“You’re going to hurt sellers by calling the top of the market. Now everyone is going to rush for the exits and there will be a glut of sellers, pushing down prices. You need to think before you say things and how it will impact the market” said one unhappy pest control business owner to me in an email in response to this Commentary.

I am flattered that a reader thinks my words move the multi-billion dollar global pest control market, especially in light of the fact that I can’t even convince my wife where we should go out to dinner (let alone the other things I try to convince her to do).

If I owned a pest control company and was thinking about selling it, I don’t think that I would be worried about a “glut of sellers.”

In the US market, the entry of Anticimex and the resurrection of ServiceMaster has provided a certain level of support to the market. ServiceMaster has completed 11 acquisitions thus far this year and intends to do at least 50 more by the end of the year, while AX is on track to build its North American business to north of $200 million in 2019. All the while, both of these players have really cramped Rentokil’s North American style, especially on the East Coast as supply of quality targets dwindles. Though Rentokil did acquire a PCT Top 40 company on the east coast this morning.

This week, as PCT Magazine publishes its 2019 Top 100 list with ghosts of pest control companies past, I head to sell-side meetings in the US. One of the US states that I will be in, if it were a country, would be a top 50 global economy and it literally has nothing left in terms of independent pest control companies of scale and capabilities. After this deal is over, that’s it, the rest of the businesses there are small, inefficient enterprises that will take years to generate into Top 100 companies.

So, be of good cheer my unhappy reader, you needn’t worry about a “glut of sellers.”

If I were a buyer in the US, on the other hand, I think that I would be getting a little bit nervous right about now. Multiples are already in the stratosphere, the Big Four are buying everything (including rubbish companies) while the market is beginning to thin out in terms of businesses of scale that have real resources and capabilities. While there will always be revenue to acquire, it’s getting a little harder to buy real capabilities.

Sell-side processes are going into three, four, five and sometimes more rounds of bidding. If a 20x EBITA bid gets hit on a material deal, I will definitely have to eat my words from when I called the top (and I would actually be ecstatic to do so).

I have noticed, however, that there has been a palpable change in sentiment among pest control owners thus far in 2019. Individuals who I didn’t expect to pull the trigger are now heading for the exits. Is it a rush for the exits? Not yet, for now it’s a brisk walk… a light jog perhaps. The rush will happen after the market goes into the toilet, as it always does. For now, as long as the world’s central banks remain on a crash course with reality and continue to refrain from doing what’s right — normalizing interest rates — this market will continue… until it doesn’t.

Today’s Commentary:

- Announcements: This month we closed three transactions. However, today, I am just going to discuss two Top 100 transactions: Anticimex’s acquisition of JP McHale and ServiceMaster’s acquisition of Inspect-All Services, which took place over a month ago. We’ll save the rest for next time.

- The Pest Control Executive: Are You Still the Best Owner of Your Assets? Q&A on how to decide whether or not now is the right time to sell your business.

- The Institutional Investor: In today’s Institutional Investors’ section, I am going to say a few things that certain people aren’t going to like. In a world of magazines with stupid listicles, transgender bathrooms, and the French, I write this Commentary freely and openly. This is not a hit piece on ServiceMaster, but rather a story of hope. And while it’s said that all good things must come to an end, perhaps the same can be said about all bad things. As always, there are no “safe spaces” in the Commentary.

