This story begins on the morning of October 22, 2019. My flight had just taken off and I nestled into my seat to try to get some work done. An email from Jamie Clement at Buckingham Research catches my eye; the subject line is: SERV: TIMBER!!!!!!!!!!!

There is nothing in the body of the email. Damnit Jamie, what’s going on?

Oh no… ServiceMaster pre-released, this isn’t good.

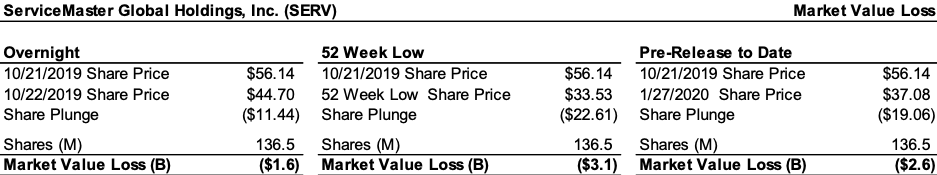

Over the course of the next 24 hours, ServiceMaster’s shares plunged ~20% based on a Q3’19 preliminary results release (unusually high termite damage claim settlements and lower profits from the fumigation business). In addition, the release mentioned the termination of Matt Stevenson, the president of Terminix Residential (representing ~70% of the business), arguably the most important business unit operating executive in the company. The subsequent underwhelming earnings call on November 5th resulted in ServiceMaster’s shares rapidly plunging to its 52-week low, in all, losing approximately $3 billion in market value versus where it was trading prior to the preliminary release on October 22nd.

Figure 1. Quantifying Q3’19 Release in Market Value Loss

The knock-on effect resulted in ServiceMaster pulling out of hundreds of millions of dollars in acquisitions, leaving sellers stranded in various stages of due diligence. The market supply of acquisition targets increased substantially, almost overnight… excess supply rippled through the global pest control M&A market and put immediate downward pressure on marginal transaction multiples. The heads of global pest control companies in Atlanta, London, and Stockholm looked on in horror as a competitor began to implode in the public equity markets.

ServiceMaster’s stunning unraveling in the fourth quarter of 2019 continues to roil the pest control market today. Just last week, CEO Nik Varty “stepped down” and the board of directors engaged Lazard to sell ServiceMaster Brands (“SMB”). In the Institutional Investors section towards the end, we are going to discuss our thoughts on the SMB divestiture, and the potential takeover of ServiceMaster by Anticimex.

But for you, the business owner, we’ll first dive into valuation multiples, why they are beginning to fall, and what you need to know to make sure that you get out in time, unscathed, in a very strong market if you intend to sell within the next five years.

Before I begin today’s Commentary, I just want to say that I hate what happened to ServiceMaster. Every one of us in this industry needs a thriving and competitive ServiceMaster. What’s happening in Memphis does none of us any good.

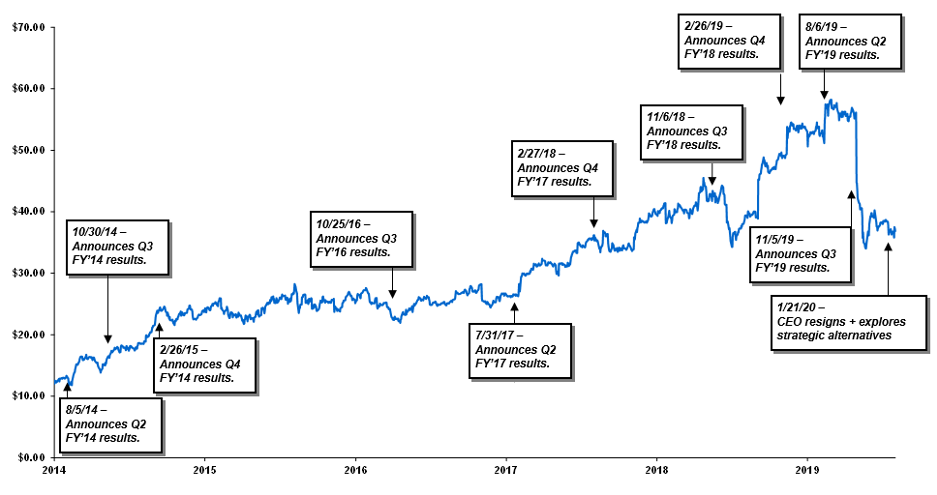

Figure 2. ServiceMaster’s 5-Year Stock Price Chart

As a pest control operator, you’ve likely grown to dislike Terminix as a competitor, and I understand that. But no matter what you think, Terminix is a powerful brand in the United States. Along with Orkin, they are the two most storied brands in US pest control history.

