Valuing a pest control business for internal or external sale. In this webinar, Pest Control Valuation and M&A 101: The Fundamentals, we cover the following:

- Every pest control business has a range of values simultaneously

Fair Market Value is what the business is worth to you (the current shareholders) while Investment Value is what the business is worth to one unique acquirer. If you don’t understand the difference between the two it can be a very costly mistake.

- The value of your business to your children or management is very different from what it is to a strategic acquirer.

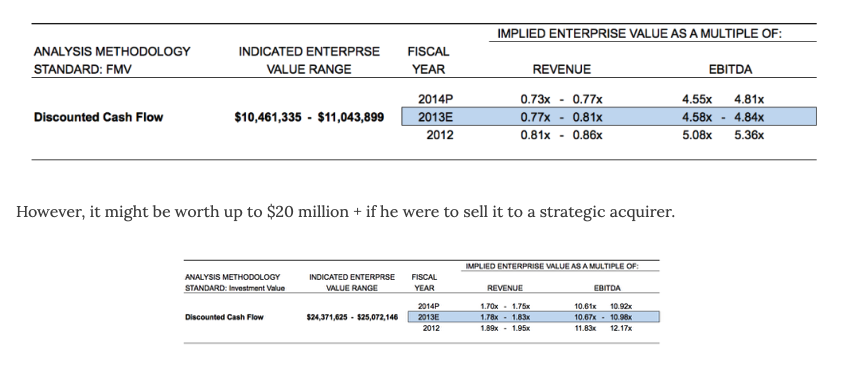

We look at the example of Project Zulu, a pest management firm generating $13M in revenue. If the owner were to sell the business to his children it might be worth about $11 million.

However, it might be worth up to $20 million + if he were to sell it to a strategic acquirer.

- Acquirers value pest control business based upon projected returns, not multiples of revenue or cash flow

- Case study in valuing a $13M in sales pest control business for internal sale and for external sale

- Acquisition multiples have increase 150% over the last decade

- We take a detailed look at a database of over 300 pest control transactions and look at how the market has changed over time.

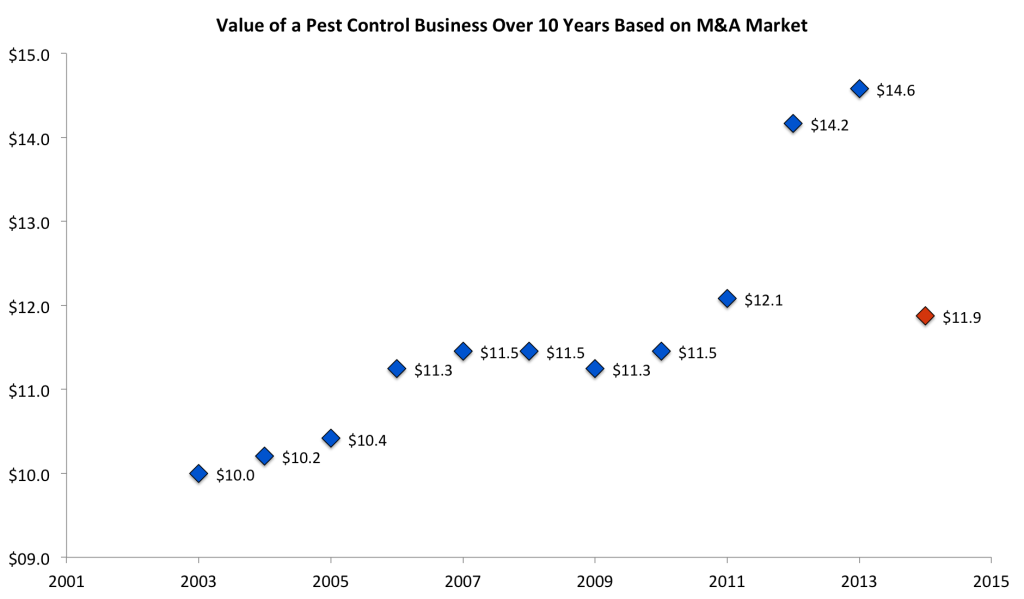

For example, in the chart below, the same business is valued on the same date every year for the last ten years. Using prevailing market implied IRRs and capitalization rates, the value of the business has changed over time. In this analysis, we have assumed that nothing about the business itself has changed from year to year. The company is generating the exact same amount of revenue and cash flow each year on the valuation date… we explore this and much more in the this webinar.

This webinar, Pest Control Valuation and M&A 101, is a replay of a live webinar presented on September 16, 2013. In order to watch in full-screen mode in your web browser, double click on the video.

Subscribe to The Potomac Pest Control Executive below to be notified when Pest Control Valuation and M&A 102, 103 and 104 are made available for viewing. Finally, we request and truly appreciate your comments, questions and suggestions in the comment box below.