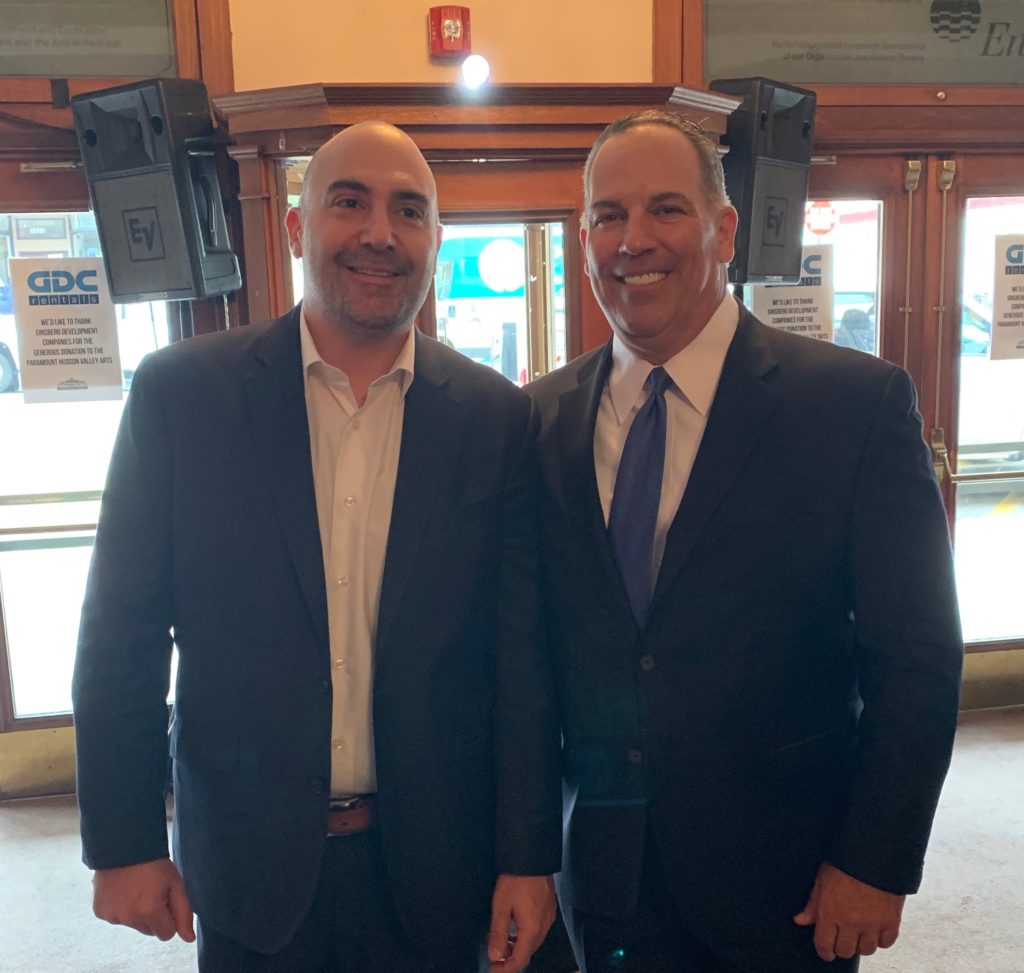

Announcement: Anticimex Acquires JP McHale Pest Management

On May 1st, we closed on the sale of JP McHale Pest Management (“JPM”) to Anticimex. For Anticimex, this transaction filled one of the only gaps the company has on the Eastern corridor, from Maine to Florida. At $25 million in revenue, JPM is number 32 on this year’s PCT Top 100. Unlike many of its competitors, JPM has consistently grown revenue and cash flow at double digits in a very competitive market. This is one of Anticimex’s most profitable and fastest growing platform acquisitions in the US and will be a real engine for growth for the Company, especially with Jim McHale and Mike Coughlan at the helm.

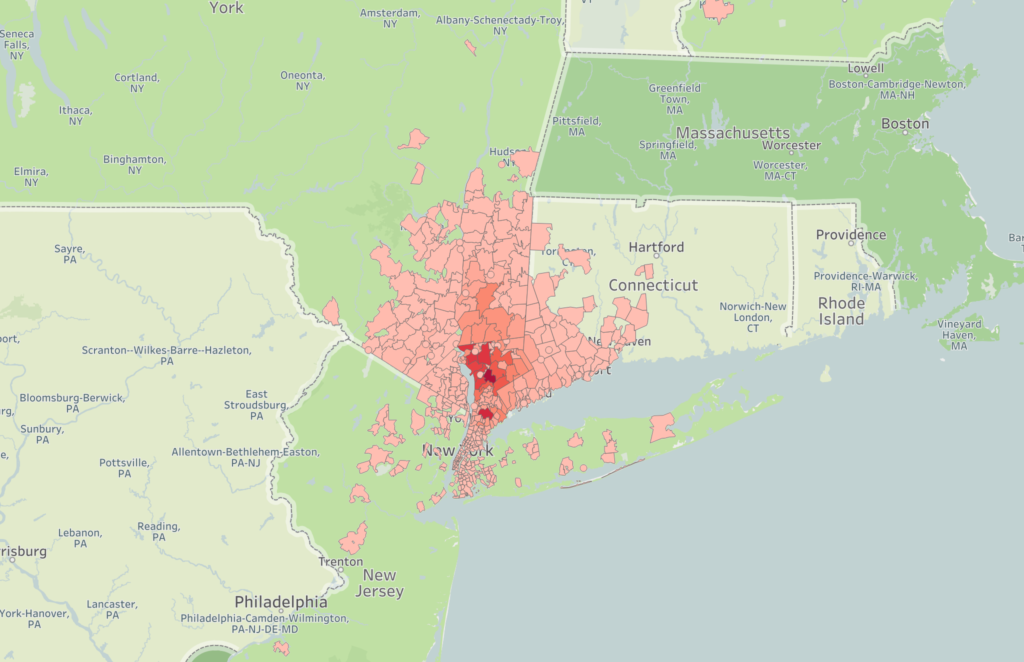

JP McHales Service Footprint in the New York Metro Area

Located in Westchester County, NY, JPM services clients in some of the wealthiest areas of the US, from Westchester, down to NYC to Western Connecticut. With the acquisition of JPM and Triple S, the Swedes now service the Pentagon, CIA, past US presidents and some of the most fabled ballparks in the nation (although I am not positive, I am pretty sure they don’t do IKEA… at least they don’t back home in Sweden).

We were engaged by JPM almost a decade ago to perform a valuation for an S-election and have remained an advisor to the Company since. If you still own a C corporation, you should do what JPM did and track us down today to get that fixed… it will haunt you when it comes time to sell if you don’t.

Jim McHale is a brilliant marketer and his innovative approach has served JPM very well over the decades. In addition to his constant “innovation around the edges,” as Jim would call it, he has built a very capable management team. Unlike many companies this size, Jim realized early on the importance have having robust internal financial capabilities. He brought on a real CFO, Mike Coughlan. Many companies don’t develop these internal capabilities and I can say that that is one of the biggest issues that companies like Anticimex run into when they acquire platform companies — weak or non-existent financial and accounting capabilities. So, if you’re in this for real, learn from Jim and make sure you’re building your internal accounting and financial capabilities and as soon as you hit $4 million or $5 million, find yourself a real CFO. You can outsource compliance (the filing of tax returns, etc) to an accountant, but if you’re going to really look to grow your business, don’t outsource key financial and managerial accounting functions.

