1st, 4th, 8th, etc.). My place is located in the 7th and I spend the majority of my time on the left bank. This is where you’ll find restaurants, classic Parisian cafés, and the sights, tastes and sounds of some of Paris’s oldest neighborhoods.

Blvd Saint-Germain runs north through the 5th and 6th arrondissements and is one of my favorite streets in the city.

As far as hotels go, since I have a place in Paris, I don’t often stay at hotels. However, there is one hotel that I’ve stayed at before that I really enjoyed and highly recommend: Prince de Galles Hotel. It’s a Marriott Luxury Collection brand and it’s a great hotel in a great area of the city. As well, there is a Michelin star restaurant in the hotel called La Scene… it’s fantastic. If you’re a Marriot Platinum Elite member and you’re not staying there in the high season, they’ll typically upgrade you to a fantastic suite that rivals every Ritz Carlton suite you’ve ever seen.

I stayed there in the fall to host meetings for Parasitec. Here is the evening view from my window:

Hotels in the central Paris will of course be more expensive than those in the outskirts of the city. However, if you can stay in the central arrondissements that border the river, you’ll be in a great position to see Paris on foot.

Where / What Should I Eat?

Paris is a massive tourist trap and it’s easy to get suckered into eating overpriced, mediocre food.

Check out Boucherie Roulière in the 6th

One restaurant that I go back to almost every time I’m in Paris is called Boucherie Roulière, nestled deep in the 6th right off Place Saint-Sulpice. In fact, I’ve sent about a dozen people from the pest control industry there over the years and everyone has really enjoyed it. Kevin Burns, head of M&A at Arrow, went there last year and said that it was one of the best, if not the best meals he had in Paris. Although it used to be a place only frequented by the locals, with the advent of Yelp and TripAdvisor, it’s becoming more and more popular so either make a reservation or get there at 7.15PM when it opens for dinner or you’ll never get a table.

I am not one to generally take photos of food (unlike that friend that we all have on Facebook who constantly feels compelled to post photos of everything he eats, including his breakfast at the Waffle House… like we’ve never seen eggs and bacon before), I’ve provided some photos below.

You might not find someone there who speaks English very well, but like most restaurants in Paris, they will have a menu in English lying around somewhere.

Although the photo above looks like a New York strip, it’s actually calf’s liver. I am not a huge liver fan, but it was so good it is one of those meals that I will never forget. They only serve this on rare occasions and if you’re lucky enough to be there when it’s on the menu, absolutely order it.

L’Avant Comptoir: Standing Room Only

Another place that I highly recommend in the 6th is called L’Avant Comptoir (and its seafood sister restaurant next door called L’Avant Comptoir de la Mer).

It’s essentially a French tapas bar. There are no tables and everyone eats standing (although they now have put some bar stools in) at the bar. As you can by the photo below, the menu is on cards hanging from the ceiling. You walk in, take a look up and choose what you want. For those of you who can’t remember your high school French, they have photos of the dishes.

Below is a photo of the foie gras with cherry sauce. Again, since it’s a tapas place, you’ll get to sample a handful of small dishes. If you’re a wine fine, this place has a fantastic daily selection of French wines and the bartenders are excellent at making pairing suggestions. L’Avant Comptoir and its sister restaurant next door (if you’re a seafood fan) are both excellent and well worth it.

Where Should I Go?

Everyone goes to the Eiffel Tower, so I know you’ll be going there.

If you are going to do the tourist thing and bring some wine and baguettes to enjoy the sunset on Champs de Mars in front of the Eiffel Tower, then stop by La Petite Epicerie Parisienne right off the corner of Avenue Bosquet and Rue de Grenelle (about 2 blocks from the Eiffel Tower). They have a solid selection of beverages and other snacks for your relaxing evening.

Right next door to Petit Epicerie is Les Gourmandises d’Eiffel, a bakery that has the best butter croissants in the 7th.

I looooovve me some buttery and crispy croissants. However, a few things to keep in mind while you’re searching for a world class croissant.

The Perfect Croissant

First, in Paris, any given bakery will sell two types of croissants: a croissant and a croissant au beurre. The croissant au beurre is a “butter croissant” and that’s the bad boy that you want. The outside is crispy and the inside is moist and tasty. It took me months to figure this out, but once I did, I never went back. If you walk in and ask for a “croissant” you’re going to get the standard croissant, so ask for a croissant au beurre… you thank me later.

Second, bread is baked in the mornings (for lunch) and then again around 6.30pm for the dinner crowd. If you want a fresh, warm and crispy loaf, either go in the morning or go right before dinner. As for the croissant, it’s baked in the morning, and by around 10am it starts to soak up the humidity from the air and turn into a soggy sponge. So get your croissants first thing in the morning and you’ll be in heaven.

By now you’re standing out in front of the Eiffel Tower and you’re wondering whether or not you should stand in line for two hours to ascend this great beast.

I would argue that there are much better views in the city, many of which you don’t have to stand in line for. If you look to the southwest from from the 7th, you’ll see a strange, dark building sticking out like a sore thumb. That’s Montparnasse tower in the 15th and if you head to the top you’ll get one of the best views on the European continent…. and surprisingly, almost no one does it.

There is an observation deck at the top of Montparnasse tower that was literally built for photographers. If you can get there on a relatively clear night right before sunset, you won’t want to leave because this will be your amazing view…even on an overcast evening it’s something worth seeing, as you can see by the photo below.

I could go on for pages and pages about the things to see and do in Paris. Over the course of my life I’ve spent a cumulative of about five years in the City of Light and I often find myself missing it. As we’re about to land, I’ll give you a few final tidbits that will save you some time.

The Louvre

If you want to spend the day at the Louvre, do yourself a favor and BUY YOUR TICKETS ONLINE IN ADVANCE. If you do this, you’re looking at 15-minute wait rather than standing in a massive, multi-hour line like a peasant during the French Revolution.

Here… I’ve just added four hours to your life: Buy Louvre Tickets Online

Printemps

Another nice place for a view is the rooftop café at the department store Printemps.

Enjoy your trip and send me photos… especially if you hit one of the 400+ swingers clubs in town.