The Potomac Company is pleased to announce the acquisition of its client, Innovative Pest Management (“IPM”), by American Pest (“American”), an Anticimex Company.

IPM was founded 14 years ago by Dr. Richard Kramer, Luke Krikstan and Joshua Kramer. What began as a small, three-man operation quickly grew to become one of the largest privately held pest control businesses in the DC metro area, a recent newcomer to the PCT Top 100 list and the Best of DC winner for three of the last four years.

Richard Kramer, a PhD entomologist, had been in the industry for many years before striking out on his own with friend Luke and son Josh to start Innovative.

Dr. Richard Kramer commented: “I have been in pest management in some fashion or another since I was 16 years-old and could drive a spray truck for my father’s Florida lawncare business. I enjoyed the pleasure of working in that business with my father who taught me pride in workmanship and respect for customers. Most recently over the past 14 years, I experienced the irreplaceable opportunity to work with and end my full-time pest management career with Josh, my son and the face and personality of IPM. Also I had the wonderful opportunity to build IPM with our fantastic partner Luke, the company workhorse, who went anywhere anytime to take care of a customer’s need. Our people and continuous effort to solve customer pest management problems were the keys to IPM’s growth and success. Though the customer might not always be right, the customer always is first.”

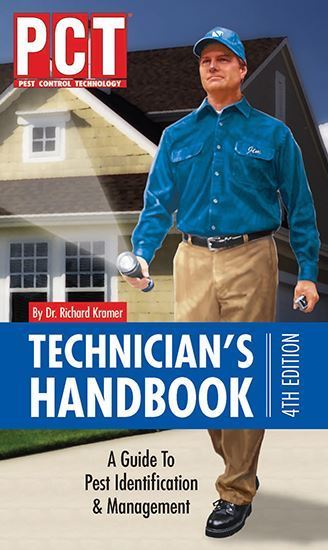

Along the way, Richard and Josh have revised the fourth edition of their now world-famous PCT Technician’s Handbook.

Paul Giannamore, managing director of Potomac, commented on the transaction: “Luke and the Kramers created IPM out of an idea to build a business from scratch that would be a place where they themselves would be proud to work. From the early years of bootstrapping the business and taking customers calls from backyards, all the way to the PCT Top 100 list, they grew Innovative one employee at a time, never losing sight of the original premise, which was always putting their people first and building a workplace that they were proud of. I’m proud to have advised the shareholders on this transaction and proud to call the Kramers friends.”

Dr. Kramer commented on working with Potomac:

“I have been in the Pest Management side of the business for 27 years, including 5 years at NPMA and I have not met anyone involved in M&A in our business that is more professional and knowledgeable than Paul Giannamore. Through the entire process involving lawyers, accountants, tax advisors, etc., Paul was the go-to guy for the final answer. I would trust no one else with the sale of my pest management business.”

He went on to say, “The decision to sell a business that my son and I had nurtured over the past 14 years was one of the most di!cult decisions I have made in my life. We started discussions with Paul more than two years prior to the sale and he walked us through the pros and cons of a sale now or later and at no time pushed one way or the other. He provided sage advice to guide us to our ultimate decision. One would think that’s the end of the story but as negotiations progressed and then stalled (due to our reflection on what we were about to do) he patiently and continuously advised on the options we were considering. Once we had decided to move forward with the sale he connected us with an accountant and other parties who could answer questions outside his expertise. Everyday until the time of closing he was by our side insuring that the merger process was smooth and seamless. After the closing he continues to be a trusted adviser. Again, I would trust no one else with the sale of my pest management business.”

Josh Kramer, partner at Innovative, commented:

Even before I met Paul Giannamore, I considered myself a student of his. A student you might ask? At the time, Paul was advising a close friend of mine Nam Kreer who was preparing to exit his successful family pest control business that had been incubating for decades. Ahead of Nam’s inviting me and my father-business partner Dr. Richard Kramer to join him and Paul for an introduction at one of their seemingly routine lunch sessions, I dug into PCT and YouTube to see what I could learn about Paul and Potomac. I can remember popping in my ear buds late one evening nearly five years ago to listen to his podcast on Pest Control Business Valuations and M & A 101. A mere ten minutes into the podcast, I knew that if the time ever came to pull the trigger and sell our business, that Paul was destined to be our guy. Selling was not on my radar at the time—but Paul had my attention.

There was no other firm to consider as I was convinced that Potomac singlehandedly paved the way to add exponential value on the seller-side and his seemingly magical wisdom was driving valuations to heights that should be alarming to the buyer-side. Despite the fact that I was a business major, albeit 22 years removed, I had never heard of a value creation zone, didn’t understand the impact of EBITDA and other nuances associated with valuing companies. Perhaps this information was out there but it wasn’t unique to the pest control industry. Paul made valuation relevant to pest control company owners and illustrated the metrics in a way that we business owners could easily understand. He is a real-life open book.

The time wasn’t right to sell then however, or even realistically ponder the idea. But as a business owner, the exit should always be evaluated. In true fast forward form, we were in our 11th year and we were in the midst of building one of the fastest growing pest control companies in the D.C. metro area. Things were moving fast and we even successfully on-boarded our first acquired firm three years ago. Then, just last year—with two partners who were inching closer to well-deserved retirement, we decided that the best course of action for the entirety of our team was to finally take a deeper dive and explore our exit. Various scenarios were considered and all along the way, Paul truly had our best interests at heart. First and foremost, he wanted to ensure that this decision was well thought out and not only influenced as a function of high-valuation market dynamics. So, it was made abundantly clear there was no pressure to pull the trigger. Ultimately though, despite our profound day-day satisfaction and love of our people and what we do, our three partners reached a consensus, put our head down and charged the finish line. I could not have asked for a better exit mentor, educator, advisor, therapist and close family friend that is Paul.

Paul Giannamore and Ericka Andes of The Potomac Company advised the Company on its sale to Anticimex / American Pest. Cory Vargo, Partner at Wipfli, advised the Company and the shareholders on tax and transaction structure.