If I were an owner of a pest control business and needed guidance, Jim McHale would be the first person I would call. In fact, over the years I’ve often found myself calling Jim for advice in a variety of areas. I already miss working with him on a daily basis. Jim, I wish you, Jen and the JPM / AX team every success in the future.

You can learn more about the transaction and the history of JPM here.

Announcement: ServiceMaster Acquires Inspect-All Services

Although we announced this deal a month ago, I haven’t had a chance to discuss it in the Commentary. At the end of the 1st quarter, we closed on the sale of Inspect-All Service’s pest control business to ServiceMaster.

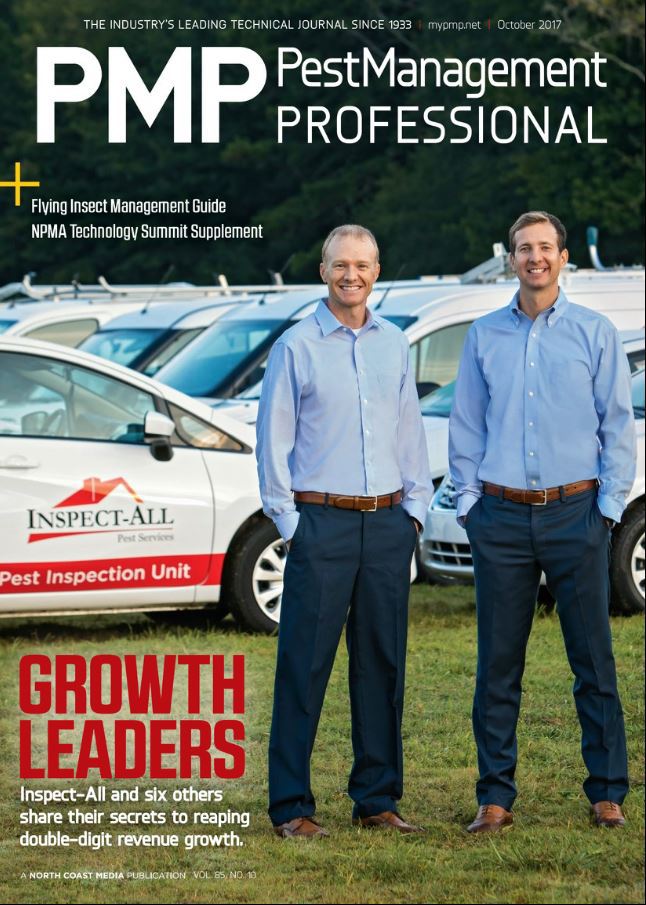

Fast-growing and dynamic, Inspect-All Services found itself on a lot of lists: the PCT Top 100, the Inc. 5000 and the Bulldog 100 for multiple years. This business was owned and operated by brothers Brandon and Brian Lunsford.

Fast-growing and dynamic, Inspect-All Services found itself on a lot of lists: the PCT Top 100, the Inc. 5000 and the Bulldog 100 for multiple years. This business was owned and operated by brothers Brandon and Brian Lunsford.

Although this business was founded by their father, Brandon and Brian bought it from him when it was less than a few hundred thousand dollars per year in revenue. Neither of the brothers were “pest” guys, per se. Rather they got into the business after pursuing different careers after graduating university. After working in very different businesses for a few years, they decided that they could take the tiny business that their father had founded and grow it. And grow it is exactly what they did.

By 2017, the combined pest control and inspection business was doing almost $8 million per year in revenue and growing at over 30% per year — all organically — in the very competitive Atlanta metro market. Further, they did it all the old-fashioned way, no door-to-door sales and no acquisitions.

The Lunsford brothers are two more examples of young people (one is 39 and one is 41) selling at the top of the M&A market. In today’s Pest Control Executive below, they tell us why they’ve decided to sell.

I really enjoyed working with Brandon and Brian and I have no doubt that this is just the beginning for these two incredible entrepreneurs.

One working with Potomac, Brandon Lunsford said:

While there are a lot of qualified advisors out there, when you’re doing the most important transaction of your life, you really need to have the absolute best in your corner. We wanted someone who has been at this for decades and had seen every situation possible, we wanted a real pro, and we got that and more with Paul Giannamore. If you’re going to do a deal, do yourself a favor and do the research like we did. Interview advisors and you’ll see just how much Paul stands out from the crowd. Engaging Potomac and having Paul at our side was literally the best and final decision that we made as owners of Inspect-All Services.

You can learn more about Inspect-All Services and the transaction here.

The Pest Control Executive: To Sell or Not to Sell, Are You Still the Best Owner of Your Assets?

I am addressing the question below today because I think that it’s on the top of everyone’s mind.

Paul,

Every time I look, you’re announcing another deal, so a big congrats on what you’re doing out there for the industry.

I don’t know if you remember me, but we spoke on the phone a few years ago. At the time, I was very burned out dealing with government forms, paperwork, health insurance plans, wage garnishments, customers and employees that I just wanted to be done with everything and do something else for the rest of my life. After a brief chat with you, you convinced me that it wasn’t the right time for me to sell. If you would have said anything other than what you did, I would have sold my business then and I would be regretting that decision today. Now we own a business that’s doing almost $4 million in revenue, something that I never thought we would achieve in the first place.