Transcripts of Pest Control Valuation and M&A 101: The Fundamentals of Valuing a Pest Control Company

Good afternoon everyone. This is Paul Giannamore from the Potomac Company. Today’s presentation is pest control valuation and M&A 101, the fundamentals.

Today we are going to do something different in fact something very different today. Typically these presentations, webinars, live events are reserved for Potomac Company clients. After last month’s presentation one of our long-term clients asked if I wouldn’t mind if he invited some industry colleagues and friends to this month’s presentation which I thought was a fantastic idea. In fact, I am going to go ahead and take it a step further. This presentation is going to be recorded and we’re going to put this on our website. I think it’s a fantastic way to give back to the pest control industry as there is a lot of misinformation floating around out there that causes managers and owners to make horrible mistakes. So this is just a nice way I think of giving back. So I won’t be as candid as I’ve been on some of the past presentations if you been with us on, but either way I think today’s going to be a lot of new information for you folks. We are going to really focus on on on doing some things we haven’t done in the past. We are going to go over the fundamentals today in some of the fundamentals include the fact that every business has a range of values. It’s a very difficult topic for business owners to get their heads around so we are going to spend some time on that. We’ll talk about how strategic acquirers value acquisition targets, we’re going to discuss the dangers of acquisition multiples, as well we’re going to talk about how the market has changed over time.

Again we’re going to focus on fundamentals and then in October we’ll start hitting valuation and M&A 102 and 103, which will cover more advanced topics so basically today is is fundamentals of valuation 102 will be the sell-side process in valuing a pest control business from a sell-side perspective and 103 we’ll begin to focus on the actual transfer of the business entity to managers, employees, and family members

You noticed that Project Zulu was on the title page. We call this the Project Zulu dilemma as investment bank it’d pretty typical of us to give our clients codenames in order preserve confidentiality. Project Zulu in this case is a fictitious pest management firm. We are going to use a somewhat of a case study format for this presentation. So, we’re going to focus on Project Zulu a fictitious pest management that’s owned and operated and I chose this sort case study for Fundamentals because when I look at our dialog box we’ve got 94 folks on this call right now and based on the guys that I know range in value or range in revenues, I should say from about 1 million sales to we’ve got a couple of guys doing north of 50 million. So it’s a pretty broad range, but I think this case study will pretty much cover 95% of you folks you’ll be dealing with these issues at one point or another if you’re not dealing with them right now.

So back to the case study our owner is contemplating either internal transfer to his children or an external sale. So our mission today will be to advise him on some strategic alternatives and we’re going to largely look at what the pest control business is worth to him as a shareholder, what is what his children, as well as what it might be worth to strategic acquires.

When I say strategic acquires I am typically referring Rentokil, Orkin or Terminix, I call them the Big Three. Some facts on Project Zulu. The business doing 13 million sales, Henry’s 67, a second-generation owner. He’s the chairman and CEO. Gordon, his son is 39. He’s the president of the business. The company is organized as a C Corp. in the United States, Henry owns 100% of the stock and has two children who are not involved in the business. Henry comes to us. He has. He has a few questions. First off, he wants to know what is businesses worth. He’s also interested in how he can go about selling it to his children, as well as if his children are not interested in the business how he can sell to third party.

Starting with the question of what it’s worth. That typically depends upon the purpose for the valuation, so again one of the things that’s difficult for business owners to get their heads around is the fact that their business has a range of values simultaneously so any given pest control company might have 15 or 20 different values depending upon the purpose of valuation and being a privately held business can’t call your stockbroker up and buy and sell stock in private business and a valuation is done at a specific point in time for specific purpose. This particular case, we have five values don’t read too much into these numbers here. I pulled them out of thin air just for illustrative purposes, but this particular company. The fixed assets or the collateral of businesses worth $8 million, whereas is worth $12 million for a cash flow perspective to the owner. That’s the fair market value, all the way on the far right end, it might be worth $26 million to strategic acquirer. So it’s a big range of a big range of values and we call we call these different perspectives of value standards of value so fair market value is a standard of value market value found fair value investment value. These are all standards of value. The three most common, which pretty much covers almost everyone on this call you be dealing with one of these three, at some point in your life. Fair value typically deals with divorces and dissenting shareholder partner disputes. Fair market values promulgated by the Internal Revenue Service is largely focused on gifting stock and estate tax purposes and Investment Value is the value to a unique acquirer.

Today we’re going to be focused on two standards of value, so we focus on fair market value. That’s what the business is worth to the current shareholders or a financial buyer, so when I say financial buyer I mean, somebody or entity that cannot create synergies when consummating the transaction so that would be your children, your managers other individuals.