The Pest Control Executive: What You Need to Know about Valuations in 2020

After years of heavy consolidation, valuation multiples in the US pest control industry have crested and begun to contract. In late 2015, Rentokil acquired Steritech, which was the bellwether transaction at the onset of the boom. Almost exactly four years later, in September of 2019, ServiceMaster acquired Nomor for 3.8x TTM revenue (I can’t disclose EV/EBITDA, so use your imagination) which in my mind marked the “melt up” transaction. As you’ll recall, in November 2018, I made a risky move and called a top in the market, writing:

On the way out of Pestworld last week, I mentioned to a friend of mine [Tim Mulrooney @ William Blair] — an equity research analyst covering the pest control industry for a large investment bank — that my next Weekly Commentary would “call a top.”

He said: “Be careful.” Clearly, he’s right.

Tim warned me beforehand, and after I published it, the M&A guys in the industry all had something to say. One of them, I can’t remember if it was Kevin Burns from Arrow or Matt Whiting from Rollins, said that I had a 50% chance of being wrong and a 50% chance of being not right.

So, what happened after I called the top?

- Twenty days later, on December 1, 2018, Rentokil closed its most expensive (on a revenue multiple basis) US deal ever

- A month later, Rollins followed suit acquiring Clark, and Anticimex and ServiceMaster would both go on to close their most expensive deals a few months later

- The period from December 2018 through September 2019 saw the highest transaction multiples in the pest control industry in history

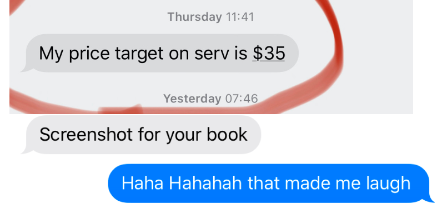

What does Tim Mulrooney say today? “You called the top (a little early, but it definitely counts). You called SERV $35.00 stock price (which is absolutely unreal how accurate you were).” Tim is referring to the $35.00 price target I put out on SERV the day after the pre-release when it was trading around the $45.00 handle.

I was able to do this because I advised on three of the four deals discussed above. They were either in process at the time that I published my piece in November, or I had a very good idea of the level of appetite. In addition to valuations in the private capital markets, not a day goes by that we don’t reference the public capital markets, as public market multiples inform our views in the private capital markets.