Every time I look, there is another company being purchased and I know that multipliers are very high, maybe the highest that they have ever been. Based on how we are growing, I know that we could get the business to $5 million, but if it takes us 3 to 5 years to do that and then the market changes, I would hate myself for the rest of my life.

What if I sell now and multipliers go up? What if I don’t sell and they go down? What if I sell and don’t have enough money for retirement? I guess I just don’t even know how to make this decision.

I know that I am rambling on, but since you deal with this every day, how are others making this decision? I guess I don’t even know where to start but since you were the exact opposite of self-interested when we spoke before, you’re the only guy in the thick of it that I can count on to give it to me straight. I know you’re super busy, but any thoughts you have would be immensely appreciated.

Well, then give it to you straight, I shall.

I’ve been advising on transactions in the pest control industry for over fifteen years and for the majority of that time, I never received many questions like the above.

The market was static, at least from a valuation perspective. Deals were almost entirely driven by life events, such as death, divorce, disputes, illness, retirement, and burnout.

That is, people would say: “I feel like I want to retire but I need $5 million. Can I sell my business for $5 million?”

If the answer was yes, retirement started in about five months. If no, grind it out for another year or two while putting away a few extra shekels for retirement.

Now that the financial markets have become a casino, being a shareholder in a pest control company is somewhat akin to owning Bitcoin today or a tech stock in the 1990s — at least from a psychological perspective.

There is currently a large disconnect between the intrinsic value of many pest control companies and the prices being offered to acquire them. Some owners are experiencing classic “fear of missing out” symptoms and others are experiencing what is akin to physical pain watching others make seemingly easy cash on the sale of their businesses.

So what do you?

As the owner of a privately-held business you wear to hats, you’re an investor and a manager. That is, you are a private equity investor with a 100% portfolio concentration risk in your pest control company. Further, you are the company’s CEO, responsible for setting strategy and organizing all of the resources and capabilities of the firm.

At age 59, while you shouldn’t bet the ranch on the roulette wheel, you still have significant time to invest. The question is, are you a good investor? If you are looking at your ownership in your pest control business as an investor, then your primary concern should be your risk-adjusted return on your investment… and right now your investment is trading at an all-time high.

If you were to monetize your pest control business today, would you get a better return, on a risk adjusted basis, by investing that money into a different asset or asset class than you would by continuing to own your pest control business?

That’s not an easy question to answer in the era of sky-high asset prices and phenomenally low interest rates. But with a little math, I think that you can get close.

If you are (a) at the age right now whereby you would naturally look to sell within five years, or (b) you are any age, and there exists a better use of capital, then you need to seriously consider selling soon. Financial repression from central banks have pulled financial returns into the future. In other words, by selling today, it will be as if you owned your business, benefited from it for five to ten years and then sold it, under normal capital market conditions.

If you are in this for the long-term and don’t have a better alternative use for the capital, then stay in the game and double-down on growing your business.

When our clients engage us, the first thing that we do is a preliminary valuation. This process answers many questions, among them:

- What is the business likely worth to strategic acquirers in the current market?

- Given my specific set of circumstances, what is the inflection point in the valuation spectrum where it makes more sense to sell now versus hold on to the business?

For most of our clients, this comes down to pure math and we do our best to try to take the emotion out of it and make it a question of mathematics.

In your particular case, you believe that your business will be 20% larger in three to five years. Although it’s very hard for anyone to say, I think that it’s probably more likely than not that in three to five years we won’t see the same sort of valuations that we are seeing today.

When we talk about trying to turn this decision into a mathematical calculation we mean looking at your total shareholder returns from holding the business versus selling it. As an owner of a business, you realize financial returns through dividends and capital appreciation. My suggestion to you would be to model out your total projected returns from your business — both dividends and capital appreciation — over the course of the next five to ten years using the historical market median transaction statistics relevant to your business. If you do that, your decision will become much clearer and that’s what we attempt to do with each of our clients. By doing that, you can compare a variety of alternative investments against the ownership of your pest control business in this market. It will help you understand if you really are still the best owner of your assets.

When we spoke a few years ago, you were burned out — in my experience that is a common, but not always the “right” reason to sell. Now that you’re a little older and a little closer to retirement, you’re beginning to fear that if you don’t pull the trigger now you might miss this consolidation bubble. At your age and the life cycle of your business, I think that you owe it to yourself to start really looking at the numbers. [For others who would like to discuss our preliminary valuation process, you can contact us here.]

You asked me how others are making this decision, so I inquired for you. Since we discuss JPM and Inspect-All this week, I asked the sellers why they decided to sell now. Both shareholder groups are very young, the McHales are in their late 40s and early 50s and the Lunsfords are in their late 30s and early 40s.

Jim McHale on why he sold his business:

“In all honesty, it was multifaceted for me. For one, I had a significant portion of my wealth locked up in this business, so the decision to sell allowed me to ‘de-risk’ my life. No more worrying about a vehicular fatality, or a bonehead move by one of our team members that could sink the business. If the whole place burns to the ground, I’ll certainly be sad, but I won’t be wiped out financially, and that’s a great feeling.

