Over the last few years Rentokil has been aggressive in acquiring pest control businesses around the globe. The focus has been to pursue platform and entry acquisitions in high-growth and emerging market economies as well as to add route density and additional capabilities in Rentokil’s existing operations.

In 2014, Rentokil acquired 30 businesses in the UK, US, Spain, Ireland, Italy, Netherlands, India, Brunei, Singapore, Sweden, Brazil, Lithuania and Korea and entered new markets in Chile, Bahamas, Mozambique and Colombia “to exploit under-served and increasingly affluent markets. Combined annual revenues of the above prior to acquisition were approximately £66m.”

While Rentokil continues to make acquisitions in hygiene and facilities services, 23 of the 30 acquisitions were in pest control. The total annualized revenue of the pest control acquisitions was £44m.

Seventeen of the 23, or 74%, were in emerging or growth quadrants of Rentokil’s capital allocation approach.

Rentokil continued to build density in its North American operations and expanded its geographic presence with seven add-on acquisitions — Indiana, Connecticut, Virginia, West Virginia, Mississippi, Washington and Oregon.

Thus far in 2015, Rentokil has completed the acquisition of Buffalo Exterminating in Western New York, Fumighar Pest Control in Colombia and Neil Younger pest business in Australia. The combined annual revenue of these three targets was £6.8m ($10.4M USD) at the time of the acquisitions.

In 2015, Rentokil will “continue to seek further acquisitions in 2015 particularly within the Growth and Emerging quadrants. We estimate our targeted spend to be in the region of £50m but this dependent on finding acquisition opportunities that meet our financial hurdles and resourcing abilities.”