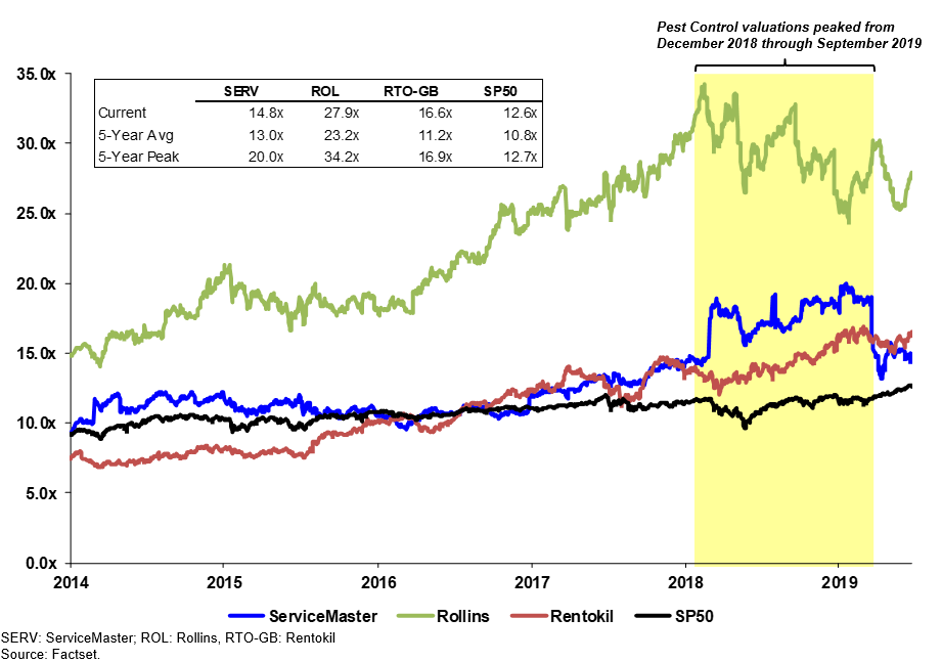

The chart below illustrates the enterprise value of ServiceMaster, Rollins and Rentokil as a multiple of forward EBITDA over the past five years:

Figure 3. 5-Year EV/NTM EBITDA

In the chart above, you can clearly see that both Rollins and ServiceMaster’s valuations peaked in the period from 2018 to Q4 2019 as ServiceMaster “narrowed the gap” with Rollins. What pest control owners should pay close attention to is that black line in the chart. That’s the S&P 500, which is currently trading at 12.6x forward EBITDA.

Whenever you open Pest Management Professional or PCT Magazine and see a large platform company sell, there is a good chance that it sold for a transaction multiple above what the current S&P index is trading for. Think about that for a second, privately held pest control businesses have been getting public company valuations for the last 18 months. When we did the Nomor deal in September, I joked with the management team that the 3.8x revenue multiple that they received from ServiceMaster was actually better than taking the company public. Hypothetically, if Nomor were 20 times the size and we would have listed it on an exchange instead of selling it to ServiceMaster, it would have likely traded closer to 3.4x revenue (again, I can’t discuss the other transaction multiples of this as they were not disclosed).

We are currently living in a small window of time when relatively inefficient pest control businesses are receiving publicly traded company valuations. This has never happened in history, and when this is done, it’s unlikely to be repeated in thirty years, if ever.

What You Need to Know about the Current Market

Is the market still extremely hot? Yes. Will 2020 be another banner year? Probably. However, ServiceMaster has shut down its M&A program entirely, save for perhaps assets of very important strategic value and tuck-in acquisitions (sub $6M in enterprise value). If anything, ServiceMaster would likely be better off buying back its own stock given the levels at which it is trading at now rather than compete for material acquisitions.

From November 12th through November 26th, ServiceMaster’s management team killed hundreds of millions of dollars in transactions under exclusivity in the US and Europe. Unfortunately, many of them were mine. From there, they began to focus on proprietary deals where the owners are not sophisticated enough to understand that they are getting a bad deal. These are great transactions for ServiceMaster and if they can accelerate buying companies that don’t know any better, they should do that all day long as they are extremely accretive. In December, ServiceMaster bought (unannounced) a PCT Top 100 company at a single digit EBITDA multiple.

As all of the transactions fell through, other acquirers in the industry, namely Anticimex and Rentokil were extremely respective of their fallen comrade. They rushed back into process and let us know that their bids were still good and that there weren’t any punitive measures for moving forward with ServiceMaster in the first place.

Over the course of January, however, it began to sink in that ServiceMaster would delay material M&A until Q3 2020 (except in rare circumstances). The acquirers began to do exactly what I would do if I were them. They began to use the unraveling of ServiceMaster to their advantage. Case in point. Less than 48 hours ago, I received an LOI on a PCT Top 100 company. In the body of the email, the acquirer wrote:

I know you and I both believe that we will see a decrease in 2019’s high valuation multiples with less potential buyers in the market. Something I think, potentially, will be good for the industry overall, if you’re not looking sell within the years to come.

I agree with this acquirer, there are less buyers at the table. But, this will only impact valuations on the margin, at least in the near term.

Here’s what I mean by that.

If you’re running a competitive, sell-side process, each bidder in the process needs to anticipate what the next likely bidder is going to do. For the last 18 months, ServiceMaster was one of many strong hands at the table, now there is an empty seat where they once sat.