Second, I decided that I would sell my equity at the top of the market, keep my powder dry and be ready to buy assets again when the market turns. With history as our guide, we know that that is a certainty… there will be a downturn. I’ve been in this business for over 30 years and have never seen such favorable market conditions for potential sellers, if I missed selling now, and these conditions don’t show up again for another 30 years, I would have really regretted not pulling the trigger.

Finally, by selling to Anticimex and being the New York platform we have resources that we’ve never had in the past. I am excited to grow the hell out of this business, something that is very difficult to do if you don’t have a strong strategic and financial backer like Anticimex. In my mind, I always thought I would do a private equity deal, but after really thinking it through and running the numbers with Paul, I decided that the resources that AX brings to the table would provide the best long-term growth opportunities for both the Company and every one of our team members.”

Brandon (39) and Brian (41) Lunsford on why they sold Inspect-All:

Just about everyone we know — including our families — was surprised that we sold our pest control business. Perhaps because selling a business is often equated with retirement, which we are certainly not doing.

Our decision, in a lot of ways, boiled down to this. We own both an inspection business and a pest control business. The value of the pest control business in this market got to a number that we never really thought we would ever see. After thinking it through, we decided that if we sold the pest control business, the proceeds from the sale would not only be an insurance policy for us and our families, but also investment capital to put into our other business and investments. Everyone says you’ve got to buy low and sell high, well, we had an opportunity to sell high and then buy low by investing in our other business. For us, it was a purely mathematical calculation. Paul really, truly helped us take the emotion out of it and I think we were very successful in doing that. That was one of the real benefits of having a true investment banker like Paul on our team. He is used to having conversations with boards of directors and institutional investors looking at risk and return, and he helped us look at our business exactly as the board of a publicly traded company would look at theirs.

Now that we’re two months from the closing, we don’t think that we could be any happier. ServiceMaster did a great job with the transition, and the only changes we’ve heard about seem to be very positive. It was a great decision selling this year and it was a great decision choosing ServiceMaster. And if you would have told us two years ago that we would be saying these words now, we would have never believed you.

The Institutional Investor: ServiceMaster in 2019 and Beyond

In the last Institutional Investors’ section we began to discuss the following question, with a focus on Rentokil. Today we are going to shift our focus to ServiceMaster.

Hi Paul,

I came across your newsletter recently and, having been an equity analyst following the trials and tribulations of Rentokil over the last 20 years (and in more recent years quite a significant turnaround in equity investors’ eyes), was very interested in your thoughts on the US pest control industry. I also enjoyed your broader commentary on central banks’ intervention in the global economy since the Financial Crisis, and wholeheartedly agree that they are the biggest culprits for the rise of inequality and frothy asset valuations. Right now, I’m very intrigued by how Terminix is going to perform following ServiceMaster’s disposal (at last!) of American Home Shield, as well as Anticimex’s more aggressive push into the US market, and Rollin’s seemingly greater appetite for acquisitions, and whether all of these factors will encroach on Rentokil’s progress in the US market; I’d be very interested to hear any thoughts you might have on these topics.

I’ve been doing deals with ServiceMaster for over fifteen years and have lived through at least six or seven Terminix presidents. It had gotten to the point that I didn’t even put their names in my phone anymore, just Terminix – President and ServiceMaster – CEO. That way, when the next one comes and goes it’s an easier edit for me.

However… could things be finally changing? After working with Nik and Dion, I began to think that maybe it’s time to actually give these guys names.

Unlike Rob Gilette, the former CEO of ServiceMaster and President of Terminix (yes, he was both the CEO and the President of Terminix, just like in Horrible Bosses when Kevin Spacey took on two executive roles), Nik actually moved his family to Memphis. Which, by the way, if you’ve ever been to Memphis — often ranked the second or third “fattest city” in the US — you know what a sacrifice that is.

In the last Commentary I said, “No matter what you think of Nik and Dion’s strategy, they are going to be willing to make some bold moves that their predecessors were either too scared, too dumb (or perhaps too smart) to make.”

Today we are going to focus on the future of ServiceMaster and some of the moves that I think Nik and Dion will make in 2019 and beyond. However, in order to discuss the future, it’s important to get some contextual background of the past. Unfortunately, the history of ServiceMaster over the last decade reads like a tragedy, so grab a box of tissues and a stiff drink… you’ll need one.

ServiceMaster: The First Turnaround and the Lost Decade – 2007 through 2017

Back in the mid-2000s, ServiceMaster was plagued by a falling stock price as a result of serious mismanagement. The company was experiencing substantial customer attrition and out-of-control costs. The board had finally had enough and the business went out to market in 2006, ultimately to be acquired by private equity firm Clayton, Dubilier & Rice (“CD&R”) in early 2007.

Back in 2007, the US pest control market was essentially a duopoly (at least in terms of the big players). Rentokil North America was barely doing $150 million in revenue, while Terminix was the largest player at $1.1 billion in revenue and Orkin was the number two player at $900 million. In those days, Orkin was the commercial pest control leader and Terminix was the residential and termite leader.

From the time that CD&R took ServiceMaster private until the IPO, ServiceMaster and Terminix turned over executive management like it was a sport. With each successive management team, there would be new initiatives and objectives and a new team of morons to execute these cockamamie plans. The company lurched from “culture building” to “cost cutting” to “innovating for the future” back to some other corporate buzzword all the while frontline technicians became more and more alienated and frustrated.