Investment value is what the business is worth to a unique acquirer, so if you take a business out to market and you get three bids tomorrow one from Orkin and one from Rentokil and one from Terminix, you’ll likely get three different perspectives on value three different investment values for one company. Now whenever we’re doing here, Potomac, whether it’s a valuation for gift and estate tax purposes whether it’s to sell to children or a strategic third-party whether we’re on the buy side or sell side whenever we’re valuing a business we always start with fair market value because it tells us what the businesses worth current shareholders. And in this particular example, the company might be worth $9 million to current shareholders and it might be worth $9 million if the shareholder sold it to his son, for example. But the business might be worth $14 million to a strategic acquirer, like a Terminix or Orkin, for example. Because Orkin can come in and buy the business and has different required rates of return being a public company, and it can create some synergies … revenue enhancements, cost savings, so whenever you go to sell your business it is important to or transfer in any way shape or form. It’s important start with understanding what fair market value is and then bridging the gap to investment value. If you were to sell this business and it were worth $9 million to you clearly your target would be that $14 million investment value. If you’re the acquirer, your target would clearly be to pay as close to $9 million as you can so the sale process as negotiation takes place, ideally within that big blue box or the value creation zone. Within that zone one plus one doesn’t necessarily equal two… it might equal three, it might equal four. Of course less than fair market value and the seller really loses greater than fair investment value the acquirer does not create any value is better off not doing the deal.

So getting back to Project Zulu were to go ahead and start with step one, which is determining fair market value. In order to do that we are going to access our valuation toolbox. This includes the three broad approaches to valuation those are the market, income and asset approaches. Now the asset approach is largely related to valuing fixed assets, businesses that are capital intensive, which is not us because our pest control businesses are largely intangible. So we are going to focus on the market and income approach. Today we are going to begin with the income approach because the income approach is the key valuation tool that investment bankers and acquirers use to determine the value of a business. The income approach quantifies the risk and return of owning an asset. It makes no difference what other individuals or companies are paying for a particular asset. It’s based solely on what that business is worth on a risk / return basis. The income approach is what every sophisticated acquirer uses. So I know that in this industry there’s all sorts of rules of thumbs floating around: one times sales, 1.5 times sales, five times EBITDA, six times EBITDA. Rentokil, Orkin, Terminix, Arrow, Massey… these sophisticated acquirers could not care less about transaction multiples. I can tell you as fact Rentokil doesn’t look at them, Terminix doesn’t look at them, Orkin could not care less about sales multiples and EBITDA multiples. They use two tools within the income approach: the discounted cash flow analysis and the internal rate of return analysis which we are going to talk about today.

But first, I want to walk through some of the basics. Now we’re moving right into some really quantitative type analyses and I’ll tell you business valuation in my opinion tends to be almost more qualitative than quantitative, but because this is a short course today we’re going to focus largely on the quantitative aspects of valuing in a pest control business. From a fundamental standpoint the value of the business driven by three factors and three factors only. Cash flow…the growth rate in cash flow and risk. When you talk about recurring revenue, and people, and long tenured employees and strategy, and so on and so forth. These are symptoms that it is what we need to focus on today is the cornerstone of what actually creates value which that is low risk and cash flow. So if we increase growth rate or cash flow value goes up, if we increase risk value goes down. And of course it plays out every day the public equity markets in the sovereign bond markets, countries that are riskier pay more interest on their bonds, Djibouti and Peru pay more on their sovereign debt than does the United States and Great Britain, although nowadays you’d almost think that the US and UK are probably more risky entities in the these countries.

We can depict this graphically here almost mathematically, I should say that value equals free cash flow divided by the risk the discount rate minus the growth rate, now you don’t need to write this down, you don’t need to remember this because I am going to bang it into your head today. But again, if we take cash flow going out the future when you adjust it by the risk, especially when I made to the firm has value because we expect to gain something from in the future, and I just did a month or so ago, I guess it was last month was my third time speaking at the PCT Pest Control M&A seminar. Some of the folks that I was on the call will…. All great people, but they spent a lot of time talking about goodwill and how long your business been around, and so forth, those are all great things, but at the end of the day a business has value for one and only one purpose is what we expect to gain from it. The past, of course, could potentially be an indicator of the future, but doesn’t have much bearing in the value of the business so our focus is solely on the future. So what a business worth to the shareholders today depends on whether it will produce for them in the future. If we can measure with the firm will produce in the future we can determine its value today. So a very basic discounted cash flow model looks like this. Don’t spend much time on this because we are going to get deeper into it as the presentation moves forward. The problem that we have in forecasting cash flow in the future is that the futures uncertain.

We’ve got external risks, we got the economy. We’ve got inflation. We’ve got competitors moving into our markets. We’ve got internal risks, managers may get hit by a bus, employees could quit, the place could catch on fire, so there’s all sorts risks everywhere we look so it becomes very difficult project cash flow going out into the future. This is where a lot of judgment and experience comes into forecasting cash flow. And because of the risks we have to discount the cash flow that we project into the future, of course the riskier the business the more we have to discount performance…. future performance. We call this the discount rate and all else being equal this is why pest control firms with higher degrees of recurring revenue are typically worth more because there is more visibility on the future revenue stream.