We believe that on average, 80% of pest control companies that go through formal process sell to the highest bidder. Therefore, we can assume that ServiceMaster was the highest bidder on 80% of the shopped deals that it acquired.

One way to extrapolate that information (the marginal bidder) is to look at past transactions where ServiceMaster prevailed, and then look at the next highest bidder.

We analyzed approximately $400 million of ServiceMaster transactions over the last 15 months and assumed that the runner-up bidder would have taken the prize. In addition, we looked at transactions where ServiceMaster should have prevailed on price but the sellers chose another acquirer (the ~20% of sellers that go with their favorites and are willing to leave money on the table). While we’re not going to publish the mean and median (that’s proprietary and we use it in our valuation models for our clients), I can tell you that the discount range was between a mere 0.9% and whopping 21%. It is abundantly clear that in modified auctions with five bidders (and in pest, it’s often three) or less, one additional empty seat at the table can make a big difference. While ServiceMaster’s marginal bid will net a little less in the pockets of sellers, core transaction multiples remain elevated; however, with one less bidder, the game just got a lot more complicated for me.

The good news in all of this for sellers is, the other players are buying and they must continue to buy. Just take a look at Rentokil. There is no doubt Andy Ransom is strolling through the streets of London with a full on erection 24/7. That business has been re-rated, inflated and off to the races. He’s done a bang up job and continues to do so.

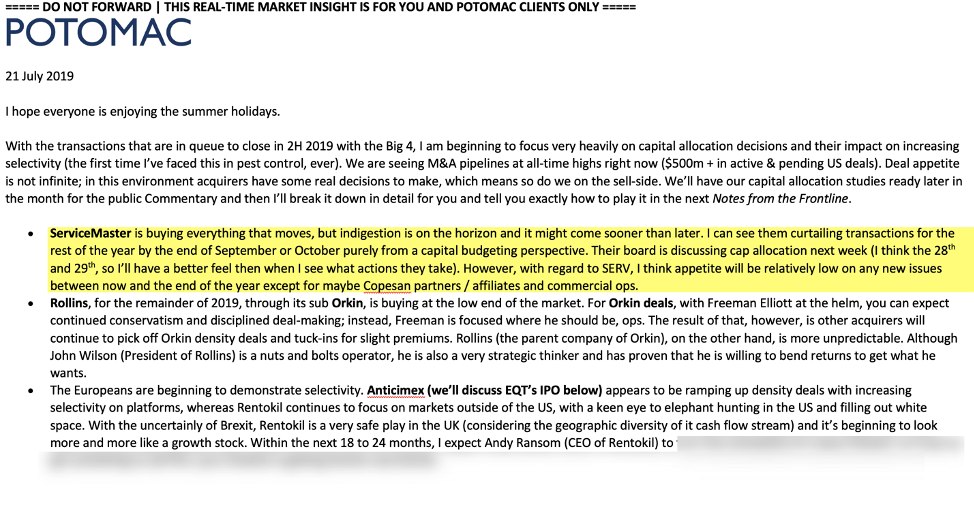

Although I was blindsided by ServiceMaster’s Q3’19 preliminary results release and subsequent turmoil, I had fully expected their slowdown in M&A and advised our clients about a more conservative ServiceMaster coming toward the end of 2019. In our July 21, 2019 Notes from the Front Line (the inside scoop for our valuation and exit planning clients), we suggested M&A appetite would take a back seat due to capital allocation priorities.

Figure 4. July 21, 2019 Notes from the Front Line

As with all consolidating industries, when supply of premium targets begin to dwindle, we have tools in our arsenal that we begin to deploy to prop up multiples. In the pest control industry, there has really only been two formal, controlled auctions in the last five years: Steritech and Nomor. Surprise, surprise, these are the two bellwether transactions in this M&A cycle.

However, for Potomac, 2020 is the year of the controlled auction. As the quantity of quality targets of scale declines, a controlled auction begins to make more and more sense. When targets are plentiful, acquirers can shun the auction. When targets are scarce, they have to play. We commenced our first controlled auction of 2020 this week and will be using this process more and more this year.