Many of the management teams that were brought in were extremely polished and sophisticated, but it appeared to me that none of them ever sat down and said, “Hmmm… we want our employees to do A, but our incentive structures causes them to do B. Perhaps we should think about changing this.”

I remember years ago I went to a Terminix closing and stuck around for a day or two and was absolutely shocked at what I saw. A few days after the closing, the area manager sat the new employees down to inform them that “nobody should think that they are not expendable here.. if you don’t earn your keep and put numbers on the board, you’re out of here.”

While this idiot was telling his new employees that they are nothing more than a number, one of the guys showed me a ServiceMaster corporate email that had just arrived on his phone. It informed all employees that it was “Diversity Awareness Month” and urged asked them “Are you having dialogues with others with whom you would not ordinarily speak? Those dialogues can help us gain a greater appreciation of one another. It can be an important step to positively enhance our world.”

What nonsense. Management was so out of touch they were actually paying some idiot to send out these newsletters. Terminix had the highest turnover in the industry (amongst the big players) and they wanted their employees to reach out and touch someone who was a little bit different from themselves. I joked with another Terminix manager that day that they should be sending emails to the board entitled “Keep a Senior Management Team for More than 2 Years Awareness Month.”

While in no way was CD&R successful in “turning around” the business, they did eventually bring it public seven years later and made a return on the investment.

From 2006 through 2017, ServiceMaster made hundreds of acquisitions, largely focusing on buying sales and entering new markets, never really looking to acquire real resources and capabilities. In many ways they sat on the sidelines while Rollins overtook them as the largest domestic player, Rentokil went from $25 million to $700 million and built a real national accounts business and Anticimex entered the US acquiring premium assets up and down the east coast.

ServiceMaster: The Eunuch and The Dark Year – 2017

While I have always liked a lot of the folks at ServiceMaster, in fact some of them are very close friends, my patience for the company had worn very thin due to some of the stupid things that they’ve done over the years.

Back in 2016, we were getting ready to take a sell-side client to market (we’ll call it Project X). ServiceMaster had been courting the sellers for quite some time and asked if they could pre-empt process. While I’ve learned over years that that typically doesn’t work out in my favor, every once in a while, I am willing to give it a go if the conditions are right… or should I say, if the numbers are right.

At the time, ServiceMaster put what was the first deal in the industry clocking in at the elusive 3.0x revenue target. After discussing it with the client, we decided that we probably weren’t going to do better in formal process and began to negotiate directly with ServiceMaster.

Everything went swimmingly until the final ServiceMaster board call a few days prior to closing. The board failed to approve the transaction, citing “it is way too expensive.”

Clearly I was incensed that the CEO would sit through dinners and meetings with the client and not have the requisite authority to champion a $50 million transaction through the board approval process. I mean, how do you even sign such an LOI, let alone get through weeks and weeks of diligence and not be able to get your board to close a deal?

For me, the final nail on the coffin for ServiceMaster in the fall of 2016 was that Rob Gilette and NO ONE on his executive leadership team had the balls to call the client and apologize… or even call the client and offer an explanation as to why he was so impotent he couldn’t get the board to approve such a relatively small transaction. As soon as that deal fell apart, I knew that there would be another massive management turnover right around the corner. And there was.

In the postmortem of ServiceMaster’s spectacular failure, I learned that “the board is shutting down all acquisition activity because management uses acquisitions as a crutch to conceal incompetence and high customer attrition rates.” And that, “there won’t be any more acquisitions until management fixes the problems.”

At first I didn’t believe it.

However, from late 2016 through late 2017, Terminix acquired less than $5 million in revenue, giving Anticimex carte blanche to acquire premier platforms up and down the east coast (Modern, Viking, American, Killingsworth) and giving Andy Ransom the perfect opportunity to pick up VDA, something SvM’s management wanted but knew its board would never approve at those prices, especially given the state of its management team.

After Project X fell apart with ServiceMaster, I decided that the only way that I would do a deal with ServiceMaster going forward is if there was a significant breakup fee in the LOI. Further, I couldn’t blame the board of directors, after all, the management team was chock full of imbeciles.

ServiceMaster: Enter the Dragon – 2018

As we all know, ServiceMaster once again played another round of management musical chairs in 2017; however, when the music stopped this time, everyone was out. Nik Varty rolled in like Marcellus Wallace to go to work on the management team with a pair of pliers and a blow torch. I’m not going to lie to you, I sat back with a big bowl of popcorn and a tasty beverage to enjoy the show.

In late 2017 as Varty began to replace management at a rapid clip, I began to hear that Terminix was once open again to doing deals… but this time it was different. Instead of buying anything that moved, Terminix was looking to acquire real “capabilities” and “unique resources.” What? I had never heard these words from them before.