When we have a client, whether it’s sell-side client, a buy-side client, a consulting client or a valuation client, we always begin with fair market value. We begin by populating an extensive, very detailed cash flow model which we refer to as a transaction model, but can be used quite frankly, for anything. So what we’ve done here is we’ve taken Project Zulu and we’ve spread the numbers into a discounted cash flow model. Again, I’m not going to a lot of the qualitative aspects of valuation today, but we projected the revenue and cash flow out into the future and using the cost of capital or the required rate of return for private pest control companies within this size range, we’ve come up with a fair market value of $10.8 million.

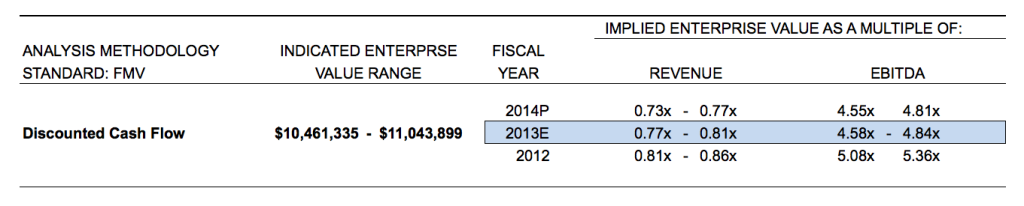

So you can see on the lower left in the WACC which is the weighted average cost of capital is 24.7%, which for businesses, for privately held pest control companies the required rates of return are typically between 20 and 30%. At least for companies kind of doing between $1 and $300 million sales. Of course, that 20 to 30% is a very broad spectrum, which can dramatically impact value… we’ll talk about that little bit later in the presentation. But what we’ve done now is we’ve determined the fair market value. This is what the business is worth to Henry. And one thing you’ll notice is we use the income approach, we did not use the market approach, which deals with revenue multiples and EBITDA multiples. And if we take right from the discounted cash flow sensitivity analysis, the range of fair market value, when we refer to fair market value it’s typically a range because valuation is range concept. We’ve got $10.5 to $11.0 million, that is the fair market value. If you look on the right, you’ll see implied valuation multiples. Revenue multiples and EBITDA multiples did not drive our valuation. These are implied. So if we take the, if we take the $10.5 million on the far end left end the range and divide by the company’s total revenue it’s trailing 12 month revenue, we get .77. So fair market value in this case, this business’s on a fair market value basis is worth about 80% of sales and about 4 1/2 times trailing EBITDA. If we begin to put together one of the schematics that we did earlier on the very far left-hand side, we can establish fair market value at $10.8 million for this business.

Now, we talked about required rates of return. The private capital markets are very different from the public sector, the public equity markets. The private capital markets are segmented. Asset backed lenders and banks will require 3.5% to 8.5% return on their money and that is quite quite low compared to what other investors require because, of course, their investments are collateralized. There’s liens on assets and the’re above equity holders in the capital structure, so it’s relatively low risk. As we start to get riskier, required rates return start to run higher. We talk about corporates.. Rentokil, Orkin and Terminix will typically have required rates of return between 10% and 18%. That means when they look to acquire a pest control business they are going to pay a no greater a purchase price than a value that will afford them, at least a 10% to 18% return.

Mezzanine and sub-debt providers are 14% to 22%. And then the majority of you would be up here where it says PEG, that’s private equity groups based this schematic here’s based upon the most recent Pepperdine study of private Markets. I quite frankly, view this as extremely accurate. So most of you have required rates of return somewhere in the 20% to 30% range actually probably closer to 24% to 30%. You can see the difference between this is where I discussed earlier, that private investors will have different rates of return requirements. If Orkin is looking to get to get a 10% to 18% return and you want to sell your business to your son and he just needs to get a 24 to 30% return. You can see how that dramatically impacts valuation. Now, we’ve determined fair market value based on the discounted cash flow model. Now it’s time to take a look at investment value, so we are going to use the same projected income statement.