Based on recent events, I recommend now, more than ever before, that you get serious about your business as an investment.

Over the last four years, a rising tide has lifted all boats. However, given ServiceMaster’s current situation, there is much more uncertainly on the horizon. For the last six months I have been writing to our clients about increased selectively at Anticimex and Rentokil.

As a business owner, when you’re contemplating a sale, you really only have control over two factors: i) timing and ii) process. If you hire a true expert, then you’ll be set on process, and it comes down to timing.

If you have flexibility in your investment horizon, you can begin preparing years in advance and strike at the perfect time, exactly what JP McHale, Triple S and MCS did. We planned and planned for years and then took these businesses out to market almost simultaneously. One of three main triggers for me when timing the market in 2018 was when ServiceMaster crossed 18.0x EV / NTM EBITDA with direct line of sight to 20.0x.

JP McHale is a great example of perfectly timing the market. Potomac was engaged by JP McHale over a decade ago to perform a valuation. Over the years we kept Jim and the McHale team dialed into exactly what was going on in the market, constantly updating our valuation model for the company. At the end of 2017, the ownership began thinking about a sale given the fact that transaction multiples were beginning to rise rapidly.

If you know Jim, then you know that he was only going to sell for a record-setting transaction multiple, and I knew that the timing wasn’t right. In late 2017, we had some informational sessions with acquirers, spending time with John Myers, John Wilson and Mikael Vinje to get a better understanding of what a transaction would look like with Rentokil, Rollins and Anticimex. And then I made Jim wait another year. In October 2018, I called him and said, “Jim, right now is the time to pull the trigger.” Less than a month later, on the morning of November 5th, 2018, Jim and I boarded a plane to Stockholm to meet with Jarl Dahlfors (CEO) and Mikael Vinje (President – North America) of Anticimex. It was on the plane back from that meeting that I wrote the Calling the Top Commentary. A few months later we closed on the sale of JP McHale and Jim became an equity partner in Anticimex. If it wasn’t the top of the pest control market, I wouldn’t even have had a shot at satisfying Jim McHale.

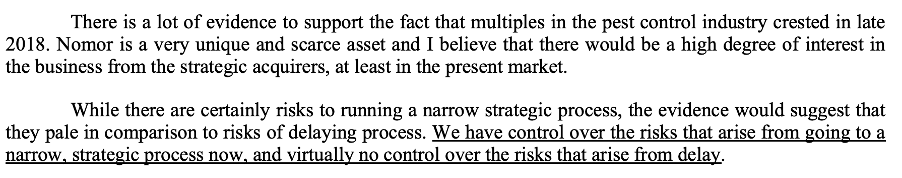

In 2016, 2017 and part of 2018, I advised patience. In 2019 and going forward, I am advising urgency. In early 2019, I was asked by private equity firm Norvestor, based in Oslo, Norway to provide my thoughts on timing with regard to the sale of Nomor, the largest independent pest control business in Europe (after Anticimex). They were considering running a full process in the fall of 2019, I disagreed, and they took my advice. Had we waited, the ServiceMaster / Nomor deal would have never happened. Here is what I said in a letter to the special committee of the board of directors immediately after our board meeting (again, 2019 and 2020 are about urgency):

The Institutional Investor: ServiceMaster at a Crossroads

In 2008 U.S. Federal Reserve embarked on the most absurd monetary experiment in history. By late November that year, the Fed began buying $600 billion in mortgage backed securities, otherwise known as quantitative easing.

Although quantitative easing was allegedly intended to “create liquidity” and “kickstart lending” what it really did was force the public to exchange trillions of dollars in interest-bearing Treasury securities for non-interest bearing base money. As no one wants to hold non-interest bearing base money, investors bought assets with it. But for every buyer, there must be a seller. And those that sold their assets received the non-interest bearing base money, so they in turn needed to buy stocks, or bonds, or real estate, anything to get out of holding zero-yield base money. As that non-interest bearing base money made its way through the economy, it drove the prices of assets up and up to a point so high as to deliver long-term returns close to that of the base money itself – zero.

