Stockholm, Sweden

6 September 2019

Today I am writing this Commentary on the plane from Stockholm, Sweden to Geneva, Switzerland. As it was a very busy week last week, this week’s Commentary will once again be a short one… but an important one.

This afternoon we closed on the sale of our client, Nomor Holdings AB (“Nomor” or the “Company”), to ServiceMaster Global Holdings (NYSE: SERV) in what I believe is ServiceMaster’s largest and most important transaction since its IPO in June of 2014. It’s clearly the largest pest control transaction in Europe in recent history and one that will change the competitive dynamics on the continent for years to come.

Today I am going discuss this historic transaction briefly without going off-script, out of respect for ServiceMaster’s investor relations folks — I don’t want to have to go out in public wearing sunglasses and hat. But I’ll have more to say about it in coming months.

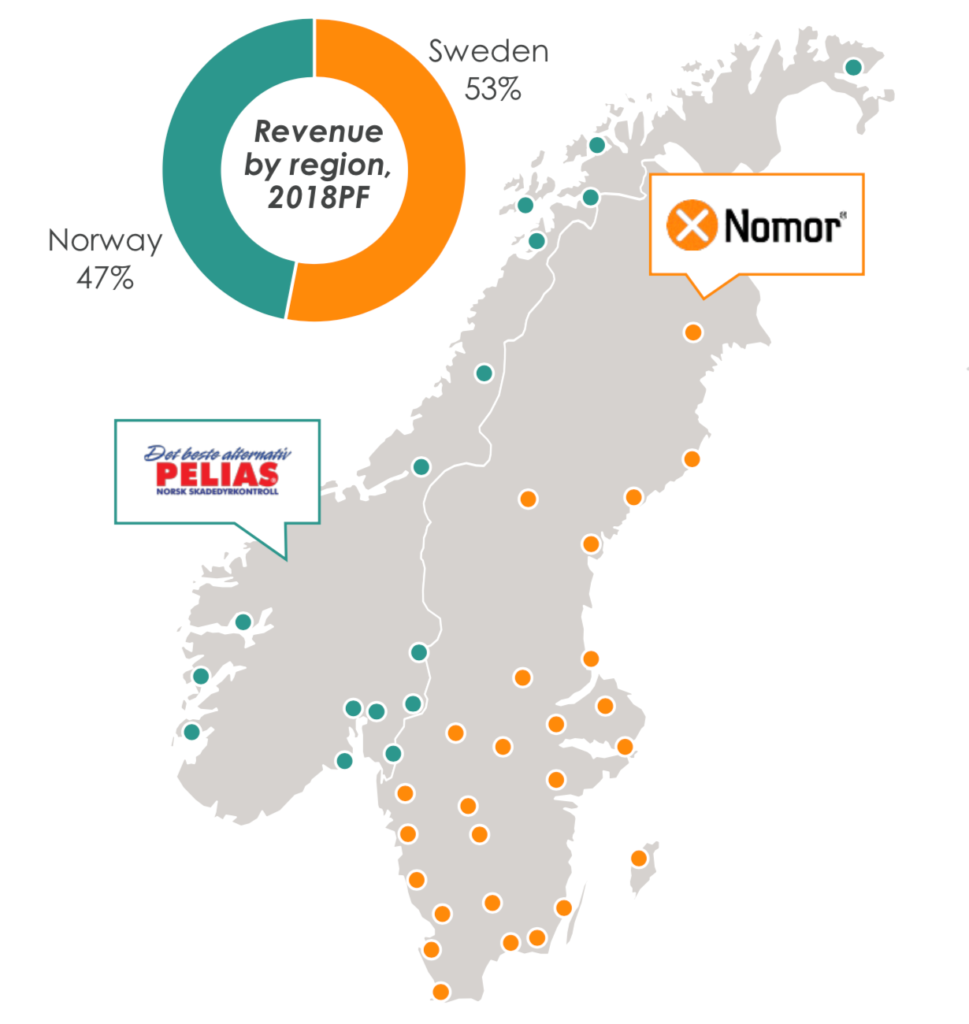

With 42 service centers in Norway and Sweden (Nomor in Sweden and Pelias in Norway) and about 500 employees, Nomor is the second-largest independent pest control company in Europe. The almost 2 billion Swedish Krona transaction (~USD $200 million) marks ServiceMaster’s official entry into Europe as a major pest control player. In fact, it takes ServiceMaster from zero in Europe to the fourth-largest pest control company on the continent, literally overnight.

As you can see in the map above, ServiceMaster and Anticimex are now cozy neighbors in Sweden and Norway.

Together, these two firms control over 90% of the Swedish pest control market, and along with Rentokil, about 85% of the market in Norway.

Until Friday, Nomor was a private equity-backed pest control company that grew at a substantial rate under the current management team — who will all remain with ServiceMaster and are excited to carve up the European pest control industry like Napoleon. The Nordic private equity firm Norvestor acquired a majority stake in Nomor in May of 2014, partnering with the current management team led by CEO Svein Olav Stölen. Over the next five years, Nomor made a series of nine strategic acquisitions more than quintupling (yeah, that’s the first time I’ve ever used that word in print) revenue.

I think that this was an outstanding move by ServiceMaster and in a lot of ways, it was a must.

First, as we’ve discussed in the past, platform opportunities in Europe are few and far between and there was no way that ServiceMaster was going to be able to grow in Europe without getting a platform, and more importantly, a management team with the experience of operating a business at scale with experience in doing strategic acquisitions. For ServiceMaster, Nomor checks all of the boxes.