The Commercial Code

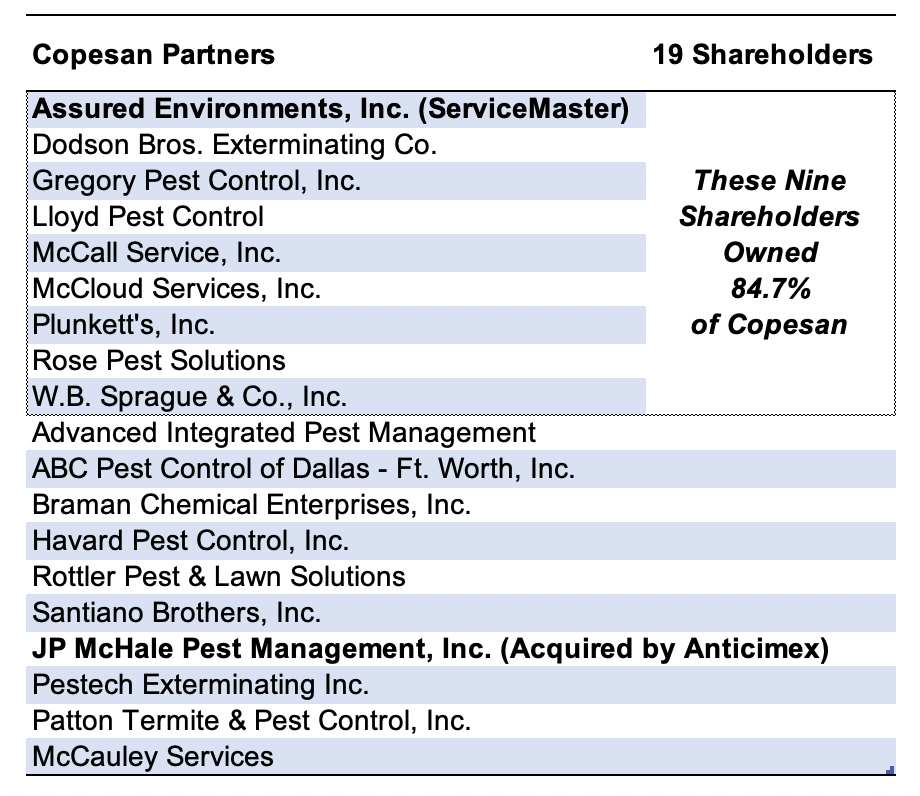

One of Varty’s first moves was to split up residential and commercial into separate divisions and acquire Copesan. At first, I thought that this was a bad move. Why would anyone want to focus on national accounts? After all, these are the customers that have the most bargaining leverage and it doesn’t take an afternoon at a boring Michael Porter class to know that buyers having a high degree of bargaining leverage tends to force prices down.

Over time, however, I have warmed up to the idea (a bit).

First, while it’s certainly not going to allow Terminix to lock up all of the Copesan partners, it will make it hard for other acquirers to buy the larger shareholders. Case-in-point, JP McHale was a Copesan equity partner and it’s now a happy member of the Anticimex family.

However, if you look at the table below, you’ll see that nine shareholders owned a majority of Copesan, and these are the companies that have a large component of Copesan business, so it will be hard for AX, Rollins and Rentokil to cozy up to some of them.

In addition, Terminix is a much better brand than Copesan. As much as everyone in the industry likes to knock Terminix, if you speak to Copesan sales reps you’ll hear things like:

“When we were just Copesan, I’d often hear from potential clients things like ‘What the hell is a Copesan?’ However, now, being part of Terminix, everyone knows who that is. They may have had a bad experience with Terminix in the past, but at least I don’t have to spend the first fifteen minutes explaining to people what Copesan is.”

To paraphrase Andy Ransom on an earnings call last year, “there is a big difference between publicly proclaiming you want to be a major commercial player and actually doing it.” However, I think that a pivot to the commercial segment is a good thing for Terminix, but it won’t be without its growing pains.

ServiceMaster: The Second Turnaround – 2018 and Beyond

In December at its Investor Day conference in New York, ServiceMaster laid out four strategic priorities for 2019.

- Improve customer retention

- Continue to drive new recurring units

- Strengthen the termite business

- Tiered service offerings

During their discussion, they talked a lot about compensation plans which I found to be very interesting. For fifteen years I’ve been saying that a major source of Terminix’s ills can be boiled down to incentive structures, or in Terminix’s case, the folly of rewarding A, while hoping for B.

Years ago, when I was engaged as strategy advisor by Scotts LawnService to help the company get into the pest control industry, the first thing that I did was go to Memphis.

I needed to understand how ServiceMaster could have the world’s largest pest control business and lawn care business under the same roof, but literally do no cross-selling whatsoever.

When I went to Memphis I learned why. Below is an excerpt from my notes from the meeting for the Scotts executive team that will help you understand:

The closest that ServiceMaster ever got to the concurrent stop model was to establish a cross-sell program between Terminix and TruGreen. The original goal was to test cross-selling as well as a basic concurrent stop between Terminix and TruGreen. ServiceMaster conducted a pilot program taking a Terminix service center and putting a TruGreen manager in charge and a TruGreen service center and putting a Terminix manager in charge. The plan was to implement cross-selling within six months and test a concurrent stop at nine months.

The test program was over in less than 180 days. It proved unsuccessful due to the culture of the organizations, the separate leadership at the most senior levels and the lack of clear incentives for technicians and salespeople to cross-sell services. Although TruGreen technicians and sales professional were charged with cross-selling pest control services, strangely, their compensation plans only provided incentives for selling (and servicing) lawn care services. One would think that this would have been management’s first change at the onset of the pilot program, but instead it was entirely ignored.

But that was just the tip of the iceberg.

A few years ago, I had dinner with an old client who had sold his business to Terminix. He brought a few of his key managers who I had gotten to know over the course of doing the deal.