As the quantity of base money increased due to successive rounds of quantitative easing in the U.S. and Europe, investors bid the price of Treasurys so high that their yields collapsed to the point in which investors were indifferent as to holding base money or Treasurys. In Europe, sovereign debt securities have been bid up so high that yields are negative in nominal terms and approaching zero in real terms.

As central bank balance sheets increased, and risk premia fell, yield seeking speculative behavior accelerated, and investors continued to look for safe pickup in yield. In the early 2000s, when interest rates were held at 1%, investors found refuge in mortgage backed securities. As they piled in this ‘safe’ investment, credit requirements were relaxed to create more and more supply of these ‘safe’ assets. Prices were bid up and yields fell, new securities were created…until the whole thing blew up.

In 2018, 2019, and 2020, with over $16 trillion in negative yielding sovereign debt around the world and a Federal Reserve balance sheet that was never unwound, that safe haven is assets like pest control – companies like Rollins “that trade just like a bond.”

I picked three equity research reports at random:

- “The most compelling facet of the Rollins story is the Company’s recession resistance” – Stephens, November 2011

- “The pest control industry is relatively asset light, has proven to be more or less recession resistant and is a huge free cash flow generator” – Stifel, May 2018

- “Rollins, Inc. (ROL-NYSE): A Safety Play with Predictable Earnings” – Joe Box, April 2012

I don’t know if I’ve ever read an equity research report on Rollins that doesn’t reference its safety, predictability and recession resilience. I used to read the same sort of things about real estate in the WSJ and NYT back in 2003, “there has never been an annual decline in the national median price [of housing] in the past four decades. Even in the recession of the late 1980s, prices edged up slightly… and, “see the residential real estate market as the best and safest place for their money.”

Based on this premise, we should all plow into the stock and bid the price up to 28.0x NTM EBITDA. I love ROL, RTO-GB and SERV. Even though I am hard on SERV from time to time, these three are great companies. But at what point are they not great investments?

In 2020, the global pest control industry is officially a central bank-induced, yield-seeking, speculative casino. After over a decade of monetary policy that I didn’t even think was possible twenty years ago (who had ever heard of a negative yielding bond back then), we find ourselves in an era when $10 million pest control companies can sell for 22.0x EBITDA multiples.

These assets are priced so high right now that their future long-term yields are close to zero.

Does the mind not rebel at any possible scenario under which a $40 million in revenue pest control company can sell for $140 million?

Well, it’s happening.

How is it that anyone can justify investing in a pest control company trading for 28.0x NTM EBITDA? I know, I know, it’s all about relative value in this environment.

Over the course of the last three years I have witnessed first-hand a tremendous amount of malinvestment take place in this industry.

In late 2016 and early 2017, valuation multiples for door-to-door companies increased 40% which attracted a tremendous amount of people to start their own door-to-door companies. At the time we saw certain door-to-door companies sell for 1.5x to 1.8x revenue. Companies began offering $50,000 sign-on bonuses to top producers and extremely high commission rates as recruiting got more and more expensive.

By early 2019, there was such a tremendous supply of these businesses for sale, the market collapsed. In Q1 2019, you were lucky to be able to sell a door-to-door business for 1.0x. Freeman Elliott, president of Orkin, quit watching movies and just listened to summer sales guys pitch their businesses for entertainment.

Over the last 24 months, we’ve seen many of these companies take on a tremendous amount of debt to grow. Why? The hope of exiting at a high multiple and taking bags of cash to the bank.

But it’s certainly not limited to the door-to-door arena. It’s even more acute in the traditional pest control industry.

The prospect of selling your business for 15.0x NTM EBITDA has driven many entrepreneurs to the banks to borrow for online, radio, TV, door-to-door, direct mail and any form of marketing and advertising they can get. Two days ago, I spoke to the president of a publicly traded pest control company who told me that “advertising is getting more and more expensive as competition bids up the price, in many ways, we’re better off buying small companies to get customers rather than paying for advertising.”