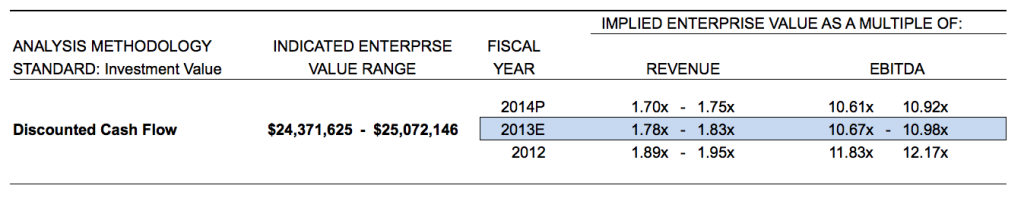

We started 2014 using the last three years as somewhat of a guide based on some qualitative analysis. We looked at average pricing and recurring revenue. We looked at strategy, people, architecture, routines and culture of the business so on and so forth, projected out into the future appropriate stream of cash flow and discounted that backed by the low-end of the required returns for corporate acquirers. So again, Terminix, Rentokil… Orkin, as you can see our fair market value..oh I’m sorry, our investment value so we can call this one of the higher investment value is not taking synergies into account. This is based purely on arbitrage or financial economies this business could potentially be worth up to $24.7 million. We of course did the same thing. The range is $24.4 to $25 million our implied revenue multiples are 1.8 times revenue and almost between 10x and 11x EBITDA. That’s investment value. So, Project Zulu’s worth $10.8 million to Henry if he were to sell it to his son or his children, he would need to sell that business somewhere in the ten to eleven million dollar range. This business can be worth up to $24 to $25 million to strategic acquirers based on a variety of factors that we are going to get very heavily into in Pest Control Valuation and M&A102 when we start to talk about synergies and how to execute a sell-side process. We’ll talk about how we can capture as close to that $24.7 million as we can. But … that’s a broad range … from a implied revenue multiple perspective .8 times revenue all the way up to 1.8 times revenue. And again we did not use multiples to drive our valuation. Multiples here were calculated after the fact. They were calculated after we determined the value and we’re using them to describe value not drive value.

So far we determined fair market value and one iteration of investment value without taking any synergies in the consideration. I think it’s time to head over and take a look at the market approach.

So when Henry came in he had heard that pest control businesses sell for one time sales. He also heard rumors others have been selling for 1.1x, 1.2x, 1.3x, 1.5x, 1.6 times sales, five times EBITDA, he wanted to know what multiple to apply his business. So we’re go to go ahead and give him a little example.

Basically what the market approach tells us is that valuation is relative and we can look at what others have paid for similar businesses and impute a value for own business. So we explain to Henry, using example here. Let’s say Joe’s pest control was acquired for $1 million. If we know that Joe’s generated EBITDA of 200,000 for the trailing 12 months, then we know that the enterprise value / EBITDA multiple was five times. Now, let me interrupt myself here, I know I keep referring EBITDA, some you folks on this call probably don’t know what that is I would actually consider yourselves better off since you don’t know what it is, but it really means interest before earnings taxes, depreciation, amortization, If you’re on the sell side you’re selling your business to someone you’re not related to, using EBITDA as a proxy for cash is fantastic as it tends to overstate earnings. If you’re out there buying businesses you never want to use EBITD for anything and we’ll talk about that in102. But for now, $1 million was a purchase price. We bought $200,000 in cash flow, again I am going to say that EBITDA is not cash flow but for simplicity sake, we’ll use it. 1 million bucks for 200,000 in cash flow. That’s a five times multiple. So if our pest control business generates $500K in LTM EBITDA and we apply that five times multiple, we can somewhat expect to sell our business for around $2.5 million or five times trailing as they would say. Of course, is extremely simplistic. The problem is this approach assumes that every seller is the same and all acquirers have the same motives and risk tolerances which is absolutely not the case. There’s tremendous amounts of distortion that arise from using the market approach and the market approach should only be used by individuals that really have a lot experience using it and can understand what distortions can arise from the market approach. For you as executives and owners of pest control businesses, I’d tell you shy away from the market approach at all cost. And we’re going to talk about why.

So back to Joe here. His business sold for five times EBITDA. If we remember from earlier in the discussion that the value of a business is the cash flow stream divided by the level of risk, less the amount of growth, so we don’t know whether or not Joe’s business is growing at 4% or 5%. We don’t know what the acquirers’ required rates of return are, but we backed into it because we know right now. Okay, he was doing $200,000 in cash flow, give or take. The business sold for five times which is equal to a million bucks more to use a 24% discount rate and a 4% growth rate. That’s the growth rate in free cash flow. The problem is applying that to our business. What if our business is growing faster than Joe’s? Well, we don’t know what Joe’s business what the growth rate free cash flow was, but if we were also doing $200,000 in free cash flow we use the same required rate of return. If we’re groing at 10% our business is now worth $1.4 million versus $1 million so multiples become very difficult use. In every single pest control company for the most part is going to have a different growth rate and if we take the 2012 PCT 100… here’s is the top 100. Actually, it’s the top 90 really because ten didn’t report a growth rate, but in the top 90 in the top PCT 100 we see growth rates ranging from -6 all away up to what’s that about 32%. Wild, wide variety of of growth rates so that’s one reason not to use transaction multiples. What if our business has a higher degree of recurring revenue, which means we have lower risk. So instead of a 24% required rate of return, we might need use a 20%, which yields $1.25 million value, so can the market approach is a route it. It’s it’s how to value a business relative to other acquisitions. It’s based on the principle of substitution, you wouldn’t go out and pay anymore for a particular asset if you could get a similar or substitute for lesser price Now there are more dangers in the market approach in the pest control industry folks tend to rely a lot on revenue multiples, which is extremely dangerous and here as the largest appraiser of pest control companies in the entire world. If there’s one claim to fame that we have it’s that. Our accredited and certified staff has appraised more pest control business than anyone else all over the world and we pulled a transaction database we had transaction database, a valuation database of over 325 transactions pest control space so we looked at 300 and I guess it was about 325 or so over the last 13 years, and we whittled it down to the last two or three years. We pulled out 27 transactions. Of those 27 transactions, the total aggregate transaction volume was $679 million. So 27 deals worth a total of $679 million the median and the mean revenue multiple is 1.1x time for pest control companies. Now, people love to throw around medians and means. What’s the going rate? Well, a lot of people say the going rate is one time sales, 1.1 time sales, 1.2 times sales…. looking at actual transactions… so these are actual transactions, $679 million worth a total number 27 out of the last 2 1/2 to three years 1.1 times revenue is the median. I only see one company in this entire chart that was acquired for 1.1 times revenue. Half of them were above that level and the other half were below, so of course you start using means and medians where does your business fit in vis-à-vis everyone’s out everyone else? Well, that’s really impossible to tell. It’s impossible to tell because you have no information on the growth rates of those other businesses or their levels of profitability, the level of recurring revenue and you don’t know the motivations and the level of sophistication of the acquirers. So there’s lot information that you don’t have, and this is of course where we get rules of thumb. It’s the market approach where we ultimately get these rules of thumb that float around that are so very dangerous.

This is selected comparable acquisition schedule. These are actual, real transactions here. I’ve kind of removed or I’ve sanitized them, but these are real pest control deals. If we look at the top transaction for example, we talked earlier about transaction multiples. It’s very simple when you look at a revenue multiple. It’s the aggregate purchase price divided by the trailing or LTM, latest twelve-month revenue, at the time of the acquisition that gives you the transaction multiple – 1.2 times sales Again, the market approach tells us what others, other companies have sold for as a multiple of sales or some proxy of cash flow and I say some proxy because EBITDA and EBIT are not cash flow. But the issue is multiples are calculated after the fact, so that deal that we just talked about that was acquired for $13.4 million that 1.2 times sales didn’t drive the deal what drove the deal was a discounted cash flow analysis and internal rate of return analysis that we discussed earlier in the income approach. The multiples, just like we had implied multiples. This 1.2 times is used to describe the deal… so multiples describe deals. They don’t drive deals. If you walk away with anything from this presentation, 1) you should understand that your business has a range of values. It’s not like a house, where you just look at the comparables in the neighborhood and determine okay, mine is a lot nicer… Add a few bucks …done. No, your business is a system, a living, breathing organism. It has a range of values. Multiples describe deals they don’t drive deals. Those are the two things I want you remember from this presentation. So unless we have information or information’s public on transactions, the market approach tells us nothing about the company’s growth rates, level recurring revenue, average pricing, resources and capabilities, or even the transaction structure. To me, somebody paying $10 million for particular business with $10 million upfront is very different than $5 million upfront and $5 million over 25 years. So it doesn’t even tell us the transaction structures which that distorts and skews multiples as well. I know I am beating a dead horse here with transaction multiples, but is one of those things that I think is one… is extremely dangerous in this industry because I think people leave a lot of money on the table because they rely on these transaction multiples.

Let’s say, for example, Company A sold for three times revenue or 6.5 times EBITA. Again that 1.3 times revenue describes the deal and just as I could say that Company A was purchased for 1.3 times revenue. I could very simply say, Company A was sold for 2.5 times or 2.5 million times the number of pens in the company’s desk or 200,000 times the number of vehicles on the company’s lot. These would all be equally accurate statements off fact and they did so for 2.5 million times a number of pens are descriptors. I can say X number of flowers or X number of employees. These just describe deals they don’t drive them. One other thing to remember about comparable acquisition analysis is comparables are multiples provided some sort of proxy for investment value or what a business is worth to a strategic acquirer. That fact it was a strategic acquirer that did the deal, it doesn’t tells what fair market value and fair market value is important because when for example, if you’re doing an S election… If you’re gifting stock to your children, if you’ve got estate tax issues, fair market value is always lower in the pest control space which has a positive impact in the amount of taxes you pay. Furthermore fair market value is a standard of value for internal deal, again with your children or management not to not investment value. So that’s why multiples don’t help you there. That difference results from the control premium that acquirers will pay to control the business as well as the synergies that are part of the deal. So in closing to the market approach, it should only be used as a sanity check …. the market approach should be used as a sanity check to check your discounted cash flow and internal rate of returns analysis again multiples are derivative, they are calculated after the fact to describe transactions.

Now we’ve already talked about the private and the public markets being very different. In the private markets you might have a business doing $1 million in free cash flow and because you are operating a private company in the private capital markets, your rates of return might be somewhere close 25%. So your business kicks off $1 million in free cash flow, your business is worth $4 million. But although technically impossible, if we were theoretically to move that business to a public exchange and now made you a publicly traded company, your $1 million in free cash flow with a 10% required rate of return would be valued at 10 million bucks. So just from the fact that you are private company and not a public company means a dramatic difference in value – $4 million versus $10 million.