Over dinner, the manager said that he was having a very difficult time with not only his sales people but also his technicians. He explained that his bonus was tied to profitability and recurring revenue, among other metrics. However, his sales people were paid a 15% commission on both recurring and one-time services.

He said, “Paul, my sales folks get it. We are supposed to be selling contract services, but a lot of these one-time jobs are chunky money. Further, it’s easier to sell a one-time service than a contract, so if they are getting the same money for each, there is no reason for them to do it no matter how important I tell them that it is.”

The more he went on, the more I realized that that was the least of his problems.

He continued, “Our people are paid to sell. Management wants sales. Technicians get paid to sell, sales people get paid to sell. The problem is, they are paid to sell, but not to service and retain customers. Guys are out selling all day long and there are not enough people to do the work, so we’re selling a lot of accounts that will actually never be serviced. It will take us too long to get out there and the customer will can us before we even get a chance to service the account. I’ll have pissed off customers and pissed off employees who don’t get their commission. It’s a train wreck and I don’t even know who to talk to about it because I don’t know who’s in charge in Memphis anymore.”

While Terminix executives were out dining on prime rib and lobster with me and my sell-side clients, Rome was burning. Not a single soul in Memphis sat down and thought through the organization’s incentive structures.

But someone finally did sit down and begin to ask those questions. Better yet, someone actually asked the frontline employees. And what do you know, changes are being made that are impacting the bottom line.

If current management does absolutely nothing else but get this right, it will be a game changer for Terminix.

International Expansion

The Terminix crew is not happy with the growth of Rentokil and Anticimex on US turf. As I mentioned, for years Terminix’s acquisition activity was focused on buying revenue rather than buying resources and capabilities. They’ve allowed Rentokil and Anticimex to pick up acquisition targets with true capabilities, while instead buying businesses like Magical in Canada. The only thing magical about that company is that it didn’t go out of business years ago. While the turf war rages in North America, in 2019, ServiceMaster will go global. In my mind, it’s no longer an if, but a when.

While Rollins is focused on the former Crown colonies and the UK itself, I fully expect ServiceMaster to bypass the crowded markets of the UK, Australia, and Singapore and instead focus on Asia, Continental Europe and Latin America.

In fact, I fully expect Terminix to enter China in 2019. On a trip to Asia in the fall I learned from the locals that ServiceMaster had locked up a $5 million deal in diligence that ultimately didn’t make it across the finish line. The Chinese knew Nik and Dion too well to believe that that deal was a one-off occurrence.

China is not a market that I would choose to go for a variety of reasons. First, I don’t feel like there will ever be a successful foreign, national pest control business in China — at least in the foreseeable future. Rentokil has tried that and learned the hard way. Second, there are a lot of other low-hanging fruit around the world in markets with far better risk profiles. However, I can certainly understand how China would be enticing. It’s a big market and it’s extremely fragmented… probably one of the most fragmented pest control markets in the world. By our estimates, some of the largest players in the country wouldn’t even make the US PCT Top 100 list. Nonetheless, I’d put my money on a Terminix entry into China in 2019.

I also expect ServiceMaster to enter the European market in 2019 with an acquisition in a highly fragmented country like Italy or Spain. As I said in the last Commentary, platform opportunities are few and far between on the continent, but if ServiceMaster wants to play ball there, they will need to acquire some serious managerial capabilities. Buying small businesses such as Pietro’s Pest Control & Pasta Bowl or Jose’s Rioja & Roach Killers just isn’t going to cut it.

Notwithstanding, Terminix is likely to enter the EU market in the next few months by acquiring a small, commercial business. My bet is on Spain, though Italy is certainly a possibility. Both of those countries have a plethora of small, commercial pest control companies looking for a savior partner.

Building a New Rat Trap

Anticimex is moving full-steam ahead with their SMART traps. If you go to Stockholm and watch them in action, it’s hard not to be impressed.

Today, for a change, I will keep my opinion on remote monitoring and technology-enabled traps to myself. However, I will say that there are a lot of people in the industry that get distracted by such bright, shiny objects and I believe that ServiceMaster is one of them.

I expect ServiceMaster to begin competing with Anticimex in the SMART trap realm in 2019, either by acquiring all or a portion of a digital technology company or manufacturer / designer. It will most likely be a European or Asian company, but my money is on Europe, for now — though I think there are a few options in the US. In my mind, it is likely that they will do this early summer 2019.

In Closing

I often say that the most objective proof that pest control companies are resilient is the fact that Terminix’s management has been trying to break that business for almost 20 years and has never succeeded.

Although at first glance, it might look like I’m not particularly bullish on ServiceMaster, and for a very long time that has been the case. But for all of its ills, Terminix is a great brand that has suffered poor management.

Nik, Dion and the new management team have a tremendous opportunity to effect change within that organization by simply doing basic things that so many executives before them have just neglected to do. And from where I’m standing, it appears that they have begun to do those things.

The new management team is bold and I am excited to see what they will do in the coming years. The first day that I met Nik and Dion I asked them if I should bother putting their names in my phone, or if ServiceMaster is simply just a waypoint for them as it was for so many others who have come before them. Based on my interactions with them I believe that they are in it for the long-term, but only time will tell.

My hope for them is that they continue to focus on the basics such people, architecture, culture and incentives and selectively enter new markets, while mitigating distractions that will take their focus off the core. In my mind, this is the first management team that I’ve seen in over fifteen years that can actually do what others have only talked about.