We do more valuation assignments in the pest control industry than any other firm does in a decade. However, we don’t do valuations for bank loans. In fact, our valuations specifically prohibit clients from using them for loans – but they do it anyway. Over the last six months, we’ve been contacted by over forty banks with questions on our valuations. Clients continue to seek commercial credit for expansion. When I ask clients about this, they tell me that they want to “grow as quickly as we can right now to beef up revenue for an exit.” Again, this is just all part of the yield-seeking speculative casino that is now the pest control industry.

ServiceMaster: The Morning of Missed Opportunities

On October 22nd, we received some bad news and the stock plunged.

The missed opportunity for ServiceMaster was the Q3’19 earnings call on November 5th, management’s communication was abysmal given the stakes.

The Damn Damage Claims

First, let’s look at the termite damage claims issue. When I listened to Nik field questions on that call, I began to think to myself, he is either lying or he has no idea what the hell is going in his business. Which one is worse? I know Nik, Dion, and Tony. I actually believe them to be the most honest and forthright management team I’ve seen over there in a long time. Which makes me conclude that Nik really didn’t have a good grasp of what was going on.

When I got on that call, I was looking for someone, anyone, even if it was the janitor in the background just to say, “we’ve done in-depth analysis, we know exactly what we’re dealing with, and here is how we are quantifying the exposure…” Just ring-fence the damn thing and move on.

But they didn’t do that. Instead, they made me feel like we were finding out about the damage claims at the same time.

I picked up the phone and suffered through a two hour conversation with Termite Tom. He’s a wonderfully nice guy, and I think that he is very sincere. However, he raped my eardrums for two hours about a lot of cases that I don’t really think are going anywhere.

I spoke to every pest control operator with an IQ above 50 along the Gulf coast. I quickly became more and more satisfied that while expensive, the damage claim issue is likely overblown.

Was Matt Stevenson Just an Intern?

Matt Stevenson, who I have no reason to believe was not a solid operator, disappeared in the middle of the night like a scene out of an Alfred Hitchcock movie. He barely got a two-sentence obituary on the earnings call. If this were any other business, I don’t know that I would have been so concerned.

But this is ServiceMaster. The C-Suite has had a higher turnover rate than the red light district in Amsterdam. For a guy who held arguably one of the most important positions in the company, they should have given this decision more airtime.

When they glossed over his departure, all I could think about was, “What? The turnaround is over? All fixed up and ready to go? Now it’s time for ServiceMaster to go out and start buying skating rinks, gas stations and restoration business because Terminix is clearly on auto pilot.”

Note to future managers: If you’ve got to announce the departure of one of your most important operators, and you have to do it on the same day that you’re also announcing that you might be about to step on a litigation landmine, don’t put his obituary in the footnotes.

I think that had these guys done a better job on November 5th, the stock wouldn’t be trading where it is now. Overall, it’s an expensive lesson for future executives to communicate better with the Street, at minimum.

As much as I liked Nik as a person, his departure is good for the business. Too much time was lost in China, Spain and around the world trying to create a European Copesan and buy restoration businesses. When ServiceMaster acquired Copesan, I thought it was stupid and said so. Then I warmed up to it while drinking Nik’s spiked KoolAid. Now that the board has done a review of returns on recent transactions, it turns out that I was right, it was a bad investment. I should have trusted my gut. Lesson learned.

Strategic Alternatives and a Path Forward

As usual, I am about to say some things that certain people aren’t going to like.

First, I don’t think that the market overreacted. I think that the market reacted exactly as it should have given how management handled the situation. It was management that underreacted and put all of us in this situation.

After SERV’s Q3’19 preliminary release, I looked at our financial model and said, “hmmm SERV is a 14.0x to 15.0x NTM EBITDA business unless or until management tells us why it isn’t.” With the stock still deep in the $ forties, I sent my call over to Tim Mulrooney. He recently sent this screen shot back to me for my “book”.

I also bought tens of thousands of put contracts at strike $35.00 and made $132 million in six days.

That’s a joke, I wanted to make sure that you’re still awake.

Second, as you well know, I think all of these businesses are tremendously overvalued. I would have never imagined to see the day when a pest control company traded at 28.0x NTM EBITDA.

I don’t think that any $10 million pest control company should sell for the better part of $40 million. It doesn’t mean I don’t like the $10 million pest control company, it just means that I think it’s a bad investment.