What we just talked about describes the theory behind arbitrage. And so arbitrage is the near simultaneous purchase and sales of securities in different markets in order to profit from price discrepancies Orkin, Terminix and Rentokil do this. Well, Terminix, not anymore as Servicemaster is private and while they do intend to go public we’ll see if they get there. But their cost of capital is quite low nonetheless, so they can profit from this. Essentially what they are doing is they are buying companies in the private market where there is higher required rates return and selling it to investors, so to speak in the public markets. Now you even though you are privately-held business can can create a tremendous amount of wealth if you can discover and exploit this risk, return imbalance in the market. I want to talk about that in the pest control space, the market is typically segmented in the three broad classifications. We’ve got the micro segment, which is a million dollars in sales or less nowadays it’s really closer to 600,000 or so or less in sales. We’ve got the middle market, which is companies doing $1 million to $300 million in sales and of course the publicly traded market. If we as Project Zulu pretend we’re Henry for second, we go out into the micro market and we buy up small pest control business doing $100,000 in free cash flow. In the micro market required rates of return are typically between 30 and 40% so we go out and buy a business from somebody utilizing a 33% required rate of return. We pay 300 grand for it. Even if we realizes zero synergies, the day we close that deal just for the fact that Project Zulu is a much bigger company in a different segment of the market, that hundred thousand in free cash flow, as soon as we put it on our books is now worth 400 grand because we have a lower required rate of return. Our business is bigger. It’s less risky and therefore we have a lower cost of capital. So we create, just like the Federal Reserve prints money, well now we are printing money, because we’ve just created one hundred thousand dollars in value out of thin air. Now as Project Zulu, we’ve added that additional hundred thousand to our our P&L now we turn around and we want to sell our business Project Zulu to Orkin, or Terminix, or Rentokil.

That $300,000 we spent in the micro market is now on the very next day worth $660,000. Why? Because again, the cost of capital is different in public market. We won’t be able to share all that value created through financial economies, but we could share a good chunk of it so we bought it for $300K is worth $400K+ now we turn around the very next day we sell it for $660,000. A pretty nice move. If we learn to do this right, and we begin to meticulously quantify our investment opportunities establishing hurdle rates just like the public companies do and running all investment and capital budgeting decisions by a hurdle rate. When we go out into the market we can utilize that hurdle rate as kind of a yardstick to measure the returns we’ll get from some of these smaller businesses.

As we start to talk a little bit about a preview from pest control valuation and M&A102, we’re going to get into the strategic rationales for acquisition. Usually companies like Terminix, Rentokil and Orkin will buy businesses for one of the following reasons: (1) to acquire new capabilities or add to existing ones, (2) establishing a business model, (3) to lower costs, (4) to improve market position, (5) or arbitrage, which is something we just discussed. They get returns via revenue enhancements, cost reductions, process, resources and capabilities and financial economies. This is how acquirers are able to create value by doing transactions.

The last thing I wanted to discuss before we get to questions and answers. I can see that there’s going to be a lot of Q&A because the dialog box is pretty full questions. I want to talk about the fact that the market is dynamic. In order to do that, pretend for a second that we are about to hop into a time machine and were going back in time 10 years. So today, September 16, 2013. We went back in time 10 years and a day to September 15, 2003, we landed at a closing table, the owner of a pest control business is about to sell his pest control business for $10 million. He owned a C Corp. and he was only able to sell the assets because no one at that point time, no one would purchase the stock of his company. The total proceeds were $10 million after corporate and personal taxes and the seller ended up with $4.62 million in his pocket.

Now if we were to grab him from the closing table, bring him into the future to September around sorry, September 15, 2013, a very different thing would take place. So if he had the exact same company with same financials, same performance everything. Nothing’s changed. We’ve just moved it now into the future that exact same business same financial performance would sell for $14.6 million because the market is dynamic. It changes. Further our owner be able to sell his C corporation as a sale of stock as opposed assets, which would save him millions of dollars in taxes. So by moving into the future 10 years doing the exact same deal with exact same company, the owner put 240% more in his pocket the difference between almost $11 million and $5 million is dramatic. Why does this happen? Well I have been in the industry for a long time, and unfortunately, we are the same rules of thumb spouted out by all sorts of knucklehead consultants and owners that don’t know you just random folks in the industry always hear about one-time sales, one times recurring revenue. But if we open our eyes and we look at equity markets… this is the Wilshire 5000. So, from 1971 to present look at the dramatic increase in the public equity markets. This is all traded equities in the United States. This is the basket of all of them …. the whole market index in the US is right now at all-time high, and of course people scratch their heads and say well we’re still in the doldrums of the recession why are equities at all-time high? The answer to that question is the Federal Reserve and central banks around the world are printing a tremendous amount of money and that needs to go somewhere. So when you’re printing trillions of dollars, when you’re printing $85,000,000,000+ per month that goes someplace and it’s going into real estate, it’s going into the bond markets, it’s going into the equities market. If we look at … If we look at Rollins stock. I like to look at that as a barometer and we use the backdrop of the monetary base published by the St. Louis Federal Reserve Bank, we can see Rollins is the black line. The blue bars are the is a monetary base. So in 2007, the Fed had $852 billion in cash on its books right now as we approach the end of 2013 it’s got over $3 trillion… so it’s printed over a couple trillion dollars in cash out of thin air over the last for five years and that has gone into the equity markets. Look at Rollins, it shot up almost in tandem with the Federal Reserve printing cash. At Potomac here, we have a cap rate index, we look at. We have the PPCG, which is the Potomac Pest Control Group Cap Rate Index. In this particular chart shows us the inverse of capitalization rates paid for pest control businesses utilizing a database of over 325 consummated pest control transactions over 13 years. This looks at the last 10 years, but you can kinda see how transaction multiples have creeped up over time from 2012 in 2013. They really hit their zenith and that’s tied to that black line, of course, which is the monetary base. As the Fed continues print money, not only is money going into real estate and public equities, but it is increasing the value of your pest control business, at least on paper. Our research staff put together projections for 2014 some folks here believe that the market in pest control will ultimately revert to the long-term mean by this time in 2014 and I am not so sure about that. I believe that the Federal Reserve will not taper quantitative easing. I think it’s absolutely impossible and they are going to keep that up in perpetuity, and I think that these transaction multiples will continue to increase, so I think in 2014, we’ll probably see another blue box and it will probably be higher than the one in 2013.

I love this chart. This explains… there is a tremendous amount information in this chart. This is the PPCG Cap Rate Index, the Potomac Pest Control Cap Rate Index. This looks at measures with extreme accuracy. The capitalization rate, so a cap rate is the discount rate minus the long-term growth rate used in discounted cash flow models for valuing pest control businesses. The black line is the implied year, one internal rate of return that strategic acquirers get on acquisitions. So both the cap rate, the blue columns and the black line, the lower the number, the higher the implied value of the business, and you can see in 2012 and 2013, we believe that implied year one internal rates of return have reached an unsustainable level. That means the value that acquirers are paying are below their hurdle rates, so they’re getting pretty close to costs of capital. The blue line is the interest rate and interest rates have been held down artificially based on the fact that the Federal Reserve. Every time the Federal Reserve prints money interest rates fall or remain depressed. Interest rates hit an all-time low in July 2012 based upon the GS 20 which is the good proxy for long-term interest rates published by the St. Louis Fed. July 2012 interest rates hit a floor, an all-time low. Since the summer of July 2012 interest rates have increased 150% and is the Federal Reserve entirely loses control of long-term interest rates. I personally believe that again they are not going to taper quantitative easing. I think the Fed will actually have to accelerate quantitative easing and print more money just to keep the economy on life support. I think that if they taper this it’s going to make the Great Depression look like a picnic and of course the federal regulators, Congress every moron in Washington is making every wrong decision they could possibly make, and it’s it’s a shame to see what I’ve always believed to be the greatest country in history catch on fire with all this nonsense in DC, but here is guys right before our very eyes. Our government is manipulating the price of everything. It’s even manipulating the price of your pest control business through pumping liquidity into the market. This last chart kind of depicts the man from the time machine back in 2003 was doing …right now, but why can’t I use You can see how it creeps up over time were you by 2005 2006 at 10.4 million. Many goes all the way up to the 2012 and 2013 $14.2 to $14.6 million. So the market is not is not static. It’s dynamic. The value of your pest control business changes. Now, it might not be as dramatic as overnight like the public equity markets, but I view this and my experience and judgment. I view this as a pretty authoritative study as it takes all the relevant data in and in this is it, guys. This is how the value of your pest control business or the pest control valuations and the industry at large has has changed over time. Where it ends up next year 2015 your guess is as good as mine.

So we covered a lot of ground today we talked about the fundamentals. A lot of it was repetitive. Some of it was unclear. We’ve got probably 60 or 70 questions that have popped up in the box and we’re going to get to that momentarily. For those of you who are joining us live. I wanted to thank you. I always appreciate you folks taking the time to listen to me. I learn just as much working with you is you do for me. So again, thanks for joining me today. It’s a pleasure. Those of you who are listening online if you’re looking on our website we’ll have a comment box below. If you get value out of this I’d like to know about it. If you didn’t get value out of it. I’d like to know about it. And if you have questions we’ll probably be doing some follow-up Q&A to this because his presentation You know has covered a tremendous amount information in a very short period of time is all a question so that your comments. Put your questions on the web. You can send them to me at Paul@PotomacCompany.com. You’ll see it on their website for our pest-control group is different than our main company site that is Potomac pest.com. We are going to take a two minute intermission here I’ll be right back to begin to answer these questions. Thank you.

Subscribe to the Potomac Pest Control Group YouTube Channel.