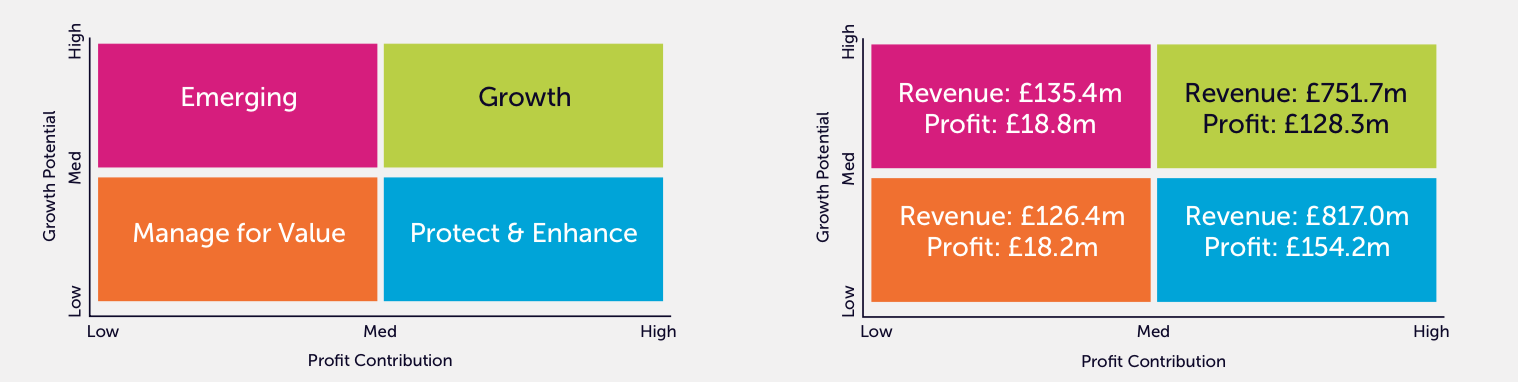

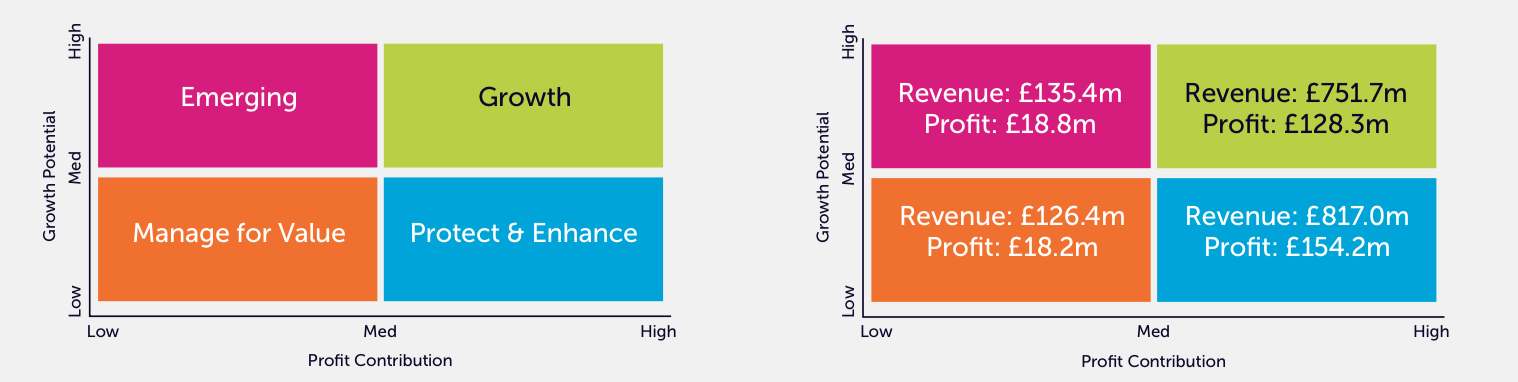

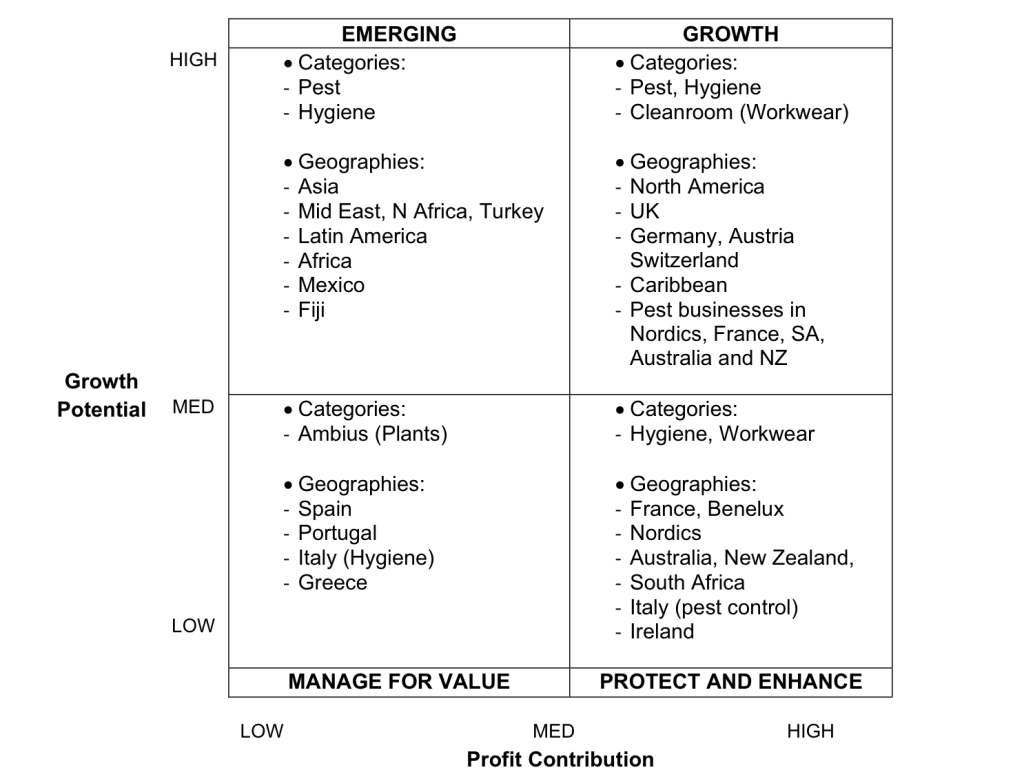

Rentokil’s differentiated quadrant matrix outlines different acquisition strategies and hurdles rates for various geographies:

Emerging Quadrant

- Percentage of group revenue: 7.4% (2013: 6.3%)

- Percentage of operating profit: 5.9% (2013: 4.8%)

- 2014 financial performance: ongoing revenue growth 21.7%, ongoing profits +22.6%

- Strategy: build leading market positions in the key cities across those markets which are identified as the best opportunities for our pest and hygiene businesses

- Key developments in 2014: sales capability upgrade in Asia, focus on building density in top 15 cities in China, sales and service productivity initiatives in Malaysia

- M&A strategy: pest control-led market entry, focus on acquiring local management capabilities, bolt-ons for density. IRR ~15%

- M&A in 2014: eight acquisitions contributing £16.9m annualised revenues (Chile, Colombia, India, Mozambique, Korea, Brazil, Brunei, and Singapore)

- Changes in 2015: inclusion of Fiji pest control (from Protect & Enhance)

Growth Quadrant

- Percentage of group revenue: 41.1% (2013: 40.3 %)

- Percentage of operating profit: 40.2% (2013: 38.2 %)

- 2014 financial performance: ongoing revenue growth +5.7%, ongoing profits +6.3%Strategy: focus on growing market share and on developing existing customers, whilst filling gaps in our geographic footprint through organic and acquisitive growth

- Key developments in 2014: strong pipeline of new pest and hygiene products and services, investment in new enhanced digital capability

- M&A strategy: extend geographic reach into new cities and build out sub-scale regions, IRR (>15%) as platform for growth

- M&A in 2014: 15 acquisitions contributing £41.7m annualised revenues (UK, Bahamas, NA, and Lithuania) Changes in 2015: inclusion of seven businesses from Protect & Enhance, including France pest and cleanrooms, Netherlands cleanrooms and Nordics, South Africa, Australian and New Zealand pest control businesses

Protect & Enhance Quadrant

- Percentage of group revenue: 44.6% (2013: 46.3 %)

- Percentage of operating profit: 48.3% (2013: 51.0%)2014 financial performance: ongoing revenue down 0.1%, ongoing profits down 4.4%

- Strategy: focus on customer service, pricing, productivity and cash

- Key developments in 2014: appointment of new Benelux management team to improve performance, rising customer satisfaction levels in South Africa, Nordics and Benelux, branch and route optimisation tools to enhance productivity, customer profitability tool to improve price management

- M&A strategy: consolidate regional and local strengths, acquire new capabilities in adjacent service areas, above average IRR (~25%)

- M&A in 2014: three acquisitions contributing £2.9m annualised revenues

- Changes in 2015: inclusion of four businesses from Manage for Value, including France Technivap, Italy pest control and Ireland pest and hygiene businesses

Manage for Value Quadrant

- Percentage of group revenue: 6.9% (2013: 7.1%)

- Percentage of operating profit: 5.6% (2013: 6.0%)

- 2014 financial performance: ongoing revenue growth up 0.5%, ongoing profits down 4.5%

- Strategy: focus on customer service, profitability, cost management, productivity and efficiency

- Key developments in 2014: focus on productivity improvements in Southern European operations, stronger than expected performance from Italy pest control and Ireland pest and hygiene

- M&A strategy: acquire bolt-ons for density – requires high IRR (~30%), divesting sub-scale unprofitable businesses

- M&A in 2014: three disposals, four acquisitions contributing £4.2m annualised revenues

- Changes in 2015: movements to Protect & Enhance as noted above