However, we live in a world right now where everyone is chasing yield. When I have dinner with the CEOs of these companies, they say things like, “I hate spending what we’re spending, but we’re rewarded for it and if I don’t do it, someone else will and we’ll miss out.” Everyone knows that this has turned into one big Ponzi scheme, but we’ve become willfully and knowingly blinded to it.

When these stocks are trading at the multiples that they’ve been trading at, any minor issue becomes amplified tremendously. Orkin experiences some bad weather, boom, hundreds of millions of dollars in value disappear in a millisecond. The janitor doesn’t take the phone from Nik and explains the termite damage claim issue, boom… billions of dollars gone. As I always say to our clients, when businesses are selling at 5.0x EBITDA multiples, do your best on the add-backs. When businesses are selling at 18.0x EBITDA, hire a forensic accounting team and make sure we’re adding back postage stamps and bubble gum to the P&L. High multiples amplify everything.

Institutional investors need to get yield and they can’t just put the money under the mattress. So, with all that said, I think that ServiceMaster is undervalued right now IF they decide to go down one of these paths:

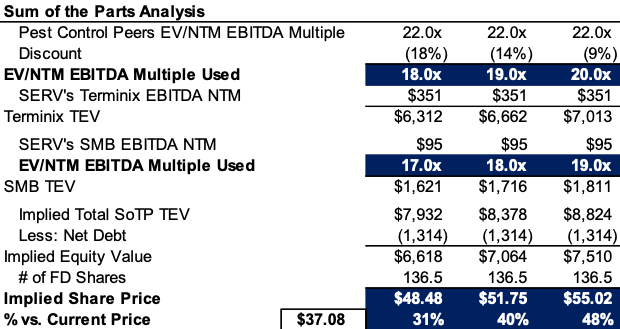

Option 1: The Easy Way = Divesting SMB and Focusing on Pest and Termite

The first step in moving this forward is to execute on the divestiture transaction. While ServiceMaster believes that this transaction will take some time, I think that they can and should get it done within 120 days. So, what does it look like? A quick review of a sum-of-the-parts value easily implies over ~$1.0 billion in net proceeds for the SMB business, this would allow ServiceMaster to de-lever as well as provide dry powder for accretive acquisitions with a focus on U.S. pest and termite.

Figure 5. Sum of the Parts Analysis

Further, this analysis supports the thesis that the market overreacted implying a 30%+ premium to the current share price, assuming SMB sells for 17.0x forward EBITDA (ServPro sold at ~20.0x) and valuing Terminix at 18.0x forward EBITDA (an 18% healthy discount to its peers).

Just divesting SMB is not going to solve all of SERV’s issues though. They really need to get a manager in place to run Terminix. The good news for ServiceMaster is, they have the ideal guy. Svein Olav Stölen, the CEO of Nomor is a turnaround artist. He’s a battle tested operator and former COO of Sweden’s Expresso House chain of coffee shops. Throughout the Nomor sell-side process, I watched as Nik and Svein Olav spent hours together talking about the turnaround. We even joked that a lot of the content from Nik’s internal speeches were lifted from Svein Olav.

Option 2: The Fun Way = Unleashing the Swedish Beast

“Jarl Dahlfors is a beast,” said Jamie Clement of Buckingham last week. “When he was at Loomis I watched him bring the former Brinks management team to their knees.”

If I were EQT, I would hop on a flight to Memphis and figure out a way to back door into the public equity markets by merging with ServiceMaster. For Anticimex, it’s less costly, but more importantly it allows them to get out into the market now, rather than in 2021.

Jarl is one of the absolute best operators I’ve seen in this industry and the best operator of Anticimex for the better part of a century. As you know, GIC just bought a 9.9% stake in Anticimex for SEK 3.8 billion, at an implied EV north of 20.0x NTM EBITDA.

And guess what, unlike everyone else that ServiceMaster has hired, Jarl actually has an outstanding track record of running a pest control company. In addition, while he’s not a woman, he is a natural blonde.

##

Paul Giannamore

Franco Villanueva-Meyer, CFA