Second, Nomor really does have an amazing management team. As the former EVP for 7-Eleven in the Nordics and COO of Espresso House, where he grew the chain from 22 to 70 stores, CEO Svein Olav Stölen is extremely disciplined and methodical. As a manager focused on profitable growth, he took Nomor from 100 million SEK to over 500 million SEK in five years — consistently growing EBITA margin year over year. He couldn’t have done it, however, without his team: Robert Stierngranat (head of sales), Andreas Olsson (COO), Jakob Sellgren (CFO) and Tor Harald Svendsen (CEO of Norway operations). ServiceMaster has made a lot of noise about buying capabilities in recent years and they nailed it with Nomor.

The Battleground Shifts to Europe, the UK and Beyond

As I have discussed quite a bit in my Commentary in recent months, the battleground for growth is beginning to shift to Europe, Asia and Latin America.

For pest control firms in Europe, you now have three acquirers: Rentokil, Anticimex andServiceMaster…. Europe is beginning to look a lot more like the US market… congratulations. What you need to keep in mind is that the only way to really maximum value upon a sale is to run a proper, controlled auction. Feel free to reach out to us now to discuss your options and plan for the future.

By the end of the month, we should see ServiceMaster complete its transaction with Rentokil (that is unless the UK CMA decides that the pest control business should be run some sort of government agency to “protect the people”).

Although this is pure speculation on my part, I believe that ServiceMaster will purchase the national accounts business of Mitie, with the remaining “local” business remaining with Rentokil. I think that this is going to create the need for ServiceMaster to get scale as quickly as possible in the UK, with a focus on resources and capabilities — similar to their focus on the continent with the acquisition of Nomor. Due to the nature of the business in the UK, it’s looking like ServiceMaster will operate there under their Terminix brand.

Once this transaction is complete, the UK will have four “national” players: Ecolab, Rentokil, Rollins and ServiceMaster. Over the course of the next 12 to 18 months this will dramatically change the acquisition landscape in the UK. Further, as when Rentokil and then Anticimex entered the US market, we will see acquisition multiples begin to rise in the UK.

We’ve continued to advise our UK clients to sit on the sidelines and wait … however, my advice will now begin to shift as we get closer to Q4 2019. For those of you in the UK, don’t hesitate to reach out to us to begin the planning process for what’s about to happen.

In Closing

I’ll finally be back to writing the Commentary on a weekly basis next week. We’ve got a lot of exciting things to discuss, reports to release and recorded seminars to distribute. Some of this will only be distributed to our subscribers, and you can easily get on that list by subscribing in the signup box below.

Finally, the ServiceMaster / Nomor deal was a complex, cross-border transaction and I wanted to give special thanks to my colleagues Carl Fredrik Reuterswärd, Simon Mannheimer, Linus Vallman-Johansson, Ericka Andes, Nils-Hugo Benson, Markus Ekenberg and Marlein Montierro. It was a pleasure working with each and every one of you.

Congratulations Dion, Nik, Tony, Svein Olav and the Norvestor team.

Below is ServiceMaster’s official press release for the transaction:

ServiceMaster Enters European Pest Control Market with Acquisition of Nomor Holding AB

Memphis, Tenn. (September 9) —ServiceMaster(NYSE: SERV), a leading provider of pest control, restoration and cleaning services to residential and commercial customers, today announced its recent acquisition of Nomor Holding AB, a Stockholm-based pest control company, with operations in Sweden and Norway. Nomor is the fourth largest pest control company in Europe.

“We are incredibly excited to have the Nomor team join us as we launch our global expansion strategyand enter the large and growing European pest market,” said Nik Varty, CEO of ServiceMaster.“As we have shared with our investors and employees, we have global aspirations and these partners will help us execute our strategy through the established and successful platform they built in Sweden and Norway. Our new colleagues and their seasoned management team will provide us with local expertise, experienced in driving organic growth and profitability.”

“ServiceMaster is going to be a great home for Nomor,” said Svein Olav Stölen, CEO of Nomor Holding AB. “Together we will build off our already strong position in the European market. With my fantastic team and experts, and together with a world-leading pest control services organization, it’s going to be a winning concept.”

Nomor is a leading provider of pest control and hygiene services in both Sweden and Norway—where it operates the well-known Pelias brand, with a head office in Elverum. The company offers a broad range of pest control and hygiene services, including preventative pest measures, food safety services, inspection and sanitation of mold/fungi, and has deep relationships with the insurance industry in both countries.Nomor has secured its strong position in the market combining organic growth and M&A.

Nomor gives ServiceMaster a strong platform for growth in the highly-fragmented European pest control market. A nationwide network of local technicians makes Nomor the number two player in both Norway and Sweden. The company has about 500 employees and approximately 30,000 customers across Sweden and Norway.

Nomor is expected to contribute approximately $60 million in revenue and approximately $14 million of adjusted EBITDA in the full year 2020. The approximately $200 million purchase will be funded through $120 million in borrowing from the company’s revolving credit facility as well as cash from operations.

The current management team will stay in place and report to Dion Persson, senior vice president of Strategy and International Operations for ServiceMaster.

ServiceMaster acquired Nomor from Norvestor, a Nordic private equity firm focused on investing in Nordic mid-cap companies with strong growth potential, including service businesses that deliver sustainable cost efficiencies through automation and digital transformation.

ServiceMaster was advised by Foros, McDermott Will & Emery, Mannheimer Swartling Advokatbyra (Sweden), and Advokatfirmaet Thommessen (Norway). Nomor was advised by The Potomac Company, ABG Sundal Collier (Norway) and Törngren Magnell (